Dr Seuss’ The Grinch: ‘What if Christmas, he thought, doesn’t come from a store. What if Christmas, perhaps, means a little bit more.”

If you’ve had enough of Paw Patrol, Lego, Star Wars, or Thunderbirds before the presents are even underneath the tree, you could consider giving a gift that lasts this Christmas.

While your kids, godchildren or grandchildren may give you an ungrateful look of disgust right now, we can assure you they’ll be thanking you later.

Our friends at the Association of Investment Companies (AIC) have done some pretty nifty calculations showing the value of financial gifts this Christmas. So if you so wish, you can throw in a bit of moolah with your Minions, Monster Machines or monkeys.

Their figures show that over 18 years to 31 October 2015, a £100 investment into the average investment company has grown to £428, while a £100 lump sum invested annually each year, for 18 years, has grown to £4,724.

Investment companies are available through online platforms or via children’s savings schemes and Junior ISAs, and any investment company savings scheme can be designated to a child. With minimum contributions starting at £30 per month or £50 lump sum, they don’t have to break the bank either.

Good with Money alert: If you decide on a Junior ISA scheme, but are looking for one that is as kind to society and the planet as you are being to the child in question, be sure to read our Junior ISA investigation which revealed some murky investments under the bonnet of those products labelled as ethical. Otherwise you may find you’ve selected a so-called ethical option which really is not that ethical at all.

Annabel Brodie-Smith, of the Association of Investment Companies (AIC) said:“We all want our children to enjoy Christmas with lots of toys, but any parent knows that some presents are opened and quickly forgotten. Parents might like to contribute towards a gift that can last long into the future, and an investment company can be a useful way to access the long-term potential of the stock market. Investment companies have strong long-term performance and there are a diverse range of sectors and risk profiles to choose from. They can invest in a range of investments on your behalf to spread risk and are a great way to invest for children over the long-term.”

Here’s the AIC’s list of fund-manager children’s investment company savings schemes. We have highlighted the Good with Money favourites (those offering an ethical option) in bold.

| Management group | Minimum monthly regular savings | Minimum lump sum | Initial admin/annual charges | Other charges | Telephone number |

| Aberdeen Asset Managers | £30 | £150 | Initial/Admin: Nil. Annual: Nil. | Purchase: Nil. Sale: £10. Transfer Out: £30. Switch: £10. | 0500 00 00 40 |

| Alliance Trust Savings | £50 | £50 | Initial/Admin: Nil. Annual: £10 per quarter. | Purchase: £12.50 (online). £40 (phone & post). Sale: £12.50 (online). £40 (phone & post). Transfer Out: N/a. Switch: N/a. | 01382 573 737 |

| Baillie Gifford Savings Management | £25 | £100 | Initial/Admin: Nil. Annual: Nil. | Purchase: Nil. Sale: £22. Transfer Out: N/a. Switch: First free in any 12 month period, £22 thereafter. | 0800 917 2112 |

| F&C Management | £25 | £250 | Initial/Admin: Nil. Annual: £25. | Purchase: £8 (online) £12 (post). Sale: £8 (online) £12 (post). Transfer Out: £12. Switch: Nil. | 0800 136 420 |

| Graphite Capital Management (through F&C Management) | £25 | £250 | Initial/Admin: Nil. Annual: £25. | Purchase: £8 (online) £12 (post). Sale: £8 (online) £12 (post). Transfer Out: £12. Switch: Nil. | 0800 136 420 |

| J.P. Morgan Asset Management | £50 | £500 (top up £100) | Initial/Admin: Nil. Annual: Nil. | Purchase: £10. Sale: £10 (N/A for regular savers). Transfer Out: Nil. Switch: Nil. | 0800 20 40 20 |

| Scottish Investment Trust plc (Plan Manager: SIT Savings) | £25 | £250 | Initial/Admin: Nil. Annual: Nil. | Purchase: Nil. Sale: £12.50. Transfer Out: £30. Switch: N/a. | 0131 225 7781 |

| Witan Investment Services | £50 | £250 | Initial/Admin: Nil. Annual: £30. | Purchase: Nil. Sale: Nil. Transfer Out: Nil. Switch: N/a. | 0800 011 2015 |

And here’s the Good with Money view of ‘good’ Junior ISAs.

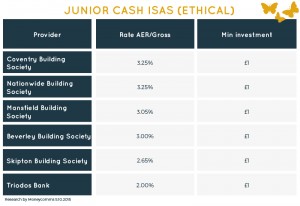

It’s easy enough choosing an ethical Junior Cash ISA – here’s our faves.

For those wanting to make the most of the potential upsides of the stock-market, Olivia Bowen of Castlefield IFAs recommends Alliance Trust for junior ISA investing, Avalon Investment Freedom Junior ISA and Sheffield Mutual’s with profits fund, open to junior ISA holders.

Where to go for more information

An excellent starting point (bien sur) would be to read the short Good with Money blog and longer investigation into Junior ISAs.

The AIC allows you to search investment companies by sector, so you can search those investment companies within the environmental sector, for example, to know that you’re choosing an environmentally-friendly option.

And of course, it’s a good idea to speak to an independent financial adviser if you remain unsure after doing your own research. Unbiased.co.uk is a website that will give you some local options or options based on what financial goal you need advice for.