Cryptocurrencies are growing as an alternative to traditional money – there are now 51 bitcoin cash machines in London. Some experts view “crypto” as an alternative to gold as a store of value in uncertain times. Some say cryptos are a more ethical, truly democratic means of exchange, as well as being more secure. We aren’t too sure what the implications are yet, but one thing is for sure: interest in investing in cryptocurrency is increasing. So when we came across this beginner’s guide, by Carl Hughes, a technology consultant with a specialism in cryptocurrencies, we asked if we could publish it (it’s the best explanation we’ve read so far.) This guide was originally published on Steemit.

My aim, as a technology consultant, is to help everyone understand cryptocurrencies, a type of digital currency, so they can be as informed as possible should they wish to use or invest in them. In this post I will help demystify the world of cryptocurrencies by answering the common questions clients and friends ask me. The focus will be to compare traditional money to cryptocurrencies.

What are cryptocurrencies?

Cryptocurrencies (or cryptos for short) are a medium of exchange and hold value for anyone wanting to use them to buy or sell goods and services. Much like you can exchange pounds into dollars, you can also exchange cryptocurrencies into traditional money and between cryptos themselves. The denomination of a Cryptocurrency is known as a coin and in the case of the “Bitcoin” crypto, it can be represented by as small amount as 0.00000001 of a bitcoin. Below is a list of the top ten cryptocurrencies showing their market share.

What technology are cryptocurrencies based on?

Money as we know it is controlled and managed by banks and financial institutions known as “Trusted Third Parties”. This man in the middle approach enables money flowing in and out of your bank account to be logged and approved, a process known as book keeping.

Our current banking system requires high overheads including buildings and people at many locations to maintain this centralised ledger of transactions which is only seen by the few and cannot be verified by the public at large.

Cryptocurrencies are built on an automatic and decentralised technology called the “Blockchain”, a software which holds the ledger of transactions distributed across a network of internet connected computers and devices called “nodes”.

This is a public and collective way of book keeping whereby essential details of each transaction are recorded and verified. For a transaction to complete, all nodes have to agree that the transaction is valid, so if you attempt to commit fraud by giving yourself say a million Bitcoins, the open ledger system will immediately see no record of this transaction and mark it as void because the nodes on the network cannot arrive at a consensus.

On this basis alone it means that overdrafts are a thing of the past, as you cannot create cryptos out of thin air like the banks do with traditional money! It is also impossible to delete or change existing transactions since they form part of one of the “blocks” in the “blockchain” and as such I feel this technology creates a transparent and accurate audit trail.

The system is based on cryptography and mathematical algorithms which means the individual who owns the cryptocurrency and other confidential details like name and account details remains private and only the details of the transaction are public such as amount, time, date are made public.

As well as maintaining the ledger of transactions, the blockchain software also creates the cryptocurrency itself which the next section goes into.

How are cryptocurrencies created?

Traditionally the control of money is given to central banks. Money at one time was backed by a weight in gold which gave money its intrinsic value and regulated the market, now nothing supports it which allows banks to create an unlimited supply of money out of thin air (called Fractional Reserve Banking)! Banks can create money from debt in the form of credit cards, loans, overdrafts and the interest payable on this debt. This centralised approach gives banks the power to inflate the economy and devalue money itself.

In the previous section I mentioned how the blockchain software that underpins cryptocurrencies has a dual purpose, to maintain the ledger of transactions and to create the currency itself.

The more powerful of the computers on the network can use the same blockchain software to create new blocks which are added to the “block-chain”. The parameters of this software stipulate that each block represents a number of crypto coins. These powerful computers are called “miners” and just like gold miners dig for gold, the blockchain miners create blocks.

Each cryptocurrency will have its own unique set of software rules like how many blocks it takes to create a coin, how powerful the computer needs to be in order to create the block itself and the maximum number of coins that can be created over time. All of these factors will influence which crypto coins a miner decides to mine and which ones are more attractive to investors.

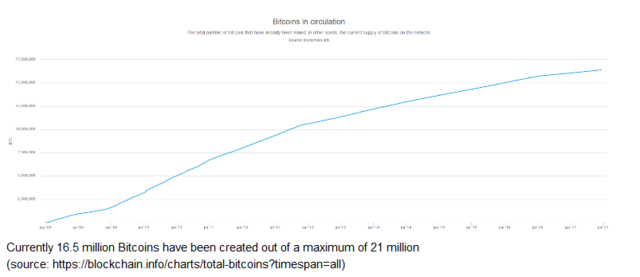

Written into the software of most cryptocurrencies is the maximum number of coins that can ever be created so as not to devalue the currency and inflate the money supply. Using Bitcoin as an example, it is only possible to create 21 million coins.

How can I create cryptocurrencies by mining?

As mentioned previously, the way cryptocurrencies are created is through a process of mining using powerful computers called “Mining Rigs”. For most people owning a “mining rig” is too expensive, involves lots of maintenance, noise and heat! The alternative is to invest in a mining contract with an online mining company (large warehouse full of powerful computers) whereby you lease some of their computer power and get paid in crypto currencies. If this interests you, I highly recommend Genesis Mining and if you click on the link below you get 3% off!

https://www.genesis-mining.com/KLH1UD

How do I buy cryptocurrencies?

Just like you can buy foreign currencies at a bank or currency exchange at the airport, there are cryptocurrency exchanges where you can convert traditional money into cryptocurrencies and cryptos between each other. I use Cryptomate, Bittylicious, Kraken and Coinbase.

How are cryptocurrencies stored using wallets?

Traditional money is either stored in a physical wallet or as virtual money in an online wallet (bank account, credit card or investment fund). Only 3% of all money exists in the physical form so let’s focus on the latter where your money is held by the bank and represented by a card in your physical wallet. You are restricted on how much you can withdraw each day in a current account, and for savings and pensions you are restricted from accessing funds for a defined number of years. In recent years country’s have controlled access to money at banks and ATMs (take Greece where in 2015 all banks were closed for a week) preventing account holders from accessing their funds and there is now talk of bank “bail-ins” where your deposits can be skimmed to support those failing banks. All of these examples demonstrate that we do not have real control of our money.

For cryptocurrencies there are no restrictions because you are the bank and have 100% control of your funds, how much you spend, when and where you spend it. I think this is great, but it does require some management and planning on your part – there is no “Bank of Bitcoin” who you can call when you lose your wallet! Instead you are your own bank manager managing your crypto funds using wallets.

Cryptocurrencies exist in a decentralised state, encrypted and secure inside the blockchain and are represented by a public address and private keys which are held inside a software wallet. The public address is used to buy and sell and the private keys represent the currency in your wallet (knowing the private keys enables you to move your currency to another wallet – disclosing them to someone else means you could lose everything!).

These days there are some very functional software wallets that allow you to synchronise your cryptocurrency across multiple devices using a password and seed (minimum of 12 words). Keeping the seeds and passwords in a safe place is crucial. I recommend Electrum for Bitcoin and Jaxx and Exodos for other cryptocurrencies.

https://jaxx.io/ | https://electrum.org/#home | https://www.exodus.io/

If you are investing a large amount of money, I recommend moving those funds to an offline physical wallet that isn’t connected to the internet like Trezor and Ledger where the private keys are only saved on the device.

Trezor Wallet (for Bitcoins) – https://shop.trezor.io?a=32a92332c0de

Ledger Wallet (other coins) – https://www.ledgerwallet.com/r/8a40

How are things bought and sold using cryptocurrencies?

Using traditional money there is a massive infrastructure of buildings and people to process everyday transactions and, if you are sending money to another bank account or converting to a different currency, there can be significant delay and charges to do so (Western Union charge between 7-29% per transaction!). Did you know that when you pay £2 for your morning espresso, the transaction has to pass through five intermediaries and it can take days before it is finally settled?

To explain how transactions take place in the crypto world let’s imagine you are on a trip to Mexico City and want to buy a cup of coffee. At the coffee shop you order the coffee costing 1 Bitcoin and they give you their bitcoin address in the form of a QR code which you scan on your phone (this is my Bitcoin wallet address as an example: 1MXXWNwTMCryQPgTCTfLxiMm8LBhtRJTCe).

I mentioned earlier that a wallet has private keys and in this situation the private keys are used to “sign” and authorise the payment – it is impossible for anyone without your private keys to do this. This transaction then gets broadcast onto the blockchain network for the miners to get busy crunching more software code to confirm that the wallet sending the bitcoin has enough funds and to validate the transaction within seconds. Each transaction can have up to six confirmations by separate miners so for large currency amounts it’s worth waiting for all six. The miners receive a fee from the transaction that both the coffee shop and yourself pay, normally a fraction of a percent (at the time of writing – 0.0008 of a Bitcoin). Notice that even though you are in a foreign country, using cryptocurrencies means that there is no exchange rate to consider and the transaction fee is the same everywhere.

The end result of this coffee purchase would be that your Bitcoin wallet has been reduced by 1 bitcoin and the coffee shop’s increased by 1.

How safe and secure are cryptocurrencies?

Your bank knows everything about you, your transaction history, how much money you have used and who you spent it with. A big reason people like cryptocurrencies is that they bring 100% anonymity through using them. All transactions are encrypted so as not to reveal who or where you are, thus reducing the possibility of falling victim to fraud or identity theft.

How valuable are cryptocurrencies?

The traditional money supply is being squeezed through inflation, bank charges and taxation which means the value of a pound or Euro today cannot buy as much as it did five years ago. As cryptocurrency transactions are anonymous it is impossible for income to be assigned to an individual unless it is exchanged back into traditional money, therefore it is free from income tax. Also, their value can be maintained because their supply is limited and it is impossible to create debt from them.

It’s worth noting that cryptocurrencies are volatile, however over the past few years they have continued to perform well and give greater returns when compared to traditional currencies. To give you an example, four weeks ago I bought some cryptocurrencies which has given me a 10% return on investment – when I look at my UK Pound (£) current account for the same period it gives me a 0.00095% return!.

Checkout https://www.coingecko.com/en to see how valuable each cryptocurrency is today.

Personally I buy cryptocurrencies in the hope that they will one day become mainstream and enable anyone with an internet connected device to do business. Today there are still many humans who do not have a bank account but do have a smart phone – this would enable them to start buying and selling local produce easily and securely using cryptocurrencies.

Are cryptocurrencies just about money?

All cryptocurrencies are based on a decentralised blockchain software model with each having its own unique technical attributes much like Microsoft, Google and Apple. Because each crypto is a software platform in its own right, means that third party projects can be built using the platform which may have nothing to do with finance. Examples include “Crypviser” who have created an anonymous messaging and social media platform, “Steemit” who have created a decentralised Facebook and “Sia” who compete directly with Dropbox and Google Drive to store your files encrypted over the blockchain.

Real world examples of cryptocurrency use

It’s estimated that only six percent of the world population has ever heard of cryptocurrencies, which in my view means there is great potential for its absorption into society. All ready there are real examples of how cryptocurrencies are being used around the world including countries like Japan (Bitcoin) and Russia (Ethereum) to start using them as official currencies, there are many Bitcoin ATMs and coffee shops and local communities are starting to embrace them as a currency. Ripple’s cryptocurrency is used by the Banks to reduce transaction time and cost associated with moving money.

Summary

I am really excited about cryptocurrencies as I feel they offer a real world solution enabling everyone to buy and sell goods without the restrictions of central banks. More importantly you can be in control of your wealth and do with it as you wish.

The opinions are the author’s own and Good With Money does not make a fee from any of the links given in this article.