Choosing a new mortgage deal is complicated enough and there’s a lot to consider. Criteria can be so exacting that you might not be lucky enough to have your pick of deals.

So it can be hard to try to bring your conscience into the equation too – but the interest on your mortgage is a big outgoing and lending to the housing market one of the biggest pillars of UK banking.

So if you can choose a building society or a challenger bank over a high street bank such as Barclays or HSBC, then do. Their rates and terms are often competitive and it means you can feel that little bit better about what your money is funding.

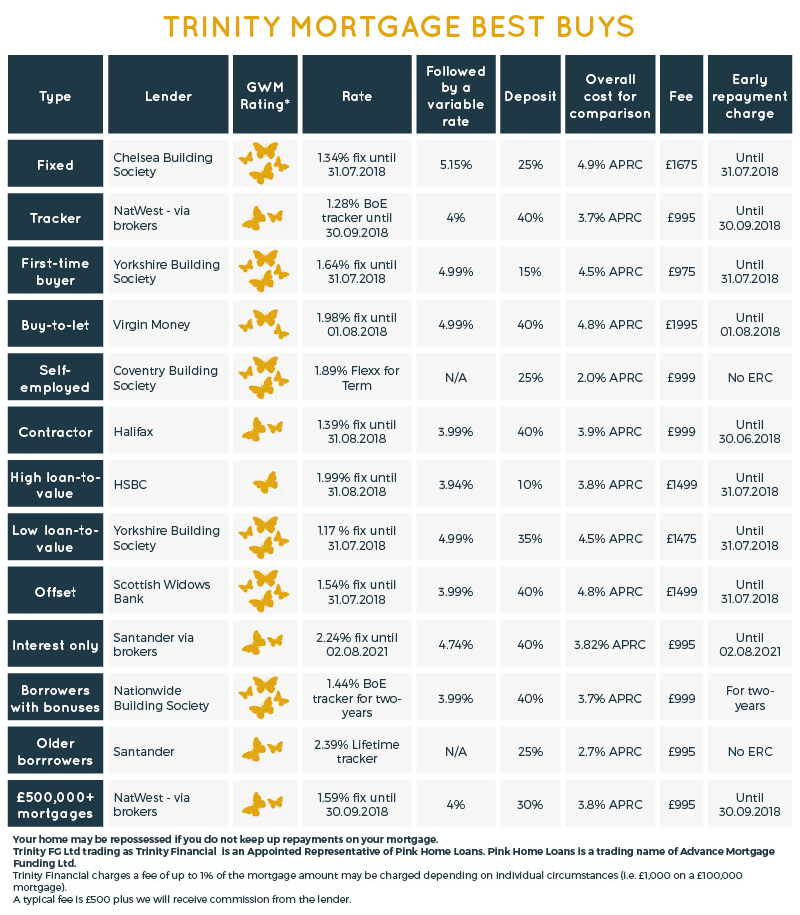

The goodness ratings in this table are based upon the latest research by Move Your Money (Good With Money’s very own goodness ratings are in development and coming soon.)

The table is broken down according to Trinity Financial’s pick of the best deal on the market now according to typical personal circumstances that can govern the rates you will be offered, loan-to-value limits and eligibility.

Ps. Becky has the Coventry BS deal.