The threat of a Brexit is increasing fears about a fall in household income, according to new research.

Despite a £95 increase in monthly disposable income from £905 to £1,000 in the last quarter, the prospect of rising house prices, job losses or changes to job market protections mean that people do not trust that this increase is here to stay.

Scottish Friendly said the rise had been felt mostly by part-time workers following the introduction of the National Living Wage in April 2016. Low inflation was also behind the increase in disposable income, after housing costs and essentials, as well as moderate pay growth.

The mutual said that nearly half of households are worried that the Referendum will reduce the amount they have to spend.

The quarterly report, which has been compiled in conjunction with leading think-tank the Social Market Foundation, reveals a small improvement overall (from £905 to £1000) in disposable income over the last quarter.

The older, the wealthier

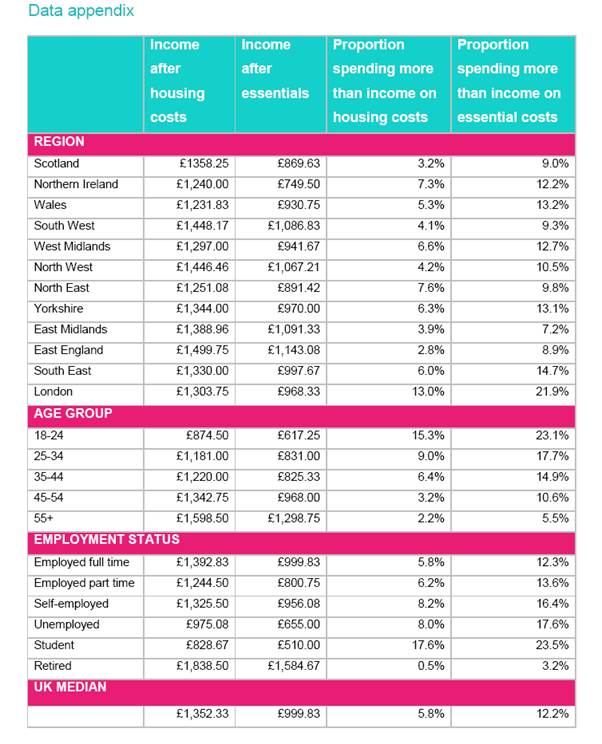

Some groups find themselves more squeezed than others. Those aged 35-44 years have just £825 left each month after buying daily necessities, less than the £831 available to 25-34 year olds and below the national median of £1,000. Those in work continue to find themselves with less disposable income than those in retirement, with the average retiree having a higher monthly disposable income of £1,585.

This disparity in favour of the older generation is attributable to them being less encumbered by the burden of housing costs.

The median 25-34 year old spends £836 on housing costs each month with £626 going on rent or mortgage payments alone. By contrast the average over 55-year old pays just £302 on housing costs with a median spend on rent or mortgage costs of zero.

This combined with the trend for older people to work longer, relatively generous private pension provisions for older people and the fact that younger generations have seen slower pay growth compared to previous generations means that older households are, on average, significantly better off.

No room for saving

Despite improvements in the headline figures of disposable income many households remain pessimistic about their financial prospects and are worried about unexpected financial or economic shocks.

Only a third of households (34 per cent) believe they will be better off financially in 12 months’ time. Meanwhile, nearly a quarter (24 per cent) believe that things will get worse for them financially and close to half (48 per cent) are worried about how they would cope with a big, unexpected bill like a broken down car or washing machine.

Such pessimism is unsurprising with more than a third of households (36.5 per cent) reporting they are worried about their debts and half (51 per cent) stating they are not in a position to regularly save or invest.

Brexit anxiety

The looming EU Referendum also appears to be a worry. Half of households (52 per cent) are concerned about the outcome of the vote and 45 per cent are anxious about how leaving the EU would affect their family financially.

The main reason cited is the possibility that a Brexit may cause prices to rise (40 per cent), lead to job losses (29 per cent) or to changes in labour market protections like paid holiday or maternity leave (19 per cent).

Calum Bennie, savings expert at Scottish Friendly, said: “The introduction of the National Living Wage is clearly a positive step and that, combined with low inflation and moderate private sector wage growth has helped certain sections of society to have more money in their pockets at the end of the month.

“However, our study continues to suggest that people are feeling financially fragile. Worries persist about preparedness for unexpected bills and debt. Not enough households are in a position to save at the end of the month and that is a concern. With financial security still seemingly very out of reach for many households, policy makers and businesses alike should take heed of the persistent insecure sentiment in the UK.”

“Uncertainty caused by the forthcoming EU referendum is also leaving many UK families feeling concerned. The possibility that prices may rise that jobs could be lost or that rules around maternity leave or paid holiday may change are clearly important points affecting many people considering the impact of the EU referendum on the pound in their pocket.”