Of all the money habits in the world, there is little out there as uninspiring as putting your money in a savings account right now, if you actually want the value of your money to grow.

Yet despite the dreadful returns from basic savings, many of us still want to put money into a bog standard account rather than risk our cash with investments.

There’s nothing wrong with this. Savings accounts are pretty risk free, relative to other options. Up to £75,000 of your money in a savings account is covered by the Financial Services Compensation Scheme (FSCS).

Solid, dependable – they are shire horses compared with more whizzy-racehorse funds or crowdfunds.

In addition to the low risk, the advantages of savings accounts over other, more potentially profitable places to put your cash are that they are easy to open, can offer easy access, small monthly deposits and often the convenience of being within the same log on as your bank account.

The problem with them is that the rates are piddly: 2 per cent is considered decent these days.

The good news is that with rates so universally low and likely to head lower this week, if you are going to save, you may as well make it an ethical account, because there is very little to choose between naff all, and absolutely naff all, returns-wise.

Here are our pick of accounts that will use your money in ways that are more environmentally and socially responsible and offer rates not far off the best anywhere.

1. Nationwide

2% for a regular saver account, instant access, minimum £1.

Nationwide is the UK’s biggest “mutual”. Mutuality means it is answerable to member-customers and not shareholders, which means it is in its interests to work for the benefit of its members.

The building society has a “Living on your side” citizenship strategy, which is how it measures its efforts on running the business in an ethical and responsible way.

Part of this is a commitment to the environment. Nationwide has just been recertified for the third time by The Carbon Trust for its carbon emissions reductions.

2. Charity Bank

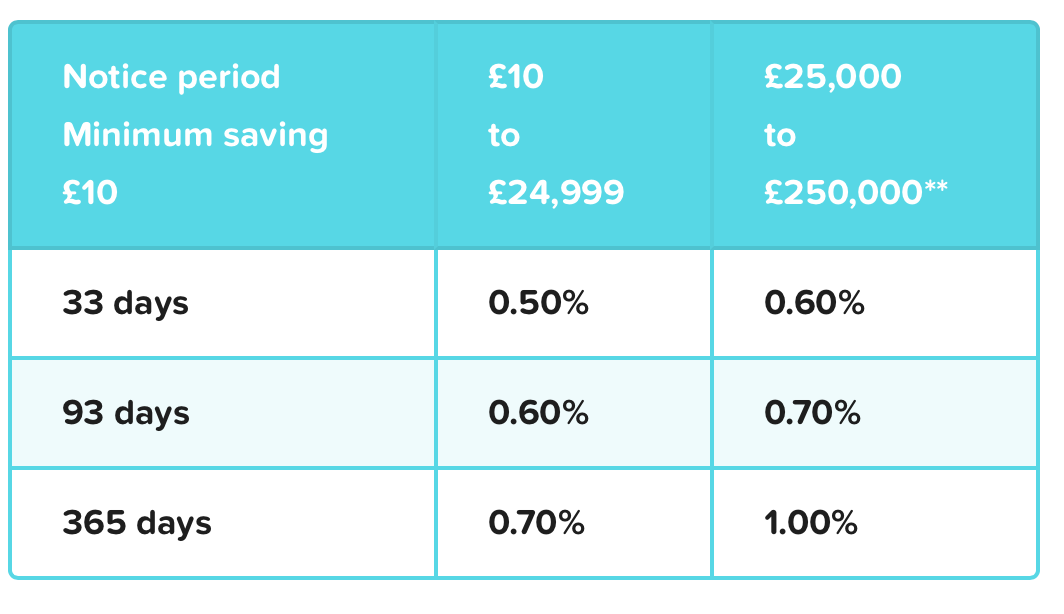

Between 0.5 per cent and 1 per cent – but you only get the higher rate on £25,000 plus of savings and with a one-year notice period.

These rates are a fair way off the best on the market, but they are what Charity Bank calls “fair”. Charity Bank is the most committed to supporting social enterprise of any lending institution around. Take a look at its impact here.

So if you are willing to make a small cut on what your money could earn in the best buys and care a lot about doing good deeds, this could be for you.

Not taking applications right now due to high demand but worth keeping an eye on – its instant access saver that can take monthly deposits from £25 offers 1 per cent.

The clue is in the name with Ecology – your money will support energy efficient building projects, retrofit and renewable energy projects, saving the planet and your money.

5. Triodos Bank

Easy access saver at 1 per cent from £1. The bank is 100 per cent ethical and totally transparent – big claims it is happy to back up. Triodos supports everything good – including arts and culture.

6. Coventry

Easy access ISA, 1.3 per cent on balances from £1. Coventry scores highly for taking its responsibility to communities and the environment seriously.

1 per cent easy access on balances of more than £1,000. Kent Reliance supports charitable causes in… you guessed it, Kent.

A regular saver of 1.25 per cent from £50 and an easy access account of 0.75 per cent from £100.

Save as much or as little as you like, as often as you wish. Deposit savings at local shops, collection points, by direct debit or directly from your wages. Credit unions aim to pay a dividend on savings once a year to all members. Dependent upon performance this can be as much as 8% of the total amount saved. Saving with a credit union means your money is benefiting your neighbours, not outside shareholders.