Is it the most exciting thing to have happened to the savings market since Premium Bond prizes? Possibly.

Even if not, the Innovative Finance ISA, also known as the IFISA, is promising to do for your savings what Game of Thrones did for TV and make them, finally once and for all, INTERESTING, by giving your money something to do other than sit in a bank account.

Good With Money, in association with Abundance Investment and Crowd2Fund, has published a guide to the IFISA.

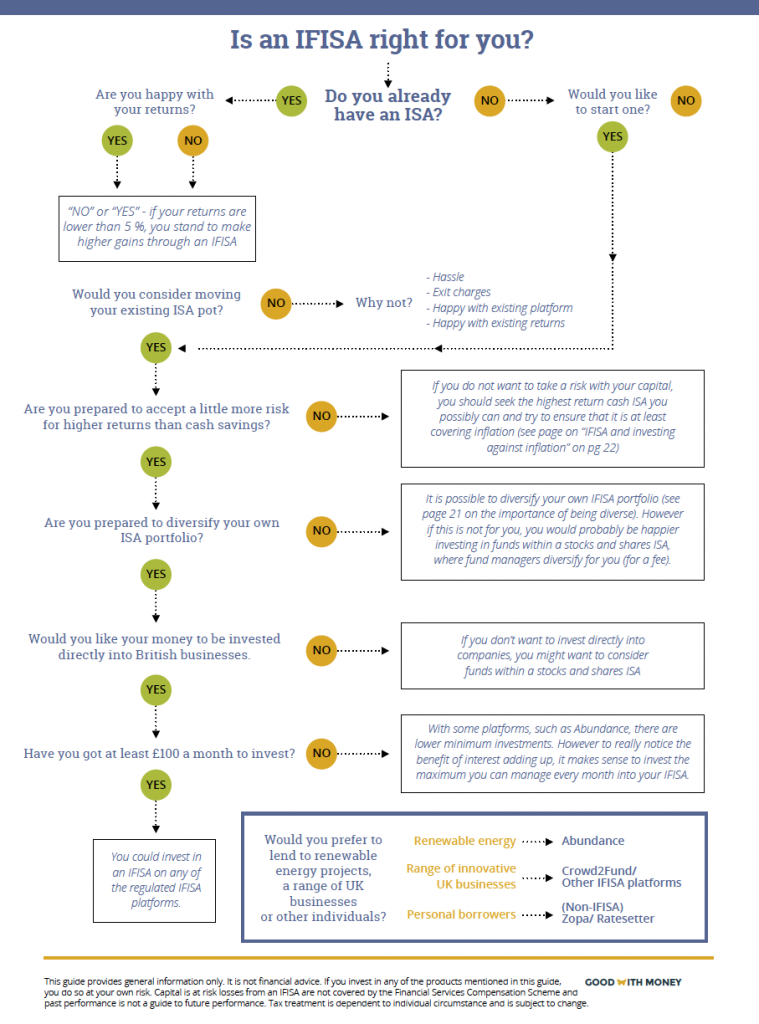

With a handy flow chart to help you decide if an IFISA – one of a number of ISA options now available, is for you, the guide explains how this type of ISA is unique and how it can fit into or even replace existing ISA savings.

According to the Great British Money Survey, 65 per cent of people “want to invest in things that give both a decent return and don’t harm our future,” while 67 per cent: “like to be in control of my savings and investments and choose exactly where my money goes.”

The Lending Works, Abundance Investment, Crowd2Fund , Crowdstacker and now Zopa are among the biggest platforms to offer the IFISA. While Abundance, Crowd2Fund, Crowdstacker all enable lenders to invest in businesses, the Lending Works and Zopa enable lending to personal borrowers to become IFISA-eligible.

Bruce Davis co-founder and managing director of Abundance Investment, said: “The IFISA’s merits go far beyond offering savers and investors a more attractive return on their money and extend to having the potential to fundamentally change the landscape of saving and investing for the better.”

Chris Hancock, founder of Crowd2Fund, said: “The Innovative Finance ISA allows the general public to take part in the acceleration of the growth of innovative British businesses at the same time as potentially earning attractive returns due the the efficiencies offered with crowdfunding and peer-to-peer investing.”

Nicholas Harding, chief executive of Lending Works, said: “This launch comes in response to unprecedented demand by investors, who are looking to new asset classes for income growth, at a time when other investments and bank savings accounts are often delivering mediocre returns, if at all.”

So if you’ve had enough of stuffy old cash and stocks and shares (although there is a place for all types of ISA, we might add), download the guide today.

What does an IFISA investor look like? Meet Richard from Liverpool

Richard is one of Crowd2Fund’s most regular investors. He is a successful businessman based in Liverpool and a serial investor on Crowd2Fund.

He set-up and owns a transport company in Liverpool. As an entrepreneur, he has always been savvy when it comes to saving and investment money. He’s risk taking, easygoing and open-minded. He is open to using emerging technology as a way of maximising returns on his investments.

“The opportunity to access higher returns while helping innovative businesses access the funds they need to grow and achieve their goals really excited me. I’ve invested more than £200,000 over the past few years and never lost a penny whilst earning a good 9.2% APR return.”

Richard understands that he may lose his investment but trusts the base level of due diligence Crowd2Fund conducts on all opportunities.

Since he joined the investor community in March 2015, he has invested in 37 different projects with amounts ranging from £5k to £35k. He’s now part of the Crowd2Fund Investor Club as one of the top investors.

One of the most valuable things for Richard is the fact that he’s directly lending his money to individuals, as a private investor, rather than through a middleman who takes a cut and all the interest goes back to him.

Sometimes when investing in businesses he also gets additional perks such as a free product from the businesses and enjoys seeing them grow. He also finds debt much simpler and reliable than equity crowdfunding.

“The Crowd2Fund platform provides lots more information than the other platforms so I can make my own decision on investment opportunities and like to see where my money is going. The platform is really easy to use, I manage my portfolio from the iPhone app.”

Since launch, Crowd2Fund has always worked hard for its users. No investors have lost money and because of its commitment to compliance and its private investors, in March 2016, Crowd2Fund became the first peer-to-peer platform to offer the Innovative Finance ISA.

“Unlike the other platforms I know that Crowd2Fund only works with private individuals, another reason the interest rate is so good but also, my earnings are tax free because I can invest through my Innovative Finance ISA.

The other amazing thing about the platform is that if I need my money out I can just sell my investment to another investor in the Crowd2Fund community.”