Sustainable Impact, March 2015

3 super findings:

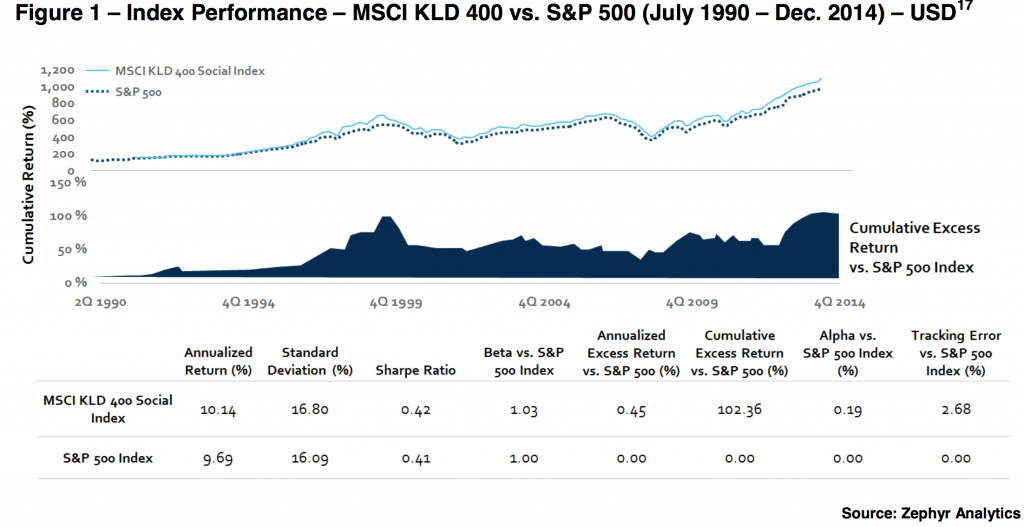

- Investing in sustainability has usually met, and often exceeded, the performance of comparable traditional investments. This is on both an absolute and a risk-adjusted basis, across asset classes and over time

-

Sustainable equity Mutual Funds had equal or higher median returns and equal or lower volatility than traditional funds for 64% of the periods examined.

- There is a positive relationship between corporate investment in sustainability and stock price and operational performance, based on a review of existing studies

Cool statistic:

“Given a $1 investment in 1993 in a value-weighted portfolio of high sustainability versus low sustainability firms, the high sustainability portfolio would have grown to $22.60 by 2010, while the low sustainability portfolio would have only reached $15.40, a difference of over 46%.”

Memorable graph: