Download the PDF version of this report here.

Introduction

You have a child. You want to do the right thing by them by putting some cash aside for their future. This is why a Junior ISA, more than other types of investment, is an act of love.

Socially and environmentally responsible investments should therefore be an easy sell to parents who want to make the world a better place for their children as well as making sure they are looked after financially.

Olivia Bowen, partner at Castlefield, the ethical independent financial advisers, says: “People naturally think about ethics more (or start to if they haven’t already) when saving for kids, and often want to take less risk.”

However time and sleep poor parents may be more inclined to go for the one on the leaflet that came with the Bounty pack – that doorstopper set of marketing material you get when you have a baby. Junior ISA providers not surprisingly make the most of these.

But this decision might not turn out to be the best either financially or ethically.

And the other thing to bear in mind is that ethical investments are actually outperforming their non-ethical counterparts at the moment. In 14 out of 20 (70 per cent) different investment scenarios surveyed by Moneyfacts, the average ethical fund returned 7.8 per cent, compared with 6.5 per cent from the average non-ethical fund, in the past 12 months.

So choosing an ethical junior ISA could be the best-option for giving your children a financial boost as well as protecting the world they will live in.

Hard as it may be, it is worth putting the time aside to do a bit of research.

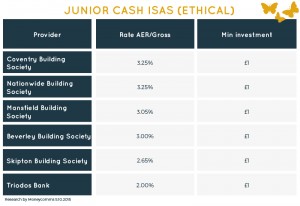

If you want a an ethical cash ISA, that’s pretty straightforward, but less financially rewarding. Building societies and Triodos are on the list and rates range from 2 to 3.5%, with a minimum investment of £1.

The fun starts with stocks and shares junior ISAs. The results of our mystery shopping investigation into the biggest ready-made and self-pick junior ISAs on the market (those that Google churns up first) are delivered below.

Stocks and shares junior ISAs

When it comes to stocks and shares Junior ISAs, you can choose funds to invest in yourself (labour-intensive but rewarding), or opt for a ready-made one, which does the choosing for you.

The latter option is much easier, but if you want your money to go somewhere good, it’s probably not for you.

Here’s why.

– A lack of truly ethical options in the junior ISA market

– A lack of transparency over where money is actually invested

– ISA options marketed as ethical sometimes are less ethical than traditional options, for example, with big holdings in oil and gas and global banks

Almost any fund can be open to Junior ISA investors. However some providers actively target this market.

These are: One Family, The Children’s ISA, Scottish Friendly, The Children’s Mutual and Shepherd’s Friendly (another mutual). Legal & General, Hargreaves Lansdown and Fidelity will also appear above the horizon line in a Google search of junior stocks and shares ISAs, so we report on their ethical status below too.

More detail:

Finding: There is a lack of availability of ethical options in the junior Stocks and Shares ISA market.

- Only two mainstream junior ISA providers offer parents a so-called ethical option: One Family and The Children’s ISA (although self-select ISA options on platforms such as Hargreaves and Fidelity allow ethical investors to choose their own funds).

Finding: Transparency is generally poor among ready-made funds, often hiding dubious investments.

- Some of the biggest junior ISA providers – The Children’s Mutual, Scottish Friendly and Shepherd’s Friendly do not give information on top ten holdings, nor do they give any mention how “ethical” the investment is. Where your money goes is hidden in downloadable PDFs and not on the main fund information pages, if the information is given at all.

This lack of transparency means that in practice, ethical considerations appear to be reserved for those who feel confident enough to pick their own funds – for instance, Hargreaves Lansdown (more detail below) is very transparent on which companies funds invest in – but you have to do your own legwork on the ethical credentials of the stocks.

Looking at each of the main funds….

– One Family, run by Engage Mutual and Family Investments, offers the Family balanced international fund, with £1 billion under management and an average annual return of 7.45% over 5 years. Alternatively, it’s ethical fund is the Family charities ethical trust fund, one tenth of the size and with a more impressive annual average return over 5 years of 8.16 per cent.

However, the ethical One Family ISA appears to be less ethical than the standard option: it is 21 per cent invested in banking and oil giants HSBC (9%), Royal Dutch Shell (9%) and Barclays (3%), whereas the standard ISA is invested in mostly gilts, corporates bonds and property.

– The ethical junior ISA from The Children’s ISA is the Edentree Amity International Fund, which, while genuinely invested in responsible companies such as Ezion Holdings and Glaxosmithkline, has not performed strongly on returns, delivering 15 per cent over five years.

– The Children’s Mutual, run by the Forester’s Company, does not label it’s junior ISA as ethical. And the holdings of the fund certainly are not (nor are details of these easy to find, buried in the price and performance section of the foresters.com website.) The top ten holdings are dubious, including Royal Dutch Shell, HSBC, British American Tobacco, Diageo and Barclays.

And yet, in its ethical policy page on the website, it has the following statement: “this approach dissuades us from buying the shares of those companies with significant association to negative externalities, since their share price could be hit by the crystallisation of a risk.” We don’t think this approach is reflected in the fund holdings.

– the Scottish Friendly junior ISA is one likely to be doing a lot of business at the moment – it is running a £50 ad offer to new customers through Bounty. Despite friendly being in the name, none of the 8 funds are ethical, but instead offer different risk profiles. Risk is also key for parents, so this is a good approach, however if an investor wanted to investigate further where there money is going, they would find it difficult.

Our efforts to find the top ten holdings listing were fruitless. We could only find the sector allocations, for example: the Higher fund is 59.6 per cent invested in US equities, but we couldn’t find which ones, only that it was run by the Legal & General US Index Trust.

There is information on the holdings of this trust on the Legal & General website, but only the hardiest researchers would get this far (the most controversial holding we found here was Exxon Mobil).

Legal & General actually manages almost all of the Scottish Friendly junior ISA fund options – the only one managed in-house is the UK Active Fund.

– The Shepherd’s Friendly junior ISA is invested in a with-profits fund, where returns are “smoothed” to even out the performance over the good and bad years, with bonus payouts from the leftovers. The “How we manage your money” downloadable PDF gives information on sectors, but nothing on allocations or stocks held – so we don’t rate it highly for transparency.

– Hargreaves Lansdown has a wide range of self-select Junior ISA options on its site that it promises you can open in “5 minutes” (hardly enough time to make an informed choice).

It has transparency in its favour. You can drill down easily on the site to identify the top ten holdings and also read detailed analysis on each fund. Because it is easy to find out where your money is going through Hargreaves (you can go straight to the company websites if you aren’t sure what they do), and serve a wide range of options, we like them as a way to choose where to invest your ISA if you are ethically-minded.

However Hargreaves doesn’t label funds as ethical or responsible, even if they are, so you have to do your own legwork here and visit the company websites themselves.

When looking at junior ISA options on the site, you can choose from its Wealth 150, Master Portfolios or “Investment Ideas”.

On the main Junior ISA page, some Investment Ideas are listed. This selection is currently topped by HL Multi Manager Special Situations Trust. Drill down, and you will find that the biggest weighting is in Neil Woodford’s Woodford CF Woodford Equity Income Class Z, (10%), which is 13% invested in tobacco – British American Tobacco and Imperial Tobacco.

In its Wealth 150 range of funds, there are some managers that are rated highly for their responsible approach to investing, such as First State Asia Pacific, which has returned 46% over 5 years, however they are not “ethical” as such.

Using the Master Portfolio tool for a £1,000 lump sum, HL recommended 4 funds:

First State Asia Pacific Leaders 20%,

Lindsell Train Global Equity, 30%,

Marlborough UK Micro cap Growth 30%

JPM Emerging Markets 20%.

With the exception of JPM Emerging Markets, which is heavily dependent on banks and has a nearly 5% allocation in oil and gas, the companies listed in each of these funds are not big no-gos (although Lindsell is not great if you don’t like investing in alcohol – it is 8% invested in Diageo).

- Legal & General offers different approaches to junior ISA investors. Option 1 is called “Responds to the market” and is a mixed investment 20 to 60% Fund – it is not ethical but doesn’t invest in commodities and invests in a range of other funds. It is 1.71 per cent down since the fund launched 1 year ago.

Option 2 is called “Follows the market” – it is the UK Index Trust – not ethical but mostly UK, with a 10.7% exposure to oil and gas – it has underperformed the IA sector average over 1, 3, and 5 years.

The last option with L&G is called “pick your own” and offers a choice of 30 funds including two specialist funds that may be of interest to ethical investors the Ethical Trust and the Global Environmental Enterprises Fund.

The L&G Ethical Trust has outperformed its sector average and the rest of the market significantly, returning 5.79% over 1 year, 47.24 % over 3 years and 74.46% over 5 years.

However it has holdings – even in its top ten, that some ethically minded investors may balk at, for example, a 3.81% stake in BG Group, the oil and gas producer. The fund has a total of 252 holdings. The top ten represents 36%. We do not think the L&G Ethical Trust deserves to be labelled ethical.

The L&G Environmental Enterprises Fund is newer and smaller, set up in June 2011 and therefore missing out on some of the gains in renewables that year. It has lost 16% in the last 12 months but over three years, returned 25% – below the sector average but respectable. All of its top ten holdings are renewable energy and energy efficiency related.

- Fidelity splits the stocks and shares junior ISA options into two: Pathfinder and Headstart. Crudely, Pathfinder is for people who want all the work done for them, Headstart is for people who want a bit of a say in where the money goes.

If you pick the Pathfinder option, you will be asked to grade your risk appetite on a sliding scale. For the purposes of this investigation, we went for the middle.

You then choose between three different fund options: Fidelity Multi Asset Allocator Strategic Fund, Fidelity Multi Asset Strategic Fund, Fidelity Multi Asset Open Strategic Fund. Yes, they do all sound pretty much the same. The difference is in the relative passivity. They go from passively-run index trackers to quite actively managed to very actively managed. We would expect passive funds to be less ethical generally. For each of these funds, the key information documents do not contain any information on the top ten holdings of the funds – only the sectors that the assets are held in, and these are not specific percentages.

The Headstart version allows you to pick investments either based on your appetite for risk or based on themes. So the themes option gives you an ethical in, no? No. The themes are emerging market, income or two-speed world, which is a mix of emerging market and developed nations (and has a fracking icon above it).

Each option will give you a range of funds to choose from. It is relatively easy at this point to find out where each fund invests. For instance, one of the eight fund picks from the two-speed world option is Rathbone Global Opportunities Instant Access. The top ten holdings of this fund are clearly listed on the fact sheet (and in fact, with the exception of Betfair, none are particularly controversial).

If you are choosing a junior ISA with Fidelity and are concerned about where your money goes, we would suggest the Headstart option would give you more of the information you would need. Nevertheless, not an “e” for ethical anywhere.

In conclusion:

The minority of funds open for junior ISAs list the top ten holdings in a place that is easy for an investor to find. This lack of transparency is one of the biggest reasons that so much is invested in companies we might disagree with behind our backs. Fund management firms must get better at communicating where investors’ cash ends up in the new era of heightened awareness of ESG risks among retail investors.

Many companies will state an ethical approach, however this is not backed up by the profile of their funds. There is a disconnect between intention and action and the industry needs to examine its own standards here and not use third party benchmarks that may not be adequate.

Where should I invest then?

Olivia Bowen of Castlefield recommends Alliance Trust for junior ISA investing, Avalon Investment Freedom Junior ISA and Sheffield Mutual’s with profits fund, open to junior ISA holders.

Can investing in oil and gas ever be considered ethical?

There are arguments, most frequently offered by the chief executives of oil companies and climate change sceptics, that investing in oil is ethical because it brings people – whole countries – out of poverty and not investing in oil would keep these people poor.

We think the argument that climate change will cause mass poverty on an unprecedented scale is much stronger. There are also other ways to bring people out of poverty that are not also damaging to the environment – the use of solar lights, for example.

We think that given the carbon exposure risk of oil and gas and the controversy over ever more expensive and risky methods of extraction, such as deepwater drilling, fracking etc. investing in oil and gas cannot be judged ethical. Moreover, it can reasonably be considered a risky investment, with the potential for significant financial losses. The oil and gas sector has performed poorly relative to environmental markets. See this blog for more.

FTSE4Good – it’s not so good

One of the reasons that ethical funds are sometimes not that ethical is that they use the FTSE4Good index. HSBC makes up 6.5% of the UK FTSE4Good index, Royal Dutch Shell 4% and Vodafone 4%, to which an ethical investor may respond: “Come again?”

A high profile investigation into money-laundering at HSBC’s Geneva office found links to drug cartels and terrorists. Meanwhile, Shell has only just pulled out of an attempt to drill the Arctic, not because it decided it was wrong, but because the site wasn’t “a gusher”. Vodafone, meanwhile, was accused of aggressive tax avoidance. You might think these activities alone would be enough to warrant exclusion from an index labelled “good”. Not so.

FTSE ranks companies with Environmental and Social Governance (ESG) ratings from 0 to 5, with 5 being the highest. Companies with a FTSE ESG Rating of 3.3 and above will be added to the Index.

The FTSE4Good criteria is well-researched and transparent, but it focuses on improvements and ESG practices, which can easily be (mis)used by large companies to offset the impact of ill-gotten gains from their bread and butter business, resulting in the bizarre pre-eminence of the likes of Shell in the index.

The index has been developed in close consultation with a broad range of stakeholders including NGOs, governmental bodies, consultants, academics, the investment community and the corporate sector. But this diffuse consultation has resulted in a lack of conviction – it only excludes two sectors: tobacco and weapons systems. The index imposes no requirement that a company must only engage in activities with positive social and environmental benefits, as you might expect given the name.

And it is influential. Many so-called “ethical” funds use the FTSE4Good to decide where to invest, and market this fact alongside soft-focus pictures of happy parents throwing their laughing children up in the air. Your average investor who wishes to make their well-meaning decision in 15 minutes is unlikely to drill down as far as the top-ten holdings, and will instead take the marketing on face value.

And yet it is still hard to be too critical, because any attempt to filter out harmful activities from the investment universe should be encouraged and the FTSE4Good plays an important part in the wider shift of capital flows from bad to good.

Active v. Passive

If a fund is passive and stocks have been picked for you, the chances are it will be less ethical, because it will more or less reflect the whole of the market (although this is considered less risky).

But if a fund is truly ethical, it should be actively-managed to ensure no unethical businesses slip in. If you pick your own stocks or funds, you can be more sure you agree with the approach of the companies you are investing in, however this may be a more risky strategy is it could lead to less diversity in your portfolio.

Environmental v. Social

It can be hard to work out what you care about and everyone’s ethics are different. Some things we all tend to agree upon – such as weapons, but it is much harder to decide whether you prioritise environmental or social concerns, for example and when choosing funds, you might have to consider which is most important to you.

Where to go for more information

It’s a good idea to speak to an independent financial adviser if you remain unsure after doing your own research. unbiased.co.uk is a website that will give you some local options or options based on what financial goal you need advice for. On ethics, the EIRIS has a consumer website that has not been updated for a while, but is still useful if you aren’t sure where you stand on things, called yourethicalmoney.org.