This morning, I clicked on the “About Us” section of one of the UK’s fastest growing peer to business lenders.

There were more than 20 male employees listed – and one woman.

Before seeing this, I’d been thinking about writing good things about this platform. But when I saw the dreadful gender balance, my heart sank and I couldn’t in good faith recommend them any more.

I just can’t think of an excuse for such a ratio, especially not at a start-up, where in theory, there would be no legacy issues and a reasonable attitude to flexibility in the work place.

This particular platform sprang from a much larger, much more traditional financial services firm. Perhaps that is the reason.

In any case it got me thinking – is my own money going to firms that have a decent gender balance right across the workforce, from board level to call centres (but most importantly at the top)? Does my money go to firms that as well as employing an equal number of women, also pay women equally?

There has been a lot of noise lately about getting more women in financial services on executive committees – not just PR and HR (the “women’s” departments, with 52% and 61% female representation, according to the report). Is anything changing?

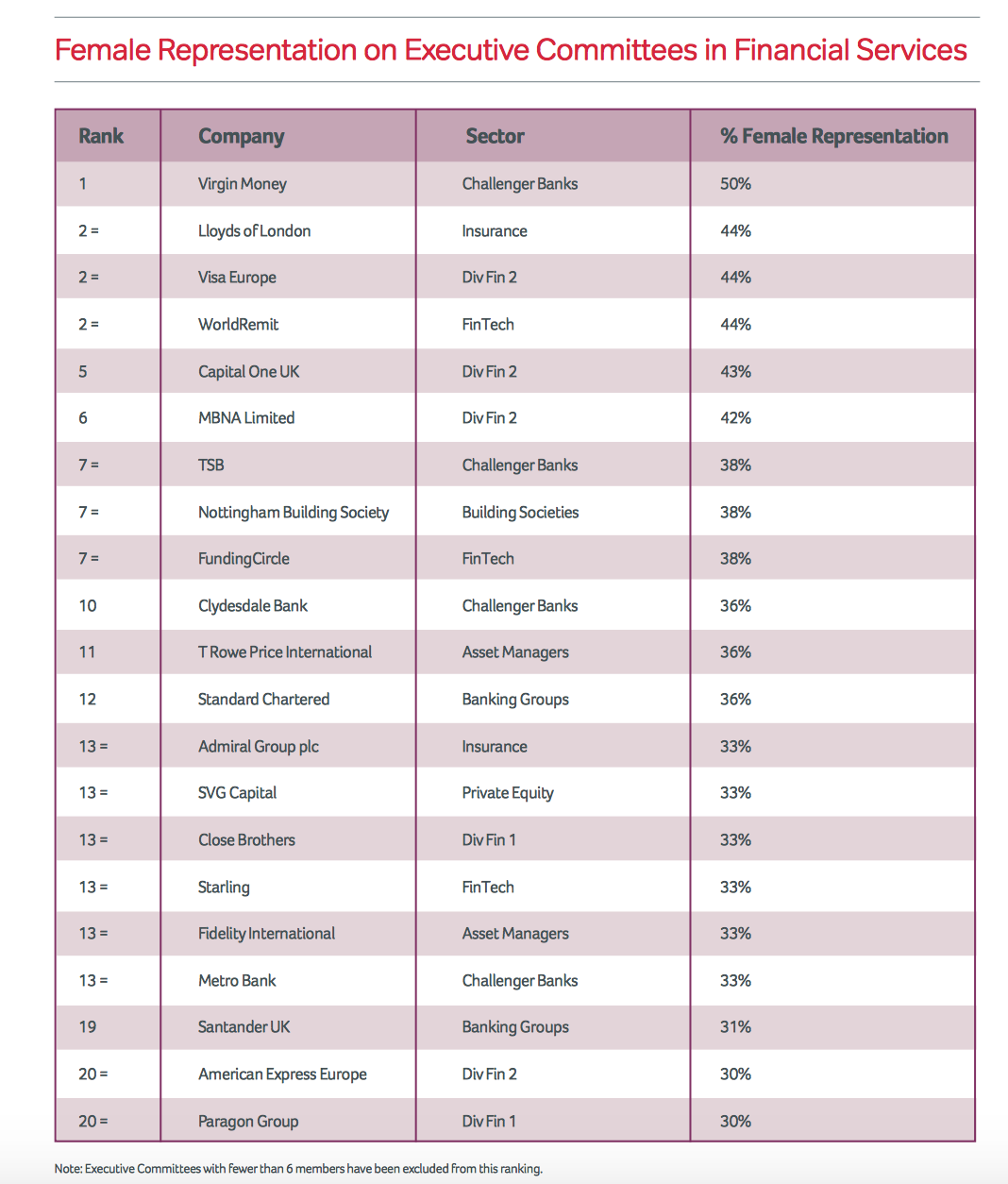

A sample of 200 firms active in UK Financial Services was taken for a report on Women in Finance by Virgin Money. It showed an average of 23 per cent female representation on Boards, but only 14 per cent on Executive Committees, so quite far from the 50/50 you would hope to find in an equal society.

Why is it not 50/50? Opinions differ. The latest Women in finance survey from Financial News, published today, found that personal support networks, including stay-at-home Dads, were the secret to success of those women that do make it:

Women in Finance: Personal support network key to City mothers https://t.co/4G2Aph5RtI pic.twitter.com/y4XHczFG69

— Financial News (@FinancialNews) April 19, 2016

Women in Finance: The stay-at-home secret behind some City mothers #womeninbusiness https://t.co/IjnSb15ZLv pic.twitter.com/fZKvq2NLZH

— Financial News (@FinancialNews) April 19, 2016

These findings strongly suggest that women with children cannot cut it in the world of finance without a kind of entourage of willing helpers filling their shoes back home.

This contrasts a little with the findings of the Virgin Money report, which suggests that culture, rather than childcare, is what holds women back. There is a boys’ club culture in financial services of long hours, presenteeism and fairly rigid routines. Senior men often hire in their own image.

As a female with two young children, I’d say childcare is the main problem. It’s very challenging logistically to nurture the lives of children and your own career – and to afford it. The cultural problems are related to this. Women with families need flexibility and a culture that values home workers as much as desk workers. Introducing these can benefit everyone. More malleable arrangements don’t affect the quality of anyone’s work. If anything, the opposite is true. Unless you are a female CEO on a salary high enough to afford a live-in nanny, you can’t afford to bend family life around an unforgiving office schedule. Which means unless you have made it the top before children, it will be a struggle.

In any case, if you wish to consider gender balances within companies when choosing where to put your money, here is a snapshot of the best performing financial services companies for female representation at board level:

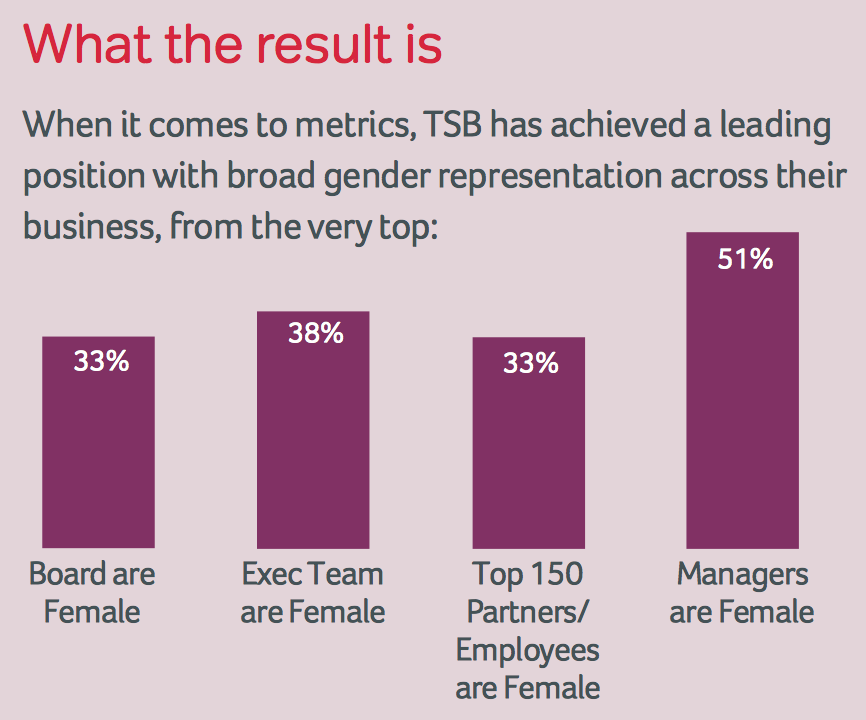

The report also singled out TSB, Lloyds Banking Group’s high street arm, for having made good progress:

… It’s something to go on for the time being.