Yes, you might be run over tomorrow.

Yes, you only live once.

And no, you can’t take it with you.

But do you know what? The average life expectancy in the UK is 81.5. 81.5!!!!

So let’s assume that you WOULD like to stop working before you die.

The average pension pot is £87,724, yielding an annual income of precisely £4,514 a year for the average retiree.

Compare that to what you earn now. Then think about inflation in between now and then. Now try and imagine living the life you want to live on that money.

It’s just as well that the craft revolution is taking off, because with those stats, you’ll be selling your hand-knitted scarves on Etsy to pay for packets of Ryvita until you shuffle off this mortal coil, having spent what would have been your retirement working towards the shortfall your piddly pensions savings left you with.

Wasn’t auto enrolment meant to fix all this?

It’s very well being auto-enrolled.

But unless your employer is paying in at least 8 per cent and preferably 10 per cent, it probably won’t be enough to leave you comfortable. And most employers are now paying in about 3 per cent, with employees contributing just over 1 per cent, giving a total contribution of just under 5 per cent, according to the latest Pension Regulator figures published today (the minimum contribution will rise to 8 per cent for employers by 2019).

Too many numbers for you? Put it this way, if you are between 20 and 35 and on an average-ish salary, you need to be putting away between £100 a month (lower age limit) and £300 a month (if you are closer to 35). And for those on average earnings, that’s quite a lot to set aside, when you could be spending it on things like your first home instead.

A stick to prod yourself with

Usually on Good With Money, we’re pretty positive. “It will be ok in the end if you work hard and are generally sensible and get your head around interest calculations”, etc etc.

But when it comes to pensions, a bit of paranoia and fear is justified.

It would be nice if people were waving banners with your name on and cheering you on as you sort your pension out. This doesn’t happen.

The truth is that the time will come when you retire, and you will be shocked about how little money you have coming in. Death might even seem preferable.

Luckily it’s sortable. And the younger you are, the better the outlook 🙂

But no one is going to do it for you. If anything, the world is against you.

Why?

Lots of reasons.

1. The state of the economy

Your retirement joy is the fall guy for our politicians’ monumental economic F’ ups.

It might seem odd to you, but actually, your dotage is ultimately paying for these now commonplace bailouts of financial markets.

How?

Well, introducing quantitative easing, reducing interest rates and bailing out banks all has to be paid for by someone. Those that pay, ultimately, are actually us – savers and taxpayers.

There is huge public sector debt as a result of all this creating money from thin air – the vast majority of which has ended up in bankers’ pension pots and property, which means less money to fund the state pension and certainly less money to fund tax relief on pensions contributions.

The Chancellor is chipping away a little bit at a time at your pension pot without you even realising and all the time encouraging you to spend and borrow instead of saving.

You are being manipulated into working until you die, because the state cannot afford for you to retire.

Don’t even ask about whether the new Lifetime ISA, coming in next year, is a back door replacement, with less tax relief, than the current pension (it is).

This sounds like a conspiracy theory doesn’t it? It’s not. It’s reality. If you squeeze a balloon, you just move the pressure elsewhere. Think of your retirement as the bit where all those economic pressures, so easily pushed aside, are building up.

2. The state of the state pension

With so many changes to the state pension, frankly, who knows what it will be worth in 30 years’ time.

Just a third of the UK population believe that the state pension will be as generous when they retire, according to Aegon. A further third believed that it would still exist, but at a less generous level, while 10 per cent of those surveyed thought that there would be no state pension at all when they reached retirement.

After the shift to a single state pension this year, claimants should receive £151 a week, or £7,852 a year.

But this depends on whether you made enough National Insurance Contributions while you were working.

You can check your’s here.

3. The growth of self-employment

There are now around 15 million self-employed people in the UK, and only one third of these are saving into their own private pension, instead relying on their business to fund their retirement, according to Aegon.

4. Our obsession with thinking property will fix everything

New findings from Aviva published today show almost half (46 per cent) of over-45 homeowners – equivalent to 6.08million UK households – see the wealth built up in their property as a key part of their retirement income plans, rising to 58% among the youngest age group asked (45-54s).

So it seems the shift in thinking of a home as somewhere to live to thinking of a home as an investment is pretty much complete.

This is not surprising given how expensive it is to get on the ladder in the first place. But it isn’t sensible people. Property is one asset class. It can down as well as up.

5. We just can’t bloody afford to retire

Perhaps it’s not so much head in the sand. Perhaps we all know exactly how dire our retirements will be and therefore choose not to think about it deliberately, to avoid depression as well as poverty.

Barely one in three (36 per cent) of unretired over-55s had started their retirement planning by summer this year: the lowest percentage since Aviva’s Real Retiremement Report began tracking this data two years ago.

And according to figures from the Department for Work and Pensions published today, last year, 10.2 per cent of over 65s are still in work – the highest level since records began.

6. Some of us don’t even know what a pension is (it’s ok)

You might know that a pension is a savings vehicle that pays you money when you retire so you can still afford to live.

You might not understand how it is different to other savings vehicles.

So in case this is you, and you were too embarrassed to ask, a pension is a special type of savings scheme because you DON’T PAY TAX ON CONTRIBUTIONS.

This means that whatever your returns are on your pension, if you are a basic rate taxpayer, a £1,000 contribution costs you £800 (because you don’t pay your 20% tax) and if you are a higher rate taxpayer, a £1,000 contribution costs you £600 (because you don’t pay your 40% tax). So you are getting an effective uplift on returns.

First steps out of pension panic

This stuff can be really, really difficult to sort out. Like downing a flaming sambuca, it’s best not to think about it too much first.

- Find out what your current pension pot is worth. You can contact your old employer’s pension departments directly or companies like PensionBee can help you with it.

- What income do you want in retirement? Aviva has this fabulous planner.

- Work out what your shortfall is.

- Establish what monthly contributions you need to make to meet it. Then increase your contributions.

If you do finally muster the courage to take these first steps, hold your breath and be prepared for yet more pain.

Because yes, of course, pension companies do not make it easy for the brave few who try to gain control of their own life savings. Pension solving gurus at PensionBee have found it takes 19 days for companies to respond to information requests, on average. Many providers prefer to respond via post and might slow things down with pernickety things like identity requests.

Romi Savova, CEO of PensionBee said: “We deal with providers day-to-day and it’s incredible how complex they make pensions. Customers face all kinds of barriers, from baffling jargon to sluggish responses, and it’s almost impossible for people to get on top of their savings.”

Sustainable pensions

Sustainable pensions

If you are going to live to 81.5 – you had better have a decent planet there on which to do it.

Your auto-enrolment scheme probably does not offer much choice when it comes to funds.

If you are investing in your own pension privately, however, you might want to pick a provider that ranks better on things like not investing in fossil fuels and prioritises corporate governance in the companies it invests in.

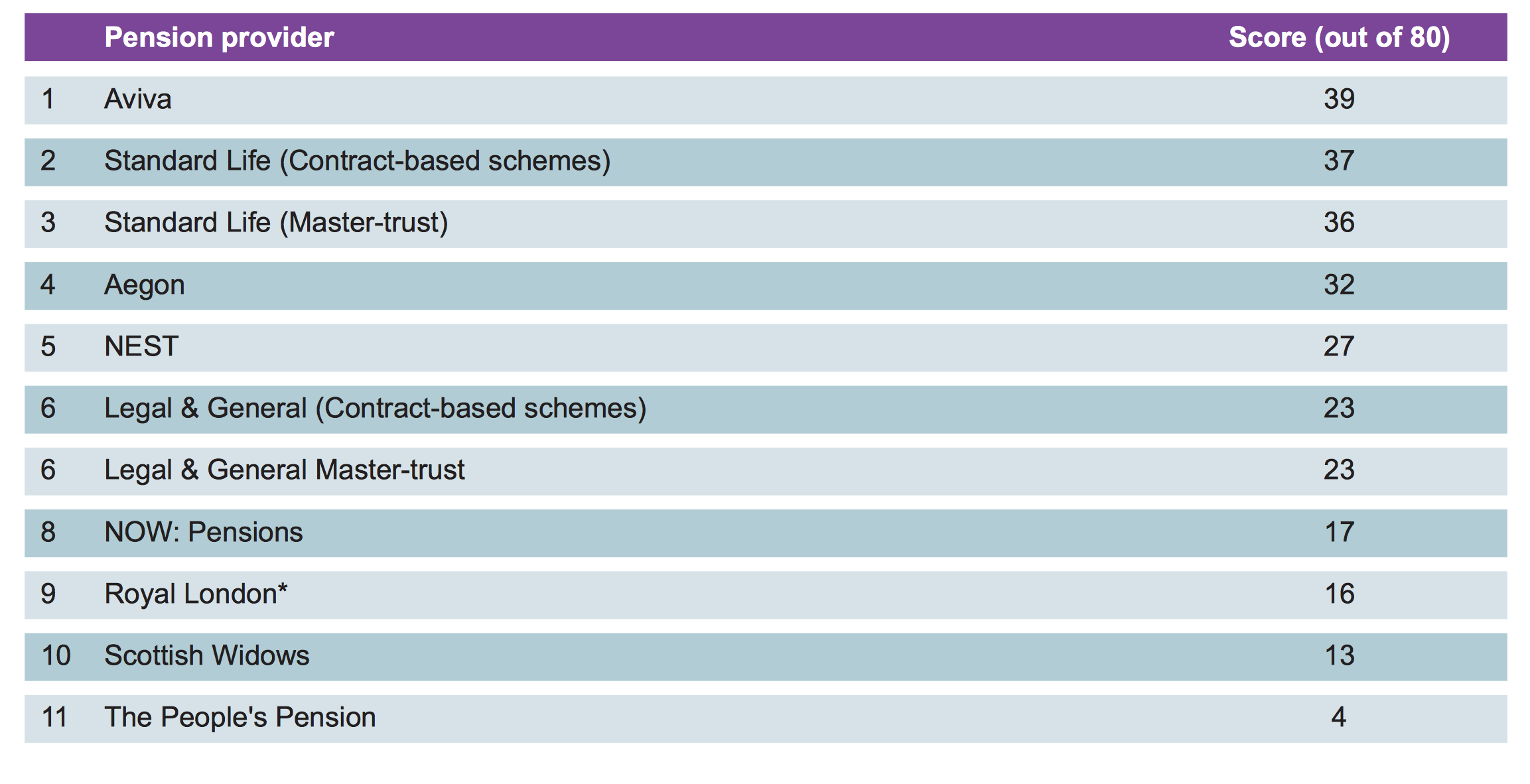

The table below shows Share Action’s rankings:

Share Action is a great resource if you want to check the sustainability records of any fund manager or large company you might find your money has been invested in on your behalf.

Good With Money has a pensions section too.

Sorting out your pension will NEVER be easy. Even with experts holding your hand and sending you cute reminders.

Who wants to think about old age and death? Not us! But Oasis were wrong, You and I are NOT going to Live Forever. So stop everything, this second, and sort out your pensions shiz. Get rich slowly. You’ll thank us one day.