You might think humankind has a lot to feel proud about. We’ve built a giant science experiment in Switzerland, developed solar energy and invented the Internet.

But if, as a society, we really wanted to feel proud of ourselves, we’d do something about the heinously embarrassing gender gap in all things economic.

We have managed to create a jobs market where one half of all humans in it are effectively subjugated for half of their working lives, despite equal if not greater skill sets, and everyone just thinks this is ok, nothing to see here, it’s the way things are?

Well, it’s not “just the way things are”. It’s criminal. We oppress 50 per cent of the species every single day.

I’ve started to write about gender imbalances before, I’ve even managed a couple of low key rants about how we should invest more in companies that champion women, but it’s hard to write when you are really cross.

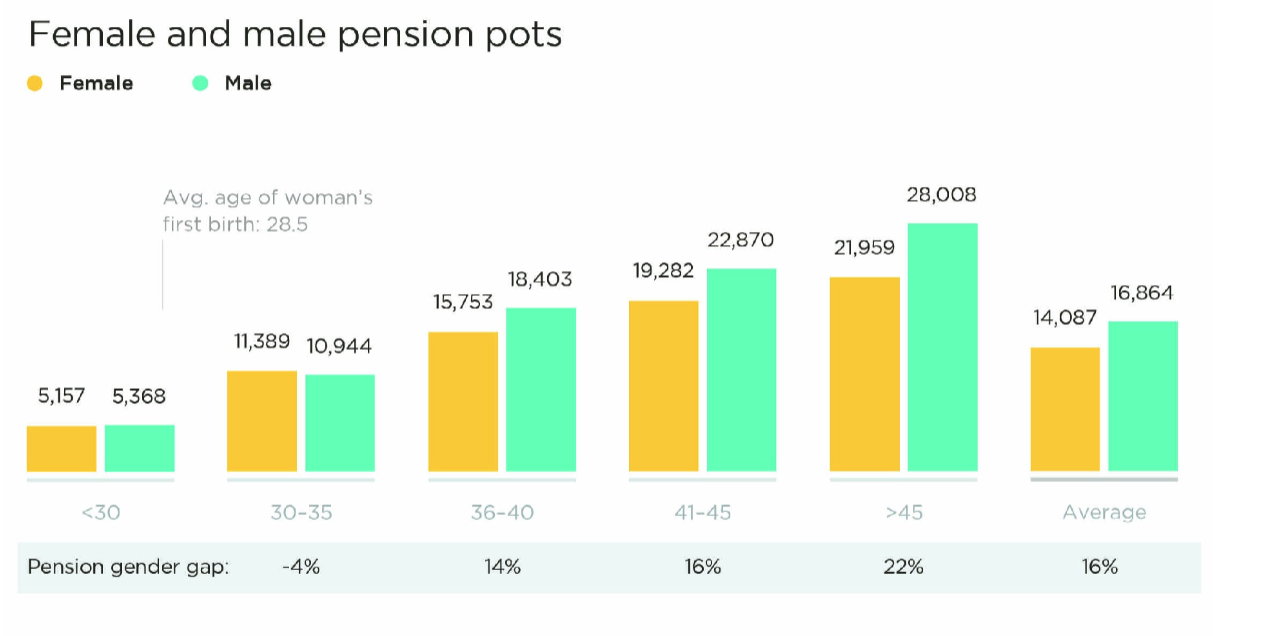

Then today, I saw something so terrifying I had to write about it. The below graph, from PensionBee, the online pension platform:

Why so shocking?

Just look what happens after 30-35. The pension gender gap grows from being non-existent to a man’s pension pot being 22 per cent bigger than a woman’s by the age of 45.

The effect of this is that we are trapping women in an economic dependency on a higher earning spouse or partner. Until they die.

Jemima Olchawski, Head of Policy and Insight at the Fawcett Society, said: “Right across their lives women earn less and so have less to save for their pensions. What’s more, whilst auto-enrolment has been an important step forward, women are still more likely to be excluded from the benefits.

“All this leaves women at risk of poverty and economic dependence in their retirement. It’s time to speed up the pace of change, close the gender pay gap and banish the dated stereotypes that mean women continue to be most likely to pay the price of care.”

The gender pension gap is immoral. A dreadful failure of modern policy. Why?

Well, consider the implications for a moment.

You start working life making your own modest contributions to a pension pot. You are sensible and therefore quite good at this. Then, you have kids (many women don’t, however most of the long term income inequality is felt by those that do). You take time out of work, because you feel you have no choice and it’s the right thing to do for your family. When you go back to work, you go back part-time and it’s an admin job well beneath your experience level.

Meanwhile, his career is flying. This drives an emotional wedge between you, a pairing originally of equal intellect and ability, now imbalanced. You console yourself with more time with the kids. It’s just as well you love watching them grow up. You put away what you can but that is almost £0. Your husband or partner’s pension effectively becomes yours too. It’s a self-fulfilling prophecy – the more you depend on his income, the less important generating your own becomes. You give up on your own economic value, because it has diminished to such a degree you are not sure it is worth getting it back.

In this quite obvious and well-trodden way, the gender pay and pension gap is forcing women into domestic servitude. Forcing. Yes, this is a denial of choice.

Then consider even more miserable implications. What if that relationship is an unhappy one? Then that denial of choice takes on a very depressing tone indeed. Trapped financially in an unhappy marriage: it’s a circumstance more women than might care to admit find themselves in.

Personally, I have lost count of the number of times women of my age with young children, who dispensed with shame years ago, have said to me: “I’d leave him, but I can’t afford it.”

What, you think they should just go? And be a single mum with even less money and less opportunity to scrape together any money of one’s own at all? We cannot be surprised that many choose to stay put and devise coping strategies, such as gin, instead.

My own mother, who entrusted my dearly departed father with everything financial, is A.N Other example of a woman who did eventually (and quite late on) break free from the economic entrapment, to find herself penniless and without a pension – not even a state one – on the other side. She’d worked for my Dad too, you see, a domestic and a commercial skivvy.

Unequal pay and the unfair burdens placed on women with families by poor policies and unenlightened employers can ONLY be corrected by the Government and employers. Such changes are the only things that will open the escape hatch for women trapped in relationships and domestic circumstances they would rather not be in simply because of their biology. It’s all perfectly do-able. Just look at Scandinavia.

For this reason, and with apologies to the wonderful Sheryl Sandberg, f*** Lean In. I’ve got another strategy: it’s called F*** This (copyright Good With Money).

There are several reasons that adopting a F*** This approach will be more effective. For one thing, it is straight forward, no stealth psychological trickery to get what you want out of life, men and work here.

But also, there are over 2.4 million women who are not in work but want to work, and over 1.3 million women who want to increase the number of hours they work, according to the Women’s Business Council. They are clearly not able to Lean In. They are clearly Falling Over. They are ready and waiting to say F*** This. In fact, I’ve a feeling all I need to do is make some placards and set a date.

Saying F*** This and legislating right now also makes economic as well as social sense. By equalising the “labour force participation rates” of men and women – sharing the workload, the UK could further increase GDP per capita growth by 0.5 percentage points per year, with potential gains of 10% of GDP by 2030.

There are some hairline scratches of progress in recent years, mostly thanks to Nick Clegg.

There’s also the recently published Women in Finance charter – a genuinely great initiative headed by Jayne Anne Gadhia, chief exec of Virgin Money. You can read the report and its recommendations here.

But there are more clear policy wins this Government could make straight away. With all the extra women in work these policies would lead to, we must surely be able to afford them:

- Offer 15 hours a week free childcare to children from the age of 1, not 3, as it currently stands. If women are expected to go back to work when maternity leave finishes after a maximum of one year, then support from childcare should start at that point, not 2 years later.

- Legislate so that all employers must offer male workers the same parental leave pay as women.

- Free, subsidised after school clubs that finish at 6pm.

- A minimum number of hours a week that can be worked from home for ALL employees.

- Gender committees on boards of large companies that monitor and publish data on average salaries for male and female staff and set targets to address imbalances over time.

There’s plenty more where that came from. But for now, it’s a good start for the F*** This movement.

The best way to say F*** This yourself, of course, is to save as much as you can into your OWN savings. Stocks and Shares ISAs and pensions, ideally.