Theresa May picked up the baton handed over by the US and China yesterday, declaring that the UK would join them in ratifying the Paris Agreement on climate change.

What has that got to do with me?

The implications for all of us go beyond breathing in fewer particles and that little thing of still having a planet to live on (phew!)

Most of the implications, believe it or not, are financial.

This is because fossil fuel producing companies are the bedrock of the global financial system.

Up to now, their performance has underpinned the financial performance of almost all of the things on which we depend: pensions, savings, ISAs… even non-financial products such as petrol, energy and food reflect the demand and supply of fossil fuels.

What does ratifying the Paris Agreement mean?

In practice this means the UK must now submit its “Nationally Determined Contribution (NDC)” showing how it plans to do its bit to limit global temperature rises to the UN Framework Convention of Climate Change.

While no legally binding output targets are set, this transparent process means countries’ plans are subject to global scrutiny. That’s a lot of peer pressure if you don’t sort out your emissions.

Reducing emissions means producing and consuming fewer fossil fuels, increasing investment in low or no carbon technologies and also in energy efficiency. (NB. It does not mean global economic collapse. Economic growth has now “decoupled” from fossil fuels, meaning it is no longer dependent on them to continue.)

The way the UK sources and uses energy is already changing – this ratification means that process is now likely to happen faster, with more support for renewables and green buildings, as well as “low carbon” energy sources, such as gas and nuclear (although these are also more controversial).

Perhaps Mrs May’s decision will bring an end to the onslaught of cynicism about whether or not manmade climate change is something to worry about (it is); perhaps it won’t. Thankfully, the discussion is now completely irrelevant.

What does this mean for my money?

Energy-related assets make up a large proportion of global stocks and shares, because energy is so fundamental to our lives.

This is why the stock market is dominated by fossil fuel companies, such as BP, Royal Dutch Shell and Exxon Mobil. They are the engines of our lives and our investments and how much money we have is to a large extent determined by how well those engines are functioning, whether we realise it or not.

But behind the scenes, large institutional investors, motivated by last year’s Paris Agreement and recognising the direction of travel away from fossil fuels, are shifting funds towards renewable fuels, waste solutions, green property and other asset classes that represent the future of energy, rather than its dirty past.

So why do we need to ratify the agreement?

It’s not easy shifting the entire global economy away from a dependency on one asset class to a totally different one. Imagine the global economy is a 1 tonne sack of potatoes. It is in one room, but needs to be moved to the next room. Now imagine the global population is three people standing around that 1 tonne sack of potatoes. They’ve got to get it into the next room. It’s going to be very difficult. They think maybe even impossible. But they have no choice. So they start to push..

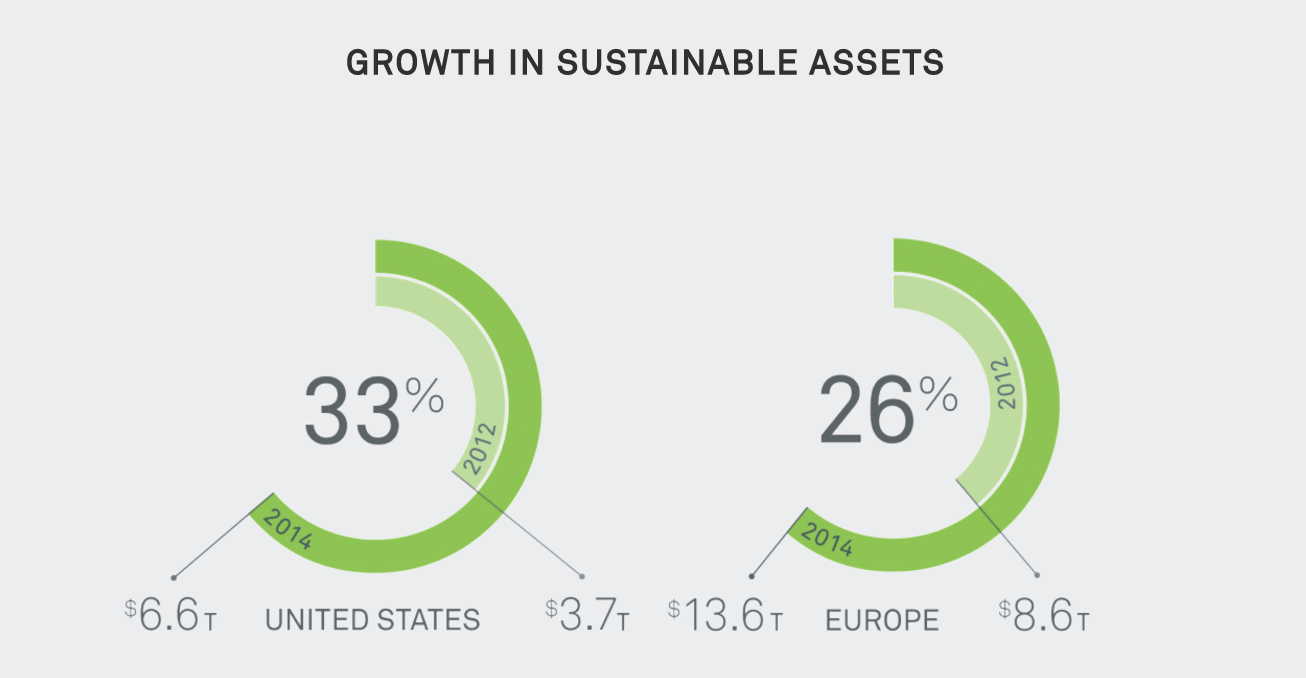

Luckily, it is happening and momentum is gathering. Look at this diagram, from BlackRock Impact, showing the speed of growth in sustainable asset classes in Europe and the US:

This means that your pensions, ISAs and other investments – even the money sitting in your current account, is increasingly being used to fund solutions rather than problems to climate change without you having to do anything at all.

But fund managers can be a strange bunch. Many of the most influential fund managers, which are responsible for deciding which companies to invest billions of pounds of our money into, are older and have grown used to the view, throughout the eighties and nineties, that fossil fuels represent good bets for investors. They can’t be bothered to push the 1 tonne sack of potatoes into the next room. In fact, they are refusing to get out of the way.

These fund managers tend to be cynical about new renewable technologies, which up to now have required subsidies – a dirty word when you are analysing the fundamental appeal of an asset class – to get off the ground.

Despite increasing research that shows social or sustainable investing strategies also represent good risk management in the long term which can even boost returns, many money managers still believe that investing in companies that also focus on social and environmental impact conflicts with their “fiduciary duty” to make as much money as possible for their clients.

They believe that because the value of these stocks can rise more slowly over time than non-ESG (Environmental Social Governance) investments, they do not represent the most profitable option. And because many low carbon companies use relatively new technologies, performance has not yet been proven over the long time horizon that many fund managers would like to see.

Other large asset managers, responsible for where trillions of dollars is invested globally, are paying lip service to the trend towards ESG, but not always following it up with where the money is invested. They are talking the talk on climate change and other issues, but not walking the walk. They are saying the sack of potatoes is already in the next room, when in reality it is barely over the threshold.

BlackRock, for example, was accused of hypocrisy recently because it published a compelling and galvanising report into environmental investing. Not long before, the fund manager, which has a 5 per cent stake in Exxon Mobil, voted against a resolution asking the world’s biggest publicly-traded oil company to disclose how resilient its investments would be if policy measures to restrict global warming to 2C were put in place. As did Vanguard, the world’s second biggest fund manager, which owns 11 per cent of Exxon.

So if you are investing or about to invest, or looking at where to put your pension savings, you can be ahead of the curve in this global switch to green energy by choosing funds with a sustainability focus. You can give the sack of potatoes a push yourself.

This does not have to be a more expensive or lower return way to manage your personal finances and it isn’t necessarily hard to find an investment or deal that is good for the planet. Providers we rate highly for their impact awareness include big names such as Nationwide Building Society. And you can find links to lots of sustainability funds even via mainstream investment platforms such as Hargreaves Lansdown.

Our top picks for sustainability funds into which you can invest your ISAs, your children’s junior ISAs or your SIPP, include:

- WHEB Sustainability – a B Corp certified fund with strong performance over one year.

- Alliance Trust Sustainable Futures Absolute Growth – read more about the performance of this fund here

- Impax Environmental Markets

You can also invest your ISA in a 100% renewable energy portfolio via Abundance Investments, which is accepting deposits for the new Innovative Finance ISA now. Or support community energy projects via Ethex.

See our nine ways to make your money greener for more ideas.