Anyone reading anything about ethical investing this week (which is more likely to be the case this week than most as it’s Good Money Week) might feel a little confused as to what actually counts as ethical and who gets to decide, such is the overwhelming array of criteria and disagreement.

That’s if you’ve actually bothered to look into it. In total, 54% of the GB public is unaware that sustainable and ethical financial products exist, rising to over 63% among millennials (18-34 yr olds), according to UK Sustainable Investment Forum research.

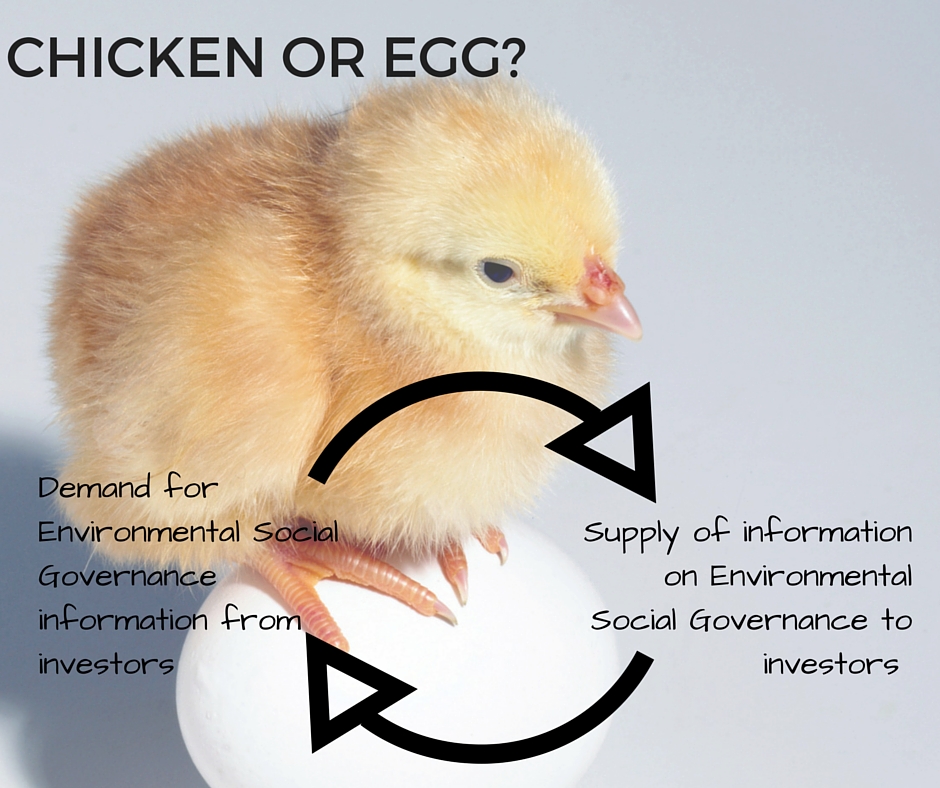

According to some IFAs, people still aren’t asking about the ethics of their investments. But that tends to be according to the IFAs that do not particularly support the view that investing ethically is a good idea. Among those that are actually a bit more au fait with ethical investment options, reports are always that there is TONS of demand.

Whichever it is, there is a lot of attention on this area at the moment mainly because of initiatives like the divestment movement, Global Sustainable Development Goals and the Paris Agreement on Climate Change.

The attention has thrown some light on the difficulties of funds or companies pitching themselves as ethical or responsible (NB. we don’t think any of what follows should put anyone off trying to invest responsibly, nor should it put providers off developing such options).

Here are some examples of debate raging at the worthier end of the fund management industry:

- Should Shell, the nicely branded oil company, be in or out?? Out, but hey, that’s just our opinion among about 25,000 others

- Is it possible to call a fund that invests in tobacco holdings socially responsible? No, but hey, who is stopping Vanguard investing in British American Tobacco?

- Is it ok to give a fund the thumbs up just for progress made rather than absolute positive contribution to society and the environment? No. See Shell above, loads of progress, but it’s bread and butter is still oil.

- Is a negative screen enough, or do the holdings within funds actively need to be making the world a better place? The latter, we reckon, now there is finally a bit of choice of companies that are aiming to make a positive contribution.

The truth is, working out what truly deserves to be called “ethical” (or “responsible”, or “thoughtful”, or “altruistic” – the newest moniker on the block) is hard. And in an industry where product differentiation is becoming increasingly difficult (“Sir, would you like the light or dark grey passive index tracker fund for your ISA today?”), the dibs on who can work out once-and-for-all who gets to be called good and who is bad is also a bit of a bunfight.

The funds, the platforms, the institutions – more and more can see that as a result of a sharp focus on transparency in the investment industry, alongside global goals and a greater interest among younger investors in what their money is funding, it’s probably worth owning this particularly righteous space.

Hence, some recent industry indignation surrounding Morningstar’s efforts to rate funds for their Environmental Social Governance (ESG, should you care to drop this acronym in at the dinner table later: “Darling, are our ISAs ESG?” “What’s that dear? Pass the sprouts). As a result of its criteria, some funds that industry insiders rate highly for genuine social and/ or sustainability do not score well and some score well that industry experts consider unethical.

Then, there’s the whole social v environmental thing. For some reason, there is a divide here: with some funds focusing on social benefits and others on environmental, seemingly (though not always) to the exclusion of the other. The truth is, if someone cares about one, they usually care about the other too. Hence E, S, and G.

It was therefore bewildering to watch a Government minister studiously avoid the use of the word green at a talk on these issues last week while promoting schemes to boost social investment tax relief – one gets the feeling that the environment is a dirty word in Westminster corridors these days. As if it’s ok to care about other people and invest accordingly, whereas to care about the planet that they live on as well is a bit too hippy for some (and perhaps, still considered anti-growth. Here’s why you can have growth and lower carbon emissions).

So what’s the answer, for the 60 per cent plus who do want their money to make the world a better place, but have not a scooby how to go about making this happen?

Well, the UK Sustainable Investment Forum has said that what we need is a kitemark labelling system for financial services firms, so that people can use the responsibility rating of a firm to decide whether to give it their custom (watch this space).

Aviva is one large firm that is clearly placing its flag on responsibility mountain and would welcome a way for regular punters to choose products based on criteria that goes beyond price and into impact.

Steve Waygood, Chief Responsible Investment Officer, Aviva Investors said: “It’s clear that the UK public are interested in sustainability, and as an industry, we need to do more to help people understand where their savings are being invested. In September Aviva published a report entitled ‘Money Talks – How Finance can further the Sustainable Development Goals’ at the UN, calling for a kite-mark system to be introduced – a Fairtrade for Finance – so that fund managers can demonstrate their credentials as responsible investors.

“Voluntary standards in other industries are relatively commonplace, like Fairtrade in the retail sector, but there is no equivalent for the finance industry. We would like to be able to certify that our funds take sustainability seriously so that we can assure our clients that our investment approach is both long term and responsible.”

And in the meantime, while no such system is in place, you can always check in with us at Good With Money. Drop us an email with your questions, whether it’s: “Is Nationwide ok for current accounts?” or “How can I make my ISA green”? We can’t give advice, but we can give you ideas and info.