Dominic Baliszewski is head of consumer strategy at Moneyhub and its parent company, Momentum.

Moneyhub was one of the first to launch of a new range of money apps designed to aggregate all our financial accounts in one place and allow us to view them all online, across different devices. The app provides users with spending analysis to show where their money goes each month. You can also set spending goals and forecasts to help plan spending and saving in the future.

Find out below how Dominic rates his own money goodness.

1. How would you rate your own personal finances for goodness, on a scale of 1 to 10? Why?

“I’d probably score myself an 8. My main priority when it comes to any financial service and, indeed, most things in life, is to choose a company that actually puts the customer first. I bank with a building society and do most of my spending on credit cards. My bank account gives me good value for money with the packaged products and my credit cards earn me air miles or points. I’m pretty good at making sure I get the maximum benefit from my money and my spending – the odd business class flight here and there just for using a credit card is a nice little treat! Using Moneyhub has also allowed me adopt an holistic approach to my finances, as I can keep track of all of my transactions in one place.”

2. What bit of your finances would you most like to change for the better?

“I was pretty well-behaved in 2016 and got into some good financial habits. Launching the Momentum UK Financial Wellness Index has really crept into my psyche and I can definitely give myself a gold star for properly managing my pension and month-to-month financial planning. That said, there is always room for improvement and this year I’d like to brush up on making my money go further through sound investment choices, and a full assessment of my current insurance contracts.”

3. Which provider are you most impressed by? Why?

“I think the new breed of banks are providing much-needed innovation in the industry. I recently went to open a current account at an established high-street bank, where I’m already a customer. I was told, in the branch, that I needed to go online, where I could book an appointment in the branch in three weeks’ time – and then it would be a few weeks from there!! Suffice it to say I walked straight back out.

“The fact that organisations think this is remotely acceptable anymore is shocking. I love what Atom Bank are doing – the ability to open an account via your phone, securely, in a matter of minutes, is what everyone should be aiming for. It’s inevitable that all of the big banks will follow suit, but only because the innovators will drag them there kicking and screaming.”

4. Which provider would you like to see hoisted by their own petard? Why?

“I’m going to try my very best to answer this without ranting. There are so many businesses that really don’t do right by their customers. Also, a number of the larger financial organisations involved in the financial crisis seem to have got through remarkably unscathed, and much more so those individuals directly involved, which bothers me a lot.”

5. Do you think you have lost out financially by making sustainable choices?

“I believe that, things as they are, anyone who ONLY wants to engage with a brand or company that adheres to a strict set of ethics will face a limited range of choices and, as a result, may not always get the best deal.

“So, my approach is to choose an organisation that sits well with me and then use any extra money that I save or earn as a result of the choice to donate to causes that I value.”

6. What personal finance headline would you most like to read in the next year, and why?

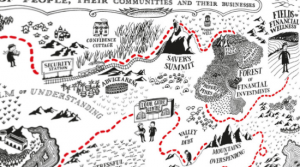

“Without wanting to sound too biased, any headline that refers to the results of the Momentum UK Financial Wellness Index, due to be published in February, would sit very well with me. The second iteration, conducted by the brilliant research team at the University of Bristol, will once again assess the financial wellness of UK households, and by comparing year-on-year results, we can begin to track significant change in the UK’s finances. Only by understanding what factors are benefitting or impacting someone’s financial wellness can people start to understand and take control of their finances – that’s our ultimate goal here.”

Watch this video to find out more about financial wellness.