This post is an extract from the newly published Good Guide to Stocks and Shares ISAs

I started investing in stocks and shares through an ISA about 18 months ago.

I was motivated by the poor returns on cash ISAs; the desire to complement my pension savings with long-term ISA investments; the desire to put my money where my mouth is (ie. in companies with a focus on sustainability) and because I just finally felt ready.

I was 34 and I had about £100 to £150 a month spare to invest. I chose a platform and set up a direct debit for £100 to invest in the WHEB Sustainability fund. It is the only fund I invest my ISA money into at the moment because it ticks all of my boxes: it is a B Corp, meaning it meets reasonably strict criteria on its impact, and it has performed well since launch.

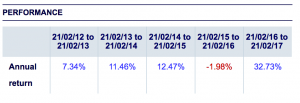

The FTSE 100 has returned 23 per cent over the same five-year period, so WHEB is doing well so far.

The fund invests in sustainable transport, health and energy efficiency, with companies such as Canadian Solar, Johnson Matthey and Kingspan.

I opened my ISA not with any particular purpose in mind – but it is for the long term and I hope will complement my pension savings. I am not using it for the kids – we save into their Junior ISAs too.

I find it quite hard to work out how much to invest in all of the different ISAs available and it isn’t easy choosing a fund when you don’t really know what differentiates them. There are literally thousands and they can all sound a bit samey.

So for me, investing in line with my values actually makes it easier to choose where to put my cash, as well as motivating me.