It seems to be a fairly common aspiration to own your own home. We have incentivised investment structures for first time buyers, but what about the market in general? Is it reasonable to think that we can afford to buy a home where we want to live? What should we be thinking about?

The Office for National Statistics (ONS) measures a huge range of things. If you want to know how the average price of a kilogram of carrots has changed since the 1970s, you can. One of the more useful things they do is put together reports about trends. Unlike some other sources you can see the data they are using.

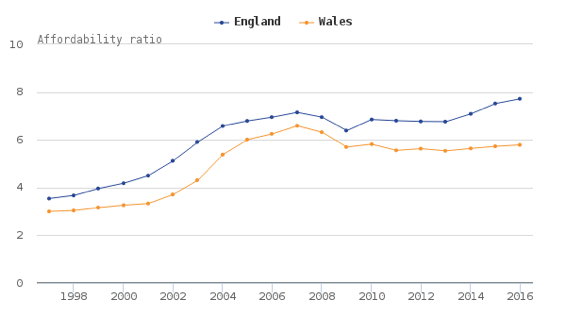

On 17 March, the ONS quietly released a publication called “Housing affordability in England and Wales: 1997 to 2016” . They compared house prices to annual earnings over the last 20 years. These are averages (medians to be precise) so they won’t reflect every person in every situation.

The first thing they saw was that people need to spend more compared to their income. The multiple went up from around 3.6x earnings to 7.6x earnings when you look at a national level.

If house prices continue to increase at the current rate (6.2% in the year to January 2017) you will not make any real progress if you just hold cash.

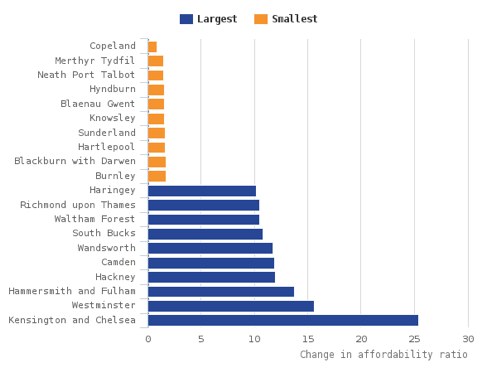

However this masks the local situation. Property in more attractive areas of London and the South East has become less affordable faster than other parts of the country.

One reason for this is that house prices have increased much faster than average earnings. A 259% price increase compared to a 68% increase in average earnings since 1997.

This is good news if you are living in your ideal home – you’ve made a paper profit. But for those of us looking to move up the ladder (and those joining it) this is a problem. What can you do about it?

- Save harder, for longer, and invest

With house prices increasing at this rate we will need to save harder than ever to build up a large enough deposit (and to cover fees and Stamp Duty). There is a limit to how much money you can afford to put by, so it seems increasingly likely that you will have to save for longer. How are you going to do it?

I looked at Moneyfacts.co.uk on 22 March 2017 and saw that the highest interest rate for a regular saver was 3.5% p.a. AER (12-month, fixed rate). The most you can save through this account is £200 a month. I worked out that you would only earn around £38.88 in the first year (around 1.6% of the total deposited). If you could continue with this deal for 5 years (you can’t with this account), you would pay in £12,000 and end up with £13,093.22 at the end of it – effectively earning around 1.8% a year.

If house prices continue to increase at the current rate (6.2% in the year to January 2017) you will not make any real progress if you just hold cash. Indeed with CPI Inflation to February 2017 rising to 2.3% (up from 1.9% in January) the buying power of your savings will go down.

Alternatively you could invest your money. Both the money you save and the interest/growth will be at risk. You could end up in a worse position. But by taking some risk you could potentially achieve higher returns over the medium term.

We wouldn’t suggest investing for less than five years, so you need to be prepared to wait. Investment returns vary hugely, but by investing on a monthly basis, you can benefit from pound cost averaging. Put simply you buy more units in the fund(s) when prices are lower. If prices go up you benefit.

- A helping hand from family

It might be possible to borrow money from a family member. However the clichéd ‘bank of mum and dad’ comes with risks. Will being a debtor have an impact on your relationship with them? What happens if you can’t pay them back? If you don’t document it correctly and they were to die HMRC might interpret it as a gift instead. They might not be issues for you, but you should certainly work them through together first.

It is often, but not always, the case that parents want to leave money to their children in their Wills. However there can also be great joy (and potential tax savings) by making gifts during your lifetime. The person giving the money can see this being enjoyed. In the event that they live for seven years the gift is typically free from Inheritance Tax (IHT). This compares well to the IHT that may have to be paid on death (40%).

A gift from family could be a great help and supplement the saving you are already doing. It is important that they only give what they can afford. We would also recommend that you both document the gift to save confusion in the future. If they plan to benefit more than one person they may wish to consider how best to do this to ensure they achieve this fairly.

- Is renting so bad?

We have a saying ‘an Englishman’s home is his castle’ and many people aspire to own their own home. Paying rent sometimes feels like we are lining the pockets of others and that this is money down the drain. In mainland Europe it seems more common for people to rent than to buy.

One of the disadvantages to owning your own home is that it is expensive and time consuming to move. You also have responsibility for maintenance.

Renters can move relatively easily with very little cost. If you can find someone to take over your tenancy you might be able to move quickly. Plus, if something goes wrong (e.g. leaky pipe, broken down boiler) your landlord will normally be responsible for fixing it.

Your home is an asset, but primarily it is a place to live: a roof over your head. The decision about whether to buy or rent should be a lifestyle choice first and a financial decision second. If you think about it this way, renting might be more attractive.

Next steps

It’s important not to get overwhelmed by the rate at which property prices are increasing. Take stock of how you want your lifestyle to look and work out whether you really do want to buy. Find out how much properties that fit the bill are to buy and to rent.

Take a look at your income and outgoings. See where you could reduce costs and increase your monthly savings. Make sure you have money set aside for emergencies before you start saving for the future. See how much you already have saved and see how close (or far) you are away from your goal.

If you have enough time before you need to access the money, look to invest it. Professionally managed investment strategies with no up-front costs or exit charges are widely available.