It’s music to the ears of environmentalists and an annoying buzz that just won’t go away for City traders. Now, the benefits of adopting an investment approach that takes into account environmental, social and governance (ESG) factors seem impossible to refute, after an in-depth study from Barclays bank found that it is more profitable.

In Barclays respected annual Equity Gilt Study, the investment bank devotes an entire chapter to the financial benefits of taking ESG into account for bond investors, as well as the wider benefits to society, in response to ESG “becoming mainstream”.

“If consideration of ESG principles can actually help to improve portfolio performance – as many adherents claim – then it would be hard to justify any resistance to their adoption.” The Barclays Equity Gilt Study 2017

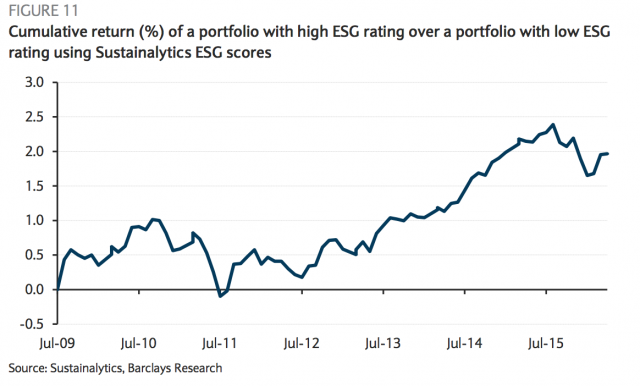

The study found: “An ESG-positive tilt leads to a small but steady performance advantage; we find no evidence of negative performance effect. We do not find any evidence to suggest that this performance advantage resulted in high ESG bonds becoming expensive versus peers and facing a prospect of mean reversion.”

What this means to you and me is – they perform better financially as well as for the planet, and there is no reason to suspect they are at greater risk of future under-performance than any other type of bond.

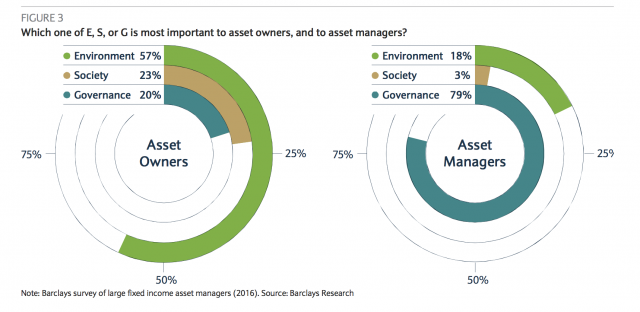

The study, one of the biggest ever into ESG investing, found that good governance had the most positive effect on investment returns, followed by environmental then social considerations. Barclays also found that strong governance attributes are related to a lower frequency of credit rating downgrades.

The authors state: “If consideration of ESG principles can actually help to improve portfolio performance – as many adherents claim – then it would be hard to justify any resistance to their adoption.”

The authors state: “If consideration of ESG principles can actually help to improve portfolio performance – as many adherents claim – then it would be hard to justify any resistance to their adoption.”

The report notes an about-turn in the perception of ESG considerations among the wider investment industry, which used to consider such factors a drag on returns. “The key to gaining traction was in reversing the perceived effect on performance. Not only is it no longer assumed that “doing the right thing” will place a drag on portfolio returns; rather, it is now seen as prudent to avoid investing in companies that have a detrimental impact on the world, because their business practices may not be allowed to remain unchanged.

The chapter concludes: “In many publicly quoted companies, corporate decision-makers have been forced to balance the long-term best interests of their firms against relentless investor pressure for short-term earnings growth.

The growth of the sustainable investing movement can help redress the balance. As ESG considerations play out over a long horizon, and as they increasingly become a priority for company managers, they may help alleviate the pressure for short-termism and rather encourage a focus on long-term value creation – to the mutual benefit of the firm, its investors and the world at large.”

The growth of the sustainable investing movement can help redress the balance. As ESG considerations play out over a long horizon, and as they increasingly become a priority for company managers, they may help alleviate the pressure for short-termism and rather encourage a focus on long-term value creation – to the mutual benefit of the firm, its investors and the world at large.”