In Dr Seuss’s children’s classic Green Eggs and Ham, first published in 1960, Sam pesters Joey to try a plate of green eggs and ham, to be told “I do not like green eggs and ham. I do not like them, Sam-I-am.”

However, it seems that green eggs have become a whole lot more palatable, if sales of Waitrose’s avocado shaped Easter eggs are anything to go by.

But while ‘green’, or perhaps more accurately ‘sustainable’ investing has come a long way and Dr Seuss excelled in simplicity, sustainable investing is a still far from being jargon free – does it need to become more accessible to investors?

These days, multi asset managers have more tools at their disposal than ever. This includes the rise of ethical ETFs, through to social housing and renewable infrastructure investment companies, and long-income REITs. Yet there has been little progress when it comes to investment jargon.

While sustainable investing has come a long way, it is just as guilty of using too much jargon as the wider investment industry, ironically given its credentials. We have a long way to go.

While sustainable investing has come a long way, it is just as guilty of using too much jargon as the wider investment industry, ironically given its credentials. Many investors are likely to have their head spinning with acronyms – ESG, SRI and SDGs are just a few. And then there’s the seemingly interchangeable labels like ‘sustainable’, ‘responsible’ and ‘impact’ investing, all with important distinctions which are in danger of being lost on the many. There are other pitfalls for the unwary, too: ‘green bonds’, for example, are not always issued by ‘green’ companies and it’s really important that investors are able to make sense of these distinctions. We have a long way to go.

There are five terms we see as being ripe for demystification.

- ESG – Environmental, Social & Governance

ESG criteria is a set of standards by which to judge a company’s operations. ‘Environmental’ criteria are used to gauge the impact of the firm’s operations on the environment. Social criteria are open to greater interpretation, but include sensitivity towards the communities in which the business operates, from human rights toresponsible employment practices. Lastly, Governance criteria refer to company best practice, such as its internal controls, leadership, executive pay and shareholder rights.

2. SRI – Socially Responsible Investing

Whether an investment is considered socially responsible depends on the nature of the business. For example, those who invest on an SRI basis will exclude companies involved in unacceptable business areas. The approach also actively seeks out companies who are engaged in positive social policies. There are no specific guidelines, but fund managers who focus on SRI tend to lay out a set of relevant criteria, which can usually be found in the fund prospectus.

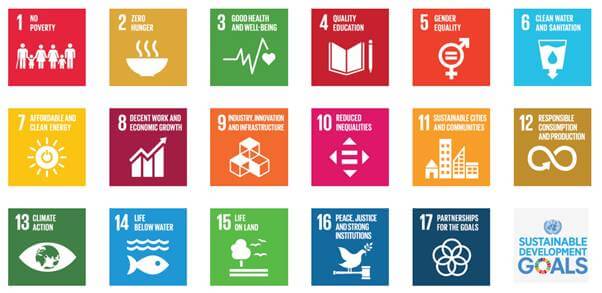

3. SDGs – Sustainable Development Goals

These are a collection of 17 goals set by the United Nations in September 2015. Although interrelated, each goal has specific targets to be achieved over the next 15 years. These are:

4. Impact Investing

This is a form of investing which tends to use the Sustainable Development Goals as a base. The idea is to invest in companies which have a positive impact on society pointing to one or more of the Sustainable Development Goals – e.g. quality education – or by serving a need which is not currently met. Unlike ESG (Environmental, Social and Governance) goals, however, which focus on a company’s operations, impact investing looks to the goods and services that the company provides. The aim is to generate both a social and a financial return.

5. Green Bonds

These are tax efficient bonds that companies issue to finance sustainable projects. If a company is undertaking a project aimed at energy efficiency, for example, it has access to a cheaper source of financing. The aim is to make such projects more attractive for companies to undertake. It’s worth being aware though that just because a company issues a green bond it doesn’t mean that the business as a whole is green. Theoretically, a company could have poor employment practices, but still issue a green bond to finance a renewable energy project.