The green bond market – which marked its tenth anniversary in 2017 – is a key component in sustainable financing.

It enables companies to tap the growing pool of cash that is looking for climate-friendly investment opportunities, converting those funds into environmentally sustainable projects.

Green bonds have matured to become an asset class in their own right providing investors with opportunities for risk management, scale and liquidity with sustainable finance.

Want to invest in a better world? Check out the Good Investment Review

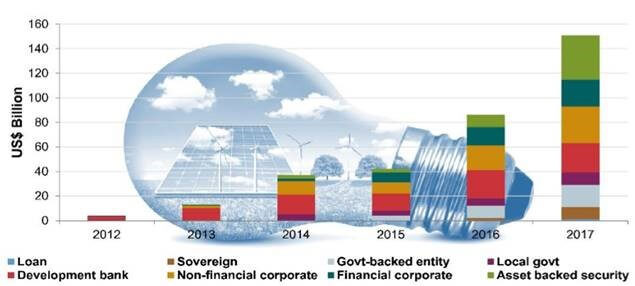

The green bond market has experienced rapid growth, particularly since 2012. A staggering US$155.5 billion of green bonds were issued globally in 2017 compared to a mere $3 billion in 2012.

Despite this, green bonds still account for less than 1 per cent of the overall global bond market, but the composition of the universe is evolving, providing investors with a wider range of choice.

Rapid growth in green bond market

Past performance is not a reliable indicator of future results. Source: Climate Bond Initiative 2017

A green bond is structured like any other fixed income instrument, with a fixed or floating interest rate and a fixed maturity date. There is one key difference: the money raised is exclusively assigned to finance projects and business activities labelled as ‘green’.

There is still a primary focus on achieving the maximum financial return, but this consideration is balanced by environmental objectives.

Green bonds generally have a medium-term maturity of five to ten years, are given credit ratings like other bonds and are issued in multiple currencies and from many issuer jurisdictions. From a credit risk perspective, the credit risk of the green bond will, more often than not, be exactly the same as the conventional bonds from the same issuer.

How are Heartwood investing in green bonds in the sustainable portfolios?

Heartwood is invested in the Allianz Green Bond Fund, which was launched in November 2015; we invested in 2017. The fund is actively managed and looks to exploit opportunities in credit selection, primary issuance and interest rate sensitivity, amongst others. The investment process is focused on fundamental credit analysis with a tactical overlay to manage interest rate risk and foreign exchange exposure. The aim is to add value through credit selection.

Allianz assesses whether a bond qualifies as ‘green’ or not according to the Climate Bonds Initiative (CBI). The CBI provides science-based assessments on projects financed through a green bond issuance. Allianz’s list of projects are based on the CBI guidelines and include renewables, emissions reduction and clean water. Allianz estimates that the impact of a €1 million investment in the fund equates to a saving of 1,512 tons of CO². To put this into context, 1,512 tons of CO² avoided is the equivalent of 3,501 barrels of oil consumed.

Future developments

Two years’ ago, most green bond issuance was coming from Europe and from multi-lateral development banks. Now we’re seeing China, and Asia more broadly, stepping up to the challenge. There is increasing geographic diversity in the market and a wider range of financial instruments.

One of the key developments in 2017 was the emergence of sovereign green bonds. Last year France successfully borrowed €7 billion to help fund energy transition projects. As well as being the largest issuance so far on the green bond market, it also has the longest maturity date and was the first by a sovereign state.

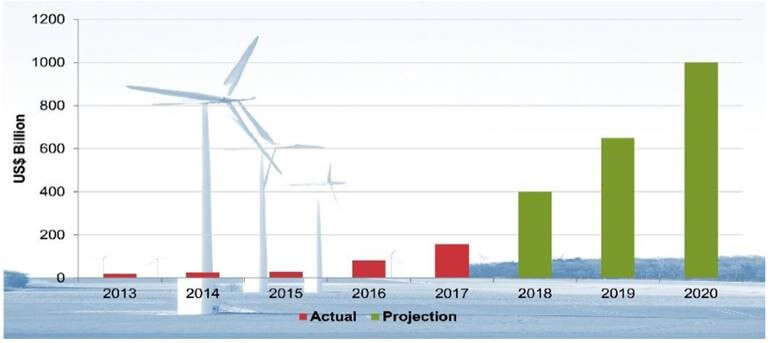

US$1 trillion of green bonds by 2020

Past performance is not a reliable indicator of future results. Source: Climate Bond Initiative 2017

In 2017, the US, China and France accounted for 56 per cent of bonds issued. In China, banks still dominate with 74 per cent of issuance, while in France, the French sovereign bond is the major contributor. Emerging markets are also showing encouraging signs of growth.

Crucially, regulation in the market, together with monitoring and benchmarking is evolving. The Climate Bonds Initiative and the International Capital Market Association, which developed the Green Bond Principles in 2014, have helped to set some principles and standards for green bond issuers to aid transparency. However, the market is still awaiting a complete set of widely accepted ‘green’ standards to provide consistency for green bond investors.

In 2017, several climate leaders called for a ten-fold increase in green bond investment from 2016 levels and set a target for 2020 of US$1 trillion. Green bonds have the potential to reach this target and to boost progress on national climate commitments. Global development needs would be met in a way that is climate compatible through financing clean energy infrastructure, sustainable transport, energy efficiency and waste management.

Further growth and diversification of the green bond market therefore remain key to achieving a sustainable future.