This article is part of a series published in association with sustainable investing app Clim8, looking at the growth of opportunities for people who want to help save the planet with their investments.

Sustainable investing is stealing the spotlight. Once stuck on the sidelines as a ‘niche’ investment strategy, it is now capturing the hearts and minds of those keen to make a difference to the planet and a profit too.

It wasn’t always considered possible to do both at the same time. Even just a decade ago, the business of making a profit was considered at odds with the campaign to prevent environmental destruction.

Investment was about finding growth in a world of finite resources, which usually meant rooting your money deep underground in oil wells – then the undisputed foundation of the global economy. It was an unspoken truth that if you wanted to make a profit, ultimately it would be the earth – or its people – that paid for it.

If you’d have said to a fund manager in the 1990s that he or she could achieve return targets while balancing risk and help to save the planet too, you’d most likely be laughed at.

Making a difference AND a profit

Fast forward to 2020 and all that has changed. Mounting evidence shows that sustainable investing is in fact performing better on average than the wider market.

Duncan Grierson, founder and CEO of sustainable investment app Clim8, says: “There is a myth that to be ‘good with money’ you have to sacrifice returns. We see the opposite happening.

“Our hypothesis is that if you invest into companies that are providing products and solutions to environmental or societal problems in the world, then as demand for these solutions grows, naturally the value of your investments will grow.

“As consumers move more to these ‘good’ companies, their value on the stock market is likely to go up which is fantastic news for your investment. Positive impact investing is not charity, it’s making good things happen with your money.”

So how did we get to this point, where positive impact investing is zooming ahead in the popularity and profit potential stakes, too? Well, it hasn’t always been so easy to match solutions to the planet’s most urgent problems with returns on your savings.

Investment options merely mirror the world around us and until recently, there weren’t enough profitable listed companies making a measurable positive impact to fill a decent, well-diversified, risk-adjusted portfolio. Thanks to new technologies and a lot of determination and drive from pioneering companies around the world, this is no longer the case.

Here’s a potted history of the changes that have taken place – primarily in the last few decades – to get to where we are now:

Early beginnings

Early beginnings

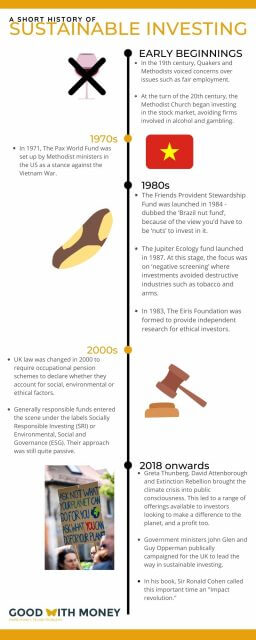

Ethical investing dates back to the 19th century, when religious movements such as the Quakers and Methodists voiced concerns over issues such as fair employment. At the turn of the 20th century, the Methodist Church began investing in the stock market, but avoided companies involved in alcohol and gambling.

1970s

The first ethical fund – the Pax World Fund – was set up in the US in 1971 by Methodist ministers as a stance against the Vietnam War.

1980s

The UK’s first ethically-screened unit trust – the Friends Provident Stewardship Fund – was launched in 1984. It was dubbed the ‘Brazil nut fund’ by some, due to the pessimistic view that you’d have to be ‘nuts’ to invest in it. This was followed in 1987 by the Jupiter Ecology fund, the UK’s first environment-focussed portfolio.

At this stage there were very little positive impact companies or sustainability focused technology solutions available to invest in. Instead, the focus was on ‘negative screening’ where ethical funds avoided destructive industries such as tobacco and arms.

This kind of sustainable investing played an important role in ending the apartheid regime in South Africa, as both individual investors and institutions sought to divest from companies that had operations in the country.

In 1983, The Eiris Foundation was formed by a group of churches and charities to provide independent research for ethical investors.

2000s

In 2000, UK law was changed to require occupational pension schemes to declare whether they account for any social, environmental or ethical factors when deciding what stocks to invest in.

In the early noughties more generally responsible funds entered the scene under the labels Socially Responsible Investing (SRI) or Environmental, Social and Governance (ESG). Their approach was still quite passive and more ‘mindful of environmental and social considerations’ than promoting an urgent need to save the planet while still making some money.

2018 onwards

Campaigners Greta Thunberg and David Attenborough, and movements such as Extinction Rebellion, brought the climate crisis into the centre of public consciousness. This has led to a range of offerings available to investors looking to make a difference to the planet and make a profit too. Far from being a niche option, positive impact investing now begs the question ‘why wouldn’t you aim for both?’

Some government ministers including John Glen and Guy Opperman publicly campaign for the UK to lead the way in sustainable investing, and in his book dedicated to the power of impact investing, Sir Ronald Cohen calls this important time an “Impact revolution.”

Changing mindsets

As Mr Grierson says: “Very recently there has also been a dramatic shift in public attitude, driven by the Covid-19 pandemic and the increasingly visible effects of climate change. We have seen wildfires burning in California, one of the richest places in the world, for the last five years. But while Greta has everyone talking about the climate crisis, we now want solutions – and to feel we are part of these solutions”.

The dawn of positive impact investing means that it’s no longer necessary to sacrifice financial returns for the sake of saving the planet. In fact, the opposite is increasingly true.

Sustainable funds outperform peers

Evidence shows that sustainable funds are consistently outperforming their traditional peers. In the first eight months of 2020, funds that invest using environmental, social and governance (ESG) principles outpaced their conventional rivals by as much as 20 percentage points, according to research by Trustnet.

While the coronavirus crisis sparked turmoil in financial markets, with stocks plunging as the pandemic took hold, only to rally strongly on the back of huge stimulus packages, sustainable funds held much more steady ground.

This is because financial markets can’t exist in isolation from social or environmental challenges. Companies’ fortunes reflect their ability to adapt to challenges and trends in the societies to which they belong.

This is more true now than ever; social and environmental challenges, and investment drivers, are increasingly overlapping. While investment managers are turning to sustainable funds at pace, some are better placed than others for creating the positive changes we need.

New digital investment apps such as Clim8 Invest also don’t have a legacy of investment in harmful industries like fossil fuels and therefore don’t face the challenge of divesting from them.

The ability to measure impact has evolved, too, so investors can see the very real impact of their money on people and society. You can choose to funnel your savings into the issues that you care about most.

In the history of investment, there has never been this amount of opportunity to profit from making a positive difference.

It’s a great moment – take advantage!

If you’re interested in making a positive impact on climate change with your savings, you can invest with Clim8 here.

Risk warning: When you invest, your capital is at risk and you could lose all of your investment. The value of investments and any income from them can go down as well as up, and past performance is not necessarily an indicator of future performance. Before you invest, make sure you are comfortable with the level of risk you are taking on.