This article is an excerpt from the Good Guide to Pensions. Download your free copy to find out more about your own pension and how to make it as good as you are.

The corporate green bond market has taken off and is only going to get bigger. But investors need to be cautious.

The market for green bonds has been booming. Demand for investments with an environmentally-friendly pedigree has increased hand in hand with a growing awareness of the need to control climate change and pollution, to prevent the erosion of biodiversity and ensure a sustainable future.

But as with every new asset class that takes off, investors need to be wary of the pitfalls.

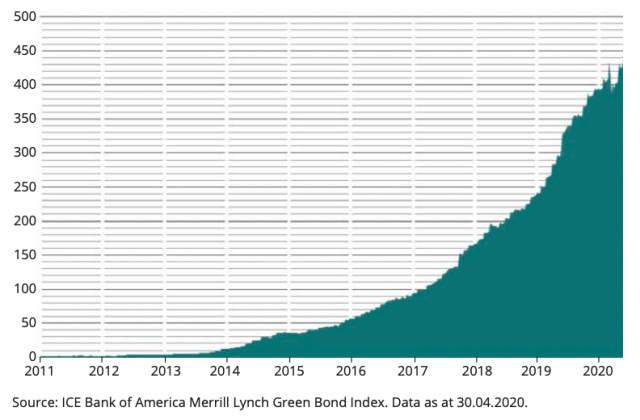

A decade ago, the market for corporate green bonds barely existed. By the end of April 2020, it was worth USD347 billion.

What are green bonds, anyway?

In a nutshell, green bonds are debt raised to finance specific environment-related projects. Part of their investment appeal is driven by regulation: governments keen to encourage green projects often offer tax breaks for holding these instruments. But they’re also attractive because they signal the sort of management farsightedness that tends to equate with long-run corporate success.

For firms, the benefits are that demand for these bonds tends to diversify their investor base. And data suggest green bond investors tend to be more committed and hold the instruments longer than they do conventional debt.

Green bonds shoot for the stars

Size of corporate and government green bond market, ICE Bank of America Merrill Lynch Green Bond Index, USDbn:

And recently, issuance has been broadening along the credit spectrum. Although corporate green bonds are mostly rated investment grade, high yield issuers like recycling and waste management company Paprec, wind turbine manufacturer Nordex and glass manufacturer O-I Packaging Group have also made forays into the market. And more could find themselves there. Fallout from the Covid pandemic could see some of the 44 per cent of the green bonds that are rated BBB – a smaller proportion than the wider corporate debt markets – become fallen angels by dropping into high yield territory.

The risk facing investors is of confusing bonds that exist out of a company’s genuine desire to push forward a green programme with those that are little more than greenwashing. That’s to say, companies issuing debt as green bonds, but then using the money raised for other purposes, such as to refinance existing debt.

There’s no clear demarcation between where the one ends and the other starts. Partly, this is because green bonds aren’t necessarily ring-fenced project financing, but rather tend to sit on the issuing company’s balance sheet and thus are part of the total mix of assets – which is why green bonds are generally assigned the company’s credit rating. But rating agencies could still downgrade green bonds on environmental, social or governance (ESG) considerations as they increasingly factor these into their analysis.

For instance, Italian electricity producer Enel was accused of greenwashing when it issued a bond linked to its commitment to increasing its use of renewables. Failure to meet targets would force the company to pay a higher coupon on the bond. That’s ostensibly green, but critics argued that in fact it was little more than an option to produce dirty power.1

Or take Teekay Shuttle Tankers, owner of one of the world’s largest fleets of oil tankers which set out to raise at least USD150 million to build four new fuel-efficient ships with a green bond. It fell short, in part because investors questioned how green even a fuel- efficient oil tanker could possibly be.2

Grey areas in green bonds

Complicating matters is how some issuers are further slicing up this class of securities, for instance ‘blue’ bonds that are related to investment in water, or ‘transition’ bonds that promote the shift to a lower-carbon economy. Meanwhile, ‘social’ bonds that promise wider societal impact have seen renewed interest following the global coronavirus epidemic.

Sometimes it makes sense to look past the green label and to invest in ordinary securities issued by a truly green company. Some firms with a strong environmental pedigree have shied away from issuing green bonds because of the still small size of the market and

its specialised nature, or because they calculate they are not being compensated for the additional compliance costs associated with green bond.

So, for instance, only three car companies have so far issued a green bond, and Tesla, leader in the field of electric vehicles, isn’t one of them. And that’s notwithstanding the sector’s wider push into green transport, particularly electrification. Indeed, the green bond market is still relatively concentrated with more than 70 per cent of issuance by financials and utilities.

But for all the grey areas in green bonds, matters are improving. Some of that improvement comes from best practice, some comes from industry bodies, and some from regulators.

For instance, having issued three sustainable bonds, culminating with a USD1 billion

debt raising in 2019, American coffee chain Starbucks has created a template for other companies to follow. Its aims of shifting the sourcing of its coffee beans to sustainable producers and making its retail operations greener attracted widespread investor support.3 The company, in turn, became an information resource for other firms seeking to raise green finance.

A voluntary industry code determines what qualifies as a green bond, which is verified by an approved party certified by the Climate Bonds Standard and Certification Scheme. This, in turn, is reinforced by a second opinion from independent external agencies, such as Sustainalytics, that review the greenness of the bond.

The EU leading the way

Finally, government agencies have been getting involved. The European Union has led the way in December 2019 by establishing rules governing which financial products qualify as “green” or “sustainable”. These rules require firms to fully disclose what proportion of their investments is environmentally friendly or sustainable. A mere 17 per cent of the market value of the green bonds held in the MSCI Green Bond Index would meet the requirements of EU Green Bond Standard (EU GBS).

But quantifying what are often qualitative aspects of operations is a challenge and the field is still new. Agencies that rate companies on environmental, social and governance criteria can provide wildly differing assessments, depending on the weights they give to various factors, such as industry, operating region and management intentions.

Given all the complexities involved, investors need to take a careful, analytical approach. Some green bonds are greener than others. Some ordinary corporate bonds issued by green companies will be greener than green bonds. And sometimes, ordinary debt finance raised by companies in dirty industries will be put towards environmentally worthy investments – especially when the firm is looking to fundamentally change the nature of its operations. Balancing environmental credentials with social factors demands taking a broad view of the market. No single green bond should be assessed in isolation of the issuing company’s overall strategy towards a greener more sustainable business model.

1 https://www.environmental-finance.com/content/analysis/in-response-to-accusations-that-enels-sdg-bond- was-greenwashing.html

2 https://www.ft.com/content/b1d4201c-f142-11e9-bfa4-b25f11f42901

3 https://www.sustainalytics.com/sustainable-finance/wp-content/uploads/2019/05/Starbucks-Sustainability-Bond-Second-Party-Opinion_05012019.pdf