The power of investment in creating positive change is explored in EQ Investors’ latest annual report.

The wealth manager’s Positive Impact Report 2021 reveals, for the first time, the ‘theory of change’ framework it uses to measure the impact of companies in its EQ Positive Impact Portfolios against the UN Sustainable Development Goals. And it calls on its peers in the finance industry to raise the bar on their own practices.

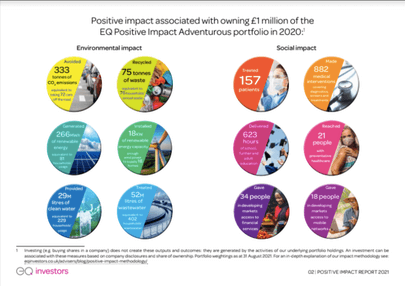

The report also outlines the environmental and social benefits linked to its clients’ investments. Key highlights of the impact made per £1 million invested in 2020 include:

- 75 tonnes of waste recycled: equivalent to 76 households’ annual waste.

- 266MWH of renewable energy generated: equivalent to 81 homes’ usage.

- 52 million litres of wastewater cleaned: equivalent to 402 households’ wastewater.

- 623 hours of school, further and adult education delivered.

- 157 patients treated.

Sophie Kennedy, Joint Chief Executive at EQ Investors, said: “As we raise the bar for our own investment practice, we invite our peers in the finance industry to join us. This report explains how we drive change through engagement – and our engagement work this year has shown that our asset manager partners are more receptive than ever.

“We collaborate with like-minded businesses, and over the last 12 months have seen a seismic shift as the finance industry takes strides towards a more sustainable mindset. We see this as the key to using finance to accelerate a move to a sustainable, equitable world.”

Bridging the gender investment gap

EQ Investor’s positive impact approach reaches beyond the traditional investor, attracting a higher proportion of female investors (54 per cent) than the UK average (43 per cent).

Louisiana Salge, Senior Sustainability Specialist at EQ Investors, said: “There can be no denying the impact of the pandemic on all our lives over the past eighteen months. Amongst the many changes seen as a result of the emergence of Covid-19 is a sharpened appetite for sustainability. At the same time, it reinforced the value of our efforts to prioritise impact factors in our investment approach.

“It’s clear that more of us want to act and do something about today’s issues – whether it’s social and economic inequalities or climate change, and investing is a powerful way to make a difference.”

Investing for a low carbon world

With an increased focus on how to decarbonise economies in the run-up to COP26, EQ Investors has measured the carbon emissions across its equity investments. The companies in the EQ Positive Impact portfolios show a significantly smaller climate change contribution and are more carbon efficient than their peers.

Engaging for change

A Good With Money ‘Good Egg’ and B Corp company, EQ Investors says it continues to engage with fund managers, policy makers and underlying companies to maximise the positive impact made from its investments. The report covers how EQ Investors drives real change through this engagement with three case studies covering: the setting of climate change targets; human rights in supply changes; and tackling obesity through nutrition.