This article is from the latest Good Investment Review, from Good With Money and Square Mile Research, which focusses on the issue of greenwash.

The path to net zero is complex but cutting real-world carbon emissions is crucial in order to preserve our financial and physical futures.

At Fidelity, we have carefully considered the different ways in which managing climate risks and accelerating the low-carbon transition could be made integral to our investment and stewardship processes. To this end, we launched our Climate Investing Policy in 2021, which we firmly believe will be effective in mitigating climate-related risks and reducing real world emissions.

Our path to net zero is anchored on targets

From an investment perspective, we are aiming to halve the carbon footprint of our investment portfolios by 2030, from a 2020 baseline, starting with equity and corporate bond holdings; and reach net zero for holdings by 2050. We have set specific emissions reduction targets for real estate and our default workplace retirement solution FutureWise.

Our net zero plan for the portfolios we manage on behalf of clients comprises two strands – integrating climate factors into investment management and transition engagement.

1. Integrate climate factors into investment management

- Further integrate climate change analysis into portfolio construction and issuer analysis.

- Invest in net zero issuers and climate solutions.

- Climate-focused stewardship: engage with companies on minimum climate standards and vote against those that do not meet them.

- Use Fidelity’s proprietary Climate Ratings, which leverage our in-house research capabilities, to assess the net zero ambition and alignment.of investee companies. This will be used to align our own portfolios

to a ‘net zero by 2050’ pathway, starting with funds that promote ESG characteristics and those with a sustainable investment objective.

2. Target highest emitters through transition engagement

Target companies in high impact sectors for intensive engagement to accelerate their transition pathways where achievable. Where companies show no progress towards (and no potential for) transition after an engagement period not exceeding three years, we will look to divest.

Focus engagement initially on thermal coal production, as the transition away from thermal

coal represents the single biggest opportunity to reduce carbon emissions over the next decade. In due course, we expect to expand transition engagement to include utilities and power generators reliant on thermal coal, leading to a phase out of thermal coal exposure by 2030 for OECD markets and by 2040 globally.

The private sector has a key role to play in facilitating the shift to clean energy, but in a way that scales genuine alternatives for baseload power generation in the many countries that remain dependent on fossil fuels while also addressing the social challenges for workers and communities impacted by the transition. The race to net zero can’t afford to leave anyone behind.

Making sure we walk the talk

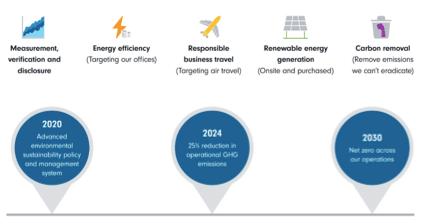

We also want to achieve net zero emissions across our corporate operations by 2030. After all, we have to do what we ask others to do. Fidelity’s business operations are guided by five principles to reduce emissions. Like other companies, we have different priorities that evolve due to factors like changes in regulations, public expectations, and market and environmental risks.

Our five principles to get to net zero

Our path to net zero will prioritise avoidance and reduction over substitution and carbon removal. This is an essential tenet to a responsible carbon reduction hierarchy because it improves the prospect of meaningful corporate transformation.

Our corporate sustainability policies support this hierarchy. An example of how we avoided nearly half of the emissions from energy use in our London office is by moving about 1,000 employees to a more energy-efficient building in 2019. Elsewhere, we have applied substitutes to minimise our carbon footprint. For example, in India, we switched to electric passenger cars from those that run on fossil fuels.

For the residual emissions we can’t eradicate, we plan to implement carbon dioxide removal (CDR) measures to achieve net zero based on best practices. These include nature-based solutions or proven carbon capture technology.

It is estimated that around a quarter of global carbon emissions and more than half of the global economy are covered by net-zero commitments, according to theRace to Zero Campaign supported by the United Nations Framework Convention on Climate Change. This is just the beginning – how companies achieve these commitments may be more vital for a truly lasting impact. We want to continuously challenge ourselves, and we hope this will inspire others to stretch their environmental targets.

The next decade is going to be crucial. We can’t solve climate change ourselves and are committed to using whatever means we have – working in partnership with our clients, companies, and governments – to get to the net zero future we all need.

Risk warning: The Good Investment Review provides general information only. It is not financial advice. If you invest in any of the products mentioned in the review, you do so at your own risk. This is not a recommendation to buy or sell any funds mentioned or engage in investment activity with any particular fund manager. Capital is at risk and past performance is not a guide to future performance.