Here we look at Tred – a green debit card that plants trees as you spend and tracks your carbon footprint.

The deal

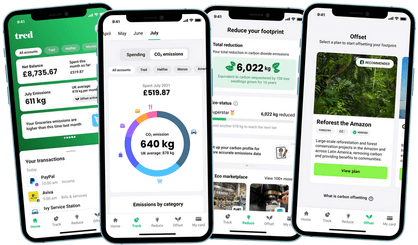

Tred is a prepaid debit card that enables you to track, reduce and offset your carbon footprint through your everyday spending.

From coffee and clothes to gym membership and flights, Tred calculates the estimated carbon emissions of every transaction you make on your card, helping you to understand your individual impact on the planet. It then helps you take actions to reduce it.

As you spend on your card, Tred plants trees on your behalf by donating a portion of the revenue it gets from retailers to reforestation projects around the world.

It also offers optional monthly subscription plans to offset your personal carbon footprint further, or even cancel it out completely. The card itself is made from 100 per cent recycled plastic and vegan inks and glues. All the carbon emissions from its production and delivery is offset.

User-friendliness

Currently, you need to join a waiting list for a Tred card as it is still in testing mode. Once it launches fully in the UK, you will be able to download the app and order your debit card, which will arrive by post. Initially, the Tred app will only be available to download on Apple devices. It is hoping to release the Android version later this year.

To apply for a Tred card, you must be aged over 18, a UK resident and have a valid UK phone number.

From the app, you will be able to transfer money onto your Tred Mastercard. Then, as you use it to make payments, it will track both your spending and your carbon footprint. You’ll get real-time notifications showing you the carbon footprint of everything you buy, from a weekly shop through to holidays.

From the app, you will be able to transfer money onto your Tred Mastercard. Then, as you use it to make payments, it will track both your spending and your carbon footprint. You’ll get real-time notifications showing you the carbon footprint of everything you buy, from a weekly shop through to holidays.

Each transaction is automatically categorised, so you’ll be able to see where your money is going (helping you to budget better) as well as which areas of your lifestyle are contributing most to climate change. This shows you where you can make the most effective changes to reduce your impact on the planet.

Tred donates 10 per cent of the revenue it makes from the ‘interchange fee’ – a charge paid by retailers each time you use your card – to reforestation projects. So you spend as you normally would, and trees are planted on your behalf. Using a Tred account and card at this level is completely free.

If you want to go further, you can choose an optional carbon offsetting plan. The four plans on offer vary by the method used to offset your carbon footprint (eg reforesting, generating renewable energy or funding ‘net negative’ buildings), and therefore also by price (see the ‘Cost of use’ section below).

Is it safe?

Tred is not a bank, as it doesn’t invest in other businesses or lend money to its customers, and is therefore not covered by the Financial Services Compensation Scheme. Instead, it is registered with the Financial Conduct Authority as an ‘Electronic Money Directive’.

It uses a company called Nium Fintech Limited to safeguard your money in a separate, ring-fenced account. Neither Tred or Nium Fintech Limited can use your funds for any other purpose, including if either company became insolvent.

Sustainable option

Tred is on a mission to help people reduce their impact on the planet and tackle climate change through their everyday spending. As well as donating a portion of its profits to global reforestation projects, it offers customers optional monthly offsetting plans to reduce or cancel out their personal carbon footprint. Every project within the offset plans is verified by offset evaluator companies Verra, Gold Standard and/or Puro.Eath. This ensures that every project provides the amount of carbon offset it claims to.

Seeing the exact environmental impact of every transaction you make on your card can also help you to make more informed lifestyle decisions.

Tred also donates one per cent of its profits to environmental causes, as part of the one per cent for the planet initiative.

Unique selling points

- Tracks your carbon footprint. Tred calculates the carbon emissions of every transaction you make, giving you an accurate, personalised carbon footprint. You can also connect your bank accounts and other cards to Tred, so you can track your total carbon footprint across all your spending.

- Responsible reforestation. Tred says it partners only with well-established projects that plant native tree species, encourage biodiversity, and who work closely with local communities.

- Sustainable offers and discounts. Get access to Tred’s partner brands and exclusive offers that will help you live more sustainably and reduce your impact on the planet.

The plus points

- Fight climate change at no extra cost. The Tred card is free to use (without an offsetting plan). Tred takes 10 per cent of the fee paid by retailers when you spend with them and uses it to plant trees on your behalf.

- Monthly spending insights. Keep track of your outgoings with Tred’s spending categories and handy graphs.

- Climate coaching. Tred will show you which areas of your lifestyle are most carbon heavy, and suggest easy sustainable switches.

Any drawbacks?

- Still in Beta mode. Tred is currently in testing mode and is operating a waiting list to receive a card. It is aiming to launch fully in the UK soon.

- No overdraft or other banking facilities. As Tred is not a bank, there is no available overdraft or other products on offer such as loans or savings accounts. This may mean that you’ll want to hang on to your usual current account.

Cost of use

Tred is free for you to use at its basic level and there are no hidden charges. If you use Tred abroad, it will apply a 0.5 per cent mark-up on each transaction carried out (on top of the Mastercard rate and the exchange rate).

You will only pay if you choose one of Tred’s optional monthly offset plans. The cost of these depends on your transactions in a given month – so if you’re reasonably planet-friendly one month, you won’t pay as much, but if you buy a lot of flights and fuel you’ll pay more.

The plans start from £2-4 per month with ‘Global Renewables’, and go up to around £20 with ‘Fund Negative Buildings’. As the price will vary depending on your how carbon intensive your card activity is that month, you can set a cap so you don’t get any nasty surprises.

How do these costs compare to competitors?

Treecard, which is also planning to launch soon in the UK, works in a similar vein to Tred where it uses a portion of the profits it makes from the interchange fee to plant trees. Treecard doesn’t offer any extra paid-for offsetting plans.

Other options

Similar ethical debit cards and current accounts worth considering are: