The Earth is experiencing its largest loss of life since the dinosaurs were wiped out, according to scientists, and it’s being driven by human behaviour.

How we farm, pollute, drive, heat our homes, and consume is far beyond what the natural resources of our planet can sustainably provide.

In October, global leaders will gather at COP16 in Columbia to take stock of their progress on critical targets to protect the Earth’s biodiversity and live within planetary boundaries.

It will be the first biodiversity COP since the adoption of the historic Kunming-Montreal Global Biodiversity Framework at COP15 in December 2022 in Canada. The framework aims to kickstart “urgent and transformative action by governments, and subnational and local authorities, with the involvement of all of society, to halt and reverse biodiversity loss.”

It follows the epic failure of the Aichi biodiversity targets, which were agreed at COP10 in Japan in 2010. Governments pledged then to halve the loss of natural habitats and expand nature reserves to 17 per cent of the world’s land area by 2020, among other targets – and failed on every count.

So what’s the role of finance?

The financial industry has a pivotal role to play in helping to turn the tide on biodiversity loss by shifting investment away from businesses and projects that destroy the natural environment, and towards those that are regenerating it.

Just as climate change has caught the attention of investors in recent years, the intertwined issue of biodiversity loss is also now becoming a top priority. This has led to a flurry of ‘biodiversity funds’ popping up. But, as always, some will be more effective at making a genuine impact than others.

Here are four that we like:

1. UBAM Biodiversity Restoration fund

This specialist global equity impact portfolio, launched in December 2021 by Union Bancaire Privée, aims to deliver positive returns by investing in businesses that are enhancing the protection and restoration of the natural world. The fund – available through platforms such as Hargreaves Lansdown and The Big Exchange (where it hold a gold medal for impact) – invests in so-called biodiversity ‘fixers.’ These are:

- Companies that are reducing biodiversity loss through their core activities

- Companies that have huge supply chains and are taking their impact on biodiversity and their responsibility seriously.

With the latter, UBAM looks to make a positive impact through engagement; with the help of its NGO partners it helps to set goals for the companies and works with them as investors to achieve them.

What’s more, UBAM invests 25 per cent of its management fee with two world-leading conservation organisations: the Cambridge Conservation Initiative (CCI) and the Peace Parks Foundation for their work in conservation and policy-making.

Victoria Leggett, fund manager of the UBAM Biodiversity Restoration fund, said: “It’s time to broaden the focus from ‘carbon-neutral’ to include ‘nature-positive’. The level of awareness of the biodiversity crisis is where climate change was five to 10 years ago, and there is now a huge amount of momentum behind it, including the UN’s ‘Decade on Ecosystem Restoration’ and COP15 on biodiversity”.

Top 7 platforms for a green stocks and shares ISA

2. Federated Hermes Biodiversity Equity Fund

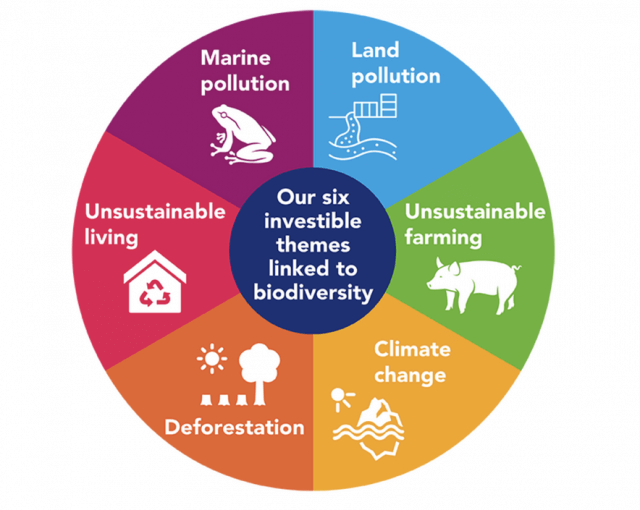

The Biodiversity Equity Fund, launched by Federated Hermes in March 2022, invests in a concentrated portfolio of best in class companies, which help to preserve or replenish biodiversity. Its investment themes include land pollution, marine exploitation, sustainable living, climate change, farming and deforestation. For each company, Federated Hermes analyses financials, ESG (environmental, social and governance) factors, and completes a biodiversity assessment.

It measures and reports the positive net impacts of its portfolio such as clean energy megawatt hours generated, megatons of waste recycled, and hectares of forest protected.

It measures and reports the positive net impacts of its portfolio such as clean energy megawatt hours generated, megatons of waste recycled, and hectares of forest protected.

Ingrid Kukuljan, Head of Impact and Sustainable Investing at Federated Hermes said: “The negative impacts of biodiversity loss pose a systemic risk to the global economy and we must stop taking nature’s permanence for granted.

“We believe now is a crucial moment to invest in the companies that help mitigate biodiversity decline. We are convinced that there is a cohort of quality, investible, stocks which provide investors profitable access to this megatrend.

To help inform their investment decisions, the fund team uses the innovative Biodiversity Trends Explorer, a tool developed by the Natural History Museum. Its Biodiversity Intactness Index (BII) estimates the loss of biodiversity across an area using a combination of land use, ecosystem, species and population data.

Top 9 ethical financial advisers

3. Fidelity Biodiversity Equity Fund

Launched in September 2022, the Sustainable Biodiversity Fund from Fidelity invests in a global equity portfolio of companies helping to preserve biodiversity.

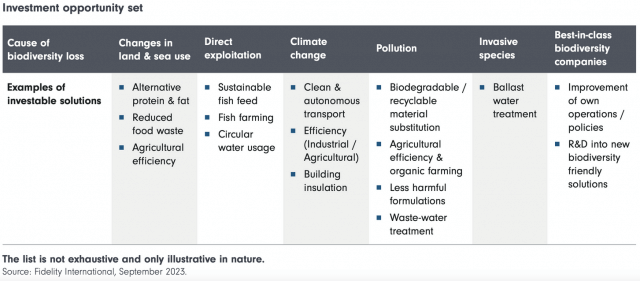

It aims to bring capital growth by investing in companies that “enable the stabilisation or mitigation of biodiversity loss through technologies and solutions that (among other things) reduce the impact of climate change, pollution and over exploitation of natural resources.”

It sees opportunities for investors in areas such as agricultural efficiency, circular water usage, waste-water treatment and research and development of new biodiversity-friendly solutions:

The Fund’s portfolio manager Velislava Dimitrova said: “In the past, market participants have taken nature for granted, viewing this capital stock as a perpetual resource. But evidence shows that nature continues to degrade as a result of human activity.

“The world is now waking up to the urgent threat to biodiversity and natural capital. Biodiversity investment solutions are emerging as the largest investment megatrend in our generation and provides opportunities for investors . The theme is at an inflection point, and belatedly transforming from a neglected risk into a top priority.”

4. AXA WF ACT Biodiversity Fund

The AXA Biodiversity Fund aims to mitigate biodiversity loss by investing in companies offering innovative solutions to address issues such as pollution on land and water, land degradation, fauna and flora protection, desertification, and overconsumption.

Launched in April 2022, the fund focuses on four themes that address biodiversity loss:

- Sustainable agricultre

- Responsible production and consumption

- Resilient infrastructure

- Technology enablers

Anna Vaananen, Head of Listed Impact Equities and manager of the fund said: “The development and prosperity of future generations rely on the joint efforts of governments, corporations and consumers working together to safeguard our natural capital. Naturally, this is also a key consideration for long-term investors like AXA IM. Crucial to this effort is recognising industry leaders that offer scalable and viable solutions to protect and preserve biodiversity through their products and services or their operational practices.

Risk warning: Investing involves risk. The value of your investments and the income from them can go down as well as up. You may not get back the full amount you invested. Information on past performance is not a reliable indicator for future performance.