The UK’s top investment funds with the lowest climate impact have been revealed in new data shared exclusively with Good With Money.

Carbon impact app Sugi analysed the popular ‘Super 60’ list of funds from investment platform interactive investor, highlighting those with a significantly lower climate impact than the relevant mainstream index. It also compared how these funds stack up in terms of their environmental impact against peer funds that invest in similar companies.

The Super 60 is a group of funds, investment trusts and exchange traded funds (ETFs) that have been handpicked by experts at interactive investor as being “quality options” for everyday investors.

Josh Gregory, CEO and Founder of Sugi, said: “While many investors want their funds to deliver financial returns without compromising the planet, many don’t know the actual impact of their investments. Being able to identify which investments have a low carbon impact – especially when compared with relevant benchmarks – can provide useful context for everyday investors when managing their portfolios.”

Josh Gregory, CEO and Founder of Sugi, said: “While many investors want their funds to deliver financial returns without compromising the planet, many don’t know the actual impact of their investments. Being able to identify which investments have a low carbon impact – especially when compared with relevant benchmarks – can provide useful context for everyday investors when managing their portfolios.”

In each of the nine core asset groups, Sugi – which enables investors to track and compare the carbon impact of their individual portfolio – identified a “best in class” fund. This is one that has a significantly smaller carbon impact than the relevant mainstream index AND peer group.

An example is Lindsell Train UK Equity, within the UK equities asset group, which has a carbon impact that is 10 times smaller than the FTSE All-Share index and 20 per cent lower than its peer funds. An investment of £10,000 would equate to one tonne of annual carbon emissions, about the same as driving a car for 5,000 miles or flying one way from London to New York.

In emerging market equities, Mobius Investment Trust has the lowest carbon impact, at more than five times smaller than the MSCI Emerging Markets Index. The fund’s carbon impact is also almost 30 per cent lower than other funds with similar holdings. An investment of £10,000 would equate to 2.5 tonnes of annual carbon emissions, about the same as flying a private jet for an hour.

The climate impact of the ii Super 60*:

| Asset group | Index’s annual carbon impact (tonnes / £10,000 invested) | Lowest carbon impact in category | Compared with index | Compared with peer group |

| UK equities

Index: FTSE All-Share |

11 tonnes | LF Lindsell Train UK Equity | -91% | -20% |

| Global equities

Index: MSCI World |

4 tonnes | Fundsmith Equity | -88% | -55% |

| Emerging market equities

Index: MSCI Emerging Markets |

13 tonnes | Mobius Investment Trust | -82% | -28% |

| Asian equities

Index: FTSE Developed Asia Pacific ex Japan |

9 tonnes | Fidelity Asia | -36% | -30% |

| European equities

Index: FTSE Developed Europe ex-UK |

8 tonnes | Man GLG Continental European Growth | -88% | -73% |

| US equities

Index: S&P U.S. Total Market |

3 tonnes | Vanguard U.S. Equity Index | Equivalent | -38% |

| Japanese equities

Index: FTSE Japan |

10 tonnes | Baillie Gifford Shin Nippon | -73% | -33% |

| Global bonds

Index: Bloomberg Global Aggregate Bond |

5 tonnes | M&G Global Macro Bond | -39% | -36% |

| Sterling bonds

Index: Markit iBoxx Sterling Non-Gilts |

4 tonnes | Rathbone Ethical Bond | -19% | -66% |

Gregory added that investors may want to look further than carbon impact to understand the overall environmental impact of their portfolio. He said: “Investors may want to consider metrics beyond carbon to see the full scale of their impact. Sugi already shows investors their ‘portfolio temperature’ – how closely aligned they are to the 1.5 degree global warming target – and we’ll be adding further impact metrics to the app soon.”

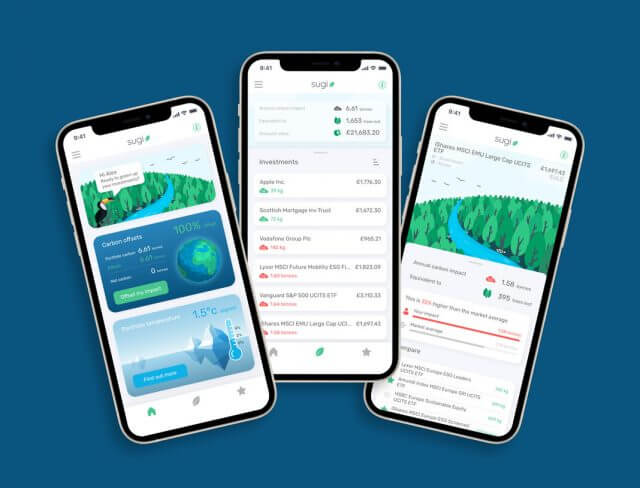

As well as providing investors with personalised metrics about the environmental impact of their portfolios, Sugi calculates carbon impact data for similar investments. This helps investors to build a greener portfolio in line with their values.

Investors are also able to counteract the impact of their portfolios by buying verified carbon credits in the app. The app currently has more than £250 million of active investment accounts on its platform.

Disclaimer: Sugi provides factual information relating to the carbon impact of investments, which should not be treated as any form of financial, investment or other professional advice or recommendation. Content within the Sugi app or supplied by Sugi in any other context should not be used as the basis for making any financial decision. Sugi does not provide any invitations or inducements to engage in investment activity.

* Sugi analysed the carbon impact for nine equity and debt asset groups of the interactive investor Super 60 list, using its TCFD-aligned carbon accounting methodologies, which incorporate Scope 1-3 emissions data

The indices used for each asset group were:

- UK equities – FTSE All-Share

- Global equities – MSCI World

- Emerging market equities – MSCI Emerging Markets

- Asian equities – FTSE Developed Asia Pacific ex Japan

- European equities – FTSE Developed Europe ex-UK

- US equities – S&P U.S. Total Market

- Japanese equities – FTSE Japan

- Global bonds – Bloomberg Global Aggregate Bond

- Sterling bonds – Markit iBoxx Sterling Non-Gilts

This article is in partnership with Sugi.