This article is from our new guide The ABCs of ISAs – a Good Guide, which is available to download for free here.

ISAs, JISAs, LISAs, IFISAs, ETFs, FOFs… the list of acronyms seems endless when it comes to investing. And that can be pretty off-putting. Even if you’ve decided you’re ready to dip your toes in the water, it can be hard to know where to start.

What even is an ISA?

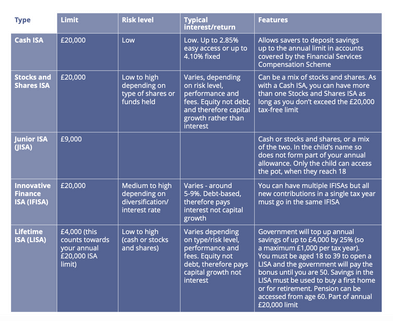

ISAs (Individual Savings Accounts) are an easy, tax-efficient way to save for the long or even shorter term. Every adult in the UK aged over 18 can pay up to £20,000 into an ISA each year without paying any tax. For children aged under 18, the annual limit for a Junior ISA (JISA) is £9,000. You have until the end of the financial year on April 5 to use that year’s allowance – it doesn’t roll over, so if you don’t use it you’ll lose it.

HMRC figures show that a massive £75 billion was paid into 13 million Adult ISAs in 2019 to 2021. The majority of this – £48.7 billion – was paid into Cash ISAs (this is a simple savings account that you don’t pay tax on).

Inflation is still high, but with the Bank of England base rate now having caught up a little, Cash ISAs are a safe and – for a change – fairly attractive place for your money this year. If you opt for a Cash ISA, you don’t have to stick with the bank where you hold your current account. There are plenty of providers to choose from that are doing good for society and the planet, such as Triodos Bank, Ecology Building Society and Nationwide.

With a Stocks and Shares ISA, you can invest your money in funds that are helping the planet and society with the prospect of a higher profit over the long term than if you had saved in cash. However, it’s important for potential investors to remember that the value of your investments can go down as well as up and your capital is at risk. Download our new Good ISA guide, the ABCs of ISAs for articles from well-established sustainable fund managers Liontrust and Triodos, and wealth managers EQ Investors.

There is also the option of an Innovative Finance ISA (IFISA), which enables you to invest directly in pioneering positive impact companies that are tackling the issues you care about most. Find out more in our article from Ethex and Energise Africa.

What are the different types of ISA?

The benefits of ISAs

Many ISA providers allow you to make one or more lump sum or regular monthly payments, up to the annual limit for that type of ISA. Making monthly payments can seem less scary than depositing a lump sum once or twice a year and particularly so given the recent rollercoaster ride of global stock markets.

For stock market ISAs, figures show that, over the long-term, investors who drip feed money into their ISAs may benefit from returns that are on a par with or higher than those of an investor who deposited a lump sum. This is due to something called pound cost averaging, and also means that those who keep their money invested over the long term may benefit from higher returns.

Pound cost averaging works because it evens out the peaks and troughs of the stock market: when stock prices are low, your money will buy more than when stock prices are high. This works over the long term. As they say, ‘you’ve got to be in it to win it.’

Download our new guide The ABCs of ISAs – a Good Guide, and get investing today!