Almost three quarters of women (74 per cent) are too nervous to invest, a new study reveals.

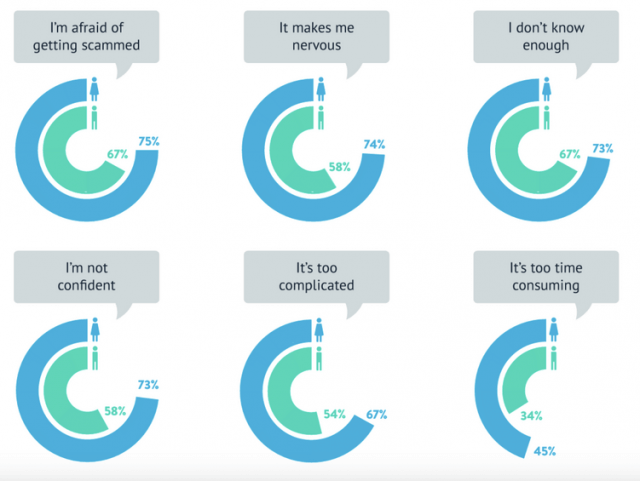

A staggering 73 per cent of women don’t feel confident investing their money – compared to just 58 per cent of men. The same goes when it comes to knowledge: 73 per cent of women haven’t invested because they feel they don’t know enough about it, versus 67 per cent of men.

Despite women being more likely to have financial goals than men – 61 per cent say they have definite savings goals for the future, compared to 49 per cent of men – the research found that most are hesitant about investing their money.

Investing platform Wealthify surveyed 2,000 Brits who have at least £5,000 in savings but haven’t invested before to understand the reasons why, and uncovered some stark differences in the attitudes towards investing between men and women.

‘Women save and men invest’

The findings endorse the traditional notion that ‘women save and men invest’: 87 per cent of women have chosen to put their money in a savings account rather than investments, with more than one in four (26%) women believing investing is not an option for them.

It means that women are missing out on the financial opportunities brought by investing – widening the gender wealth gap – and the potential to make a positive impact on people and planet, too.

Saving is less risky because your money is protected and you can get to it quickly. But it also has far less potential for meaningful returns. This is particularly true in the current high inflation environment, as cash savings will lose value in ‘real’ terms over time (i.e you’ll be able to buy less with your money in the future than you can now).

When you invest it should always be for the long term (think five years or more). The overall trend is usually upwards and your investments are likely to ride out any falls over time.

Top barriers to investing for men and women (source: Wealthify)

Interestingly, the overwhelming majority of women (90 per cent) polled say they’d be more likely to invest if they were more knowledgeable about it; another 89 per cent said they’d be more likely if there was a clear route as to how to do it. And over three quarters (77 per cent) say they’d be more likely to invest if they had access to a financial planner/adviser.

If you’re keen to take the plunge, but want some help starting out, check out our Good Guide to Financial Wellbeing for Women and Good Guide to First-Time Investing.

If you have at least £5,000 to invest, you might also benefit from a financial planner – see our top ethical picks, in particular ‘Good Egg’ firms EQ Investors, BlueSphere Wealth and Path Financial.

The pull of positive impact

Aligning investing with making a positive impact is something that might make more women consider investing. More than seven in ten women (73 per cent) say they’d be more willing to invest if they felt their investments were supporting good causes. Our top sustainable investment platforms (including Good Egg firms The Big Exchange and Simply EQ from EQ Investors) and top platforms for a green stocks and shares ISA are a great place to start.

Michelle Pearce, Co-Founder of Wealthify said: “Confidence and lack of knowledge remain key barriers stopping women from investing, despite the many digital investment services – like Wealthify that aim to remove the jargon from investing and make it as accessible and understandable as possible. You don’t have to be a financial expert to start. In fact, you don’t need to know anything if you don’t want to. Just trust the experts to take care of it for you. And if you’re unsure, you can start small and build your way up.

“Everyone deserves the chance to invest and ensure their financial stability. And, as such, we want to encourage women to take charge of their financial future.”