The US significantly trails the UK and Europe when it comes to sustainable investment and environmental, social and governance standards but could this be changing?

Chris Foster, Manager of the Liontrust GF Sustainable Future US Growth Fund, looks at the opportunities for investors as new regulations on climate change risks come into force, which follow the US Inflation Reduction Act.

The last decade has seen investors in the UK and Europe embrace sustainable investment and environmental, social and governance (ESG) standards, alongside the realisation that there are also clear financial benefits to doing so.

But investors and companies in the US have been slower to see the benefits of the sustainable approach. In fact, sustainability in the US is considerably behind where the UK and Europe are, our best guess is probably by around ten years or so.

Yet the US has some of the world’s most exciting and innovative companies, and we believe there are opportunities for investors to benefit from what is undoubtedly a market with huge opportunities for growth. Capitalism and entrepreneurialism are commonplace in the US and this has resulted in a proliferation of the creation of wonderful businesses. However, in recent times, these qualities have been reflected in valuations, which have tended be higher than other developed markets.

An exciting time to invest

Entering 2022 however, things changed dramatically. Inflation and interest rates rose beyond everyone’s expectations and the subsequent rise in discount rates brought down valuations of companies across the board, but particularly those in the US that were starting from a relatively high base. As a result, many companies look better value today and we believe this is an exciting time to be allocating capital in the market.

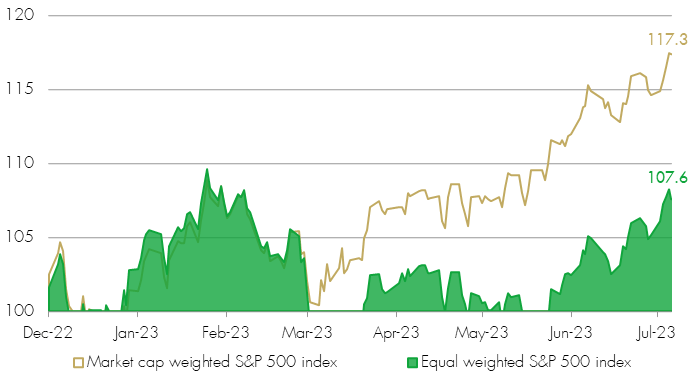

The strong performance in the US market this year has been well documented. The US stock market has performed strongly, with the S&P 500 up over 18 per cent so far in 2023. However, when you look more closely, the success of the US stock market in 2023 has been driven a very small cohort of companies (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta). So, although the US index performance has been strong to date, the equal-weighted index is up a lot less, at closer to eight per cent.

Source: Bloomberg, 01.01.23 to 14.07.23. Data normalised as of 30.12.22.

We are excited about the opportunities that lie outside of these companies that have driven the market to date – our view is that these smaller companies typically have less analyst coverage and can provide exciting growth opportunities at attractive valuations.

Meanwhile, new regulations governing the disclosure of climate-related risks and opportunities, and sustainability-related information are expected to be adopted this year by the US Securities and Exchange Commission, perhaps imminently. These should ensure that investors have far more data and information about companies’ environmental, social and governance (ESG) standards and performance than is currently the case.

Driving interest in sustainable investing

We believe this will also help to drive interest in sustainability and sustainable investment generally. We have often found that some more established businesses can be wary of disclosing too much and instead opt to do the minimum. In contrast younger and more innovative companies are often more open to engaging and disclosing on key ESG issues. The new regulations will hopefully bring the US more in line with existing regulations in the UK and Europe, and this may prove a tailwind for growth in sustainable strategies.

The US Inflation Reduction Act announced and passed in August of last year has also seen billions earmarked for investing in energy efficient projects and renewable energy etc. Although the US is noted in certain areas for general scepticism around ESG investing etc – with the debate becoming undoubtedly politicised in some areas – when there is an economic rationale, such as saving money following the rising costs of energy, the US can and often does move big and fast.

As an example, Texas generates more renewable energy than any other US state – despite opposition in many parts of Texas to climate change initiatives. In 2022 alone, Texas generated 136,118 gigawatt-hours of energy from wind and utility-scale solar. A staggering 40 per cent of its energy came from carbon-free sources – 22 per cent from renewables (predominantly wind), and 18 per cent from nuclear. (Source, US Energy Information Administration)

Looking ahead

Longer term, we believe demographics in the US may also play a role driving forward sustainable investing. Over the coming years we are likely to see a transfer of wealth from boomers to millennials – and the latter are typically much more concerned with ESG issues and climate change than most boomers.

In June, in response to client demand and to capitalise on these opportunities, the Liontrust Sustainable Investment team launched a new US sustainability fund – the GF SF US Growth Fund. While we have been investing in the US for more than 20 years and we have a proven track record, we believe the current climate provides an excellent opportunity to deploy fresh capital and to engage with the companies we invest in in order to improve their management of key ESG issues.