Peter Michaelis, of sustainable investment specialists Liontrust, reveals the companies his team considers to be essential to decarbonisation (the reduction of carbon dioxide emissions) in the UK.

Yesterday, the UK Climate Change Committee gave its advice on whether the UK government should carry its over-achievement from the Third Carbon Budget – the most recent – into the next. It is very clear that this should not happen, mainly because the harder parts of decarbonisation are ahead of us.

Here we look at some of the companies which we think are essential to decarbonisation across the economy.

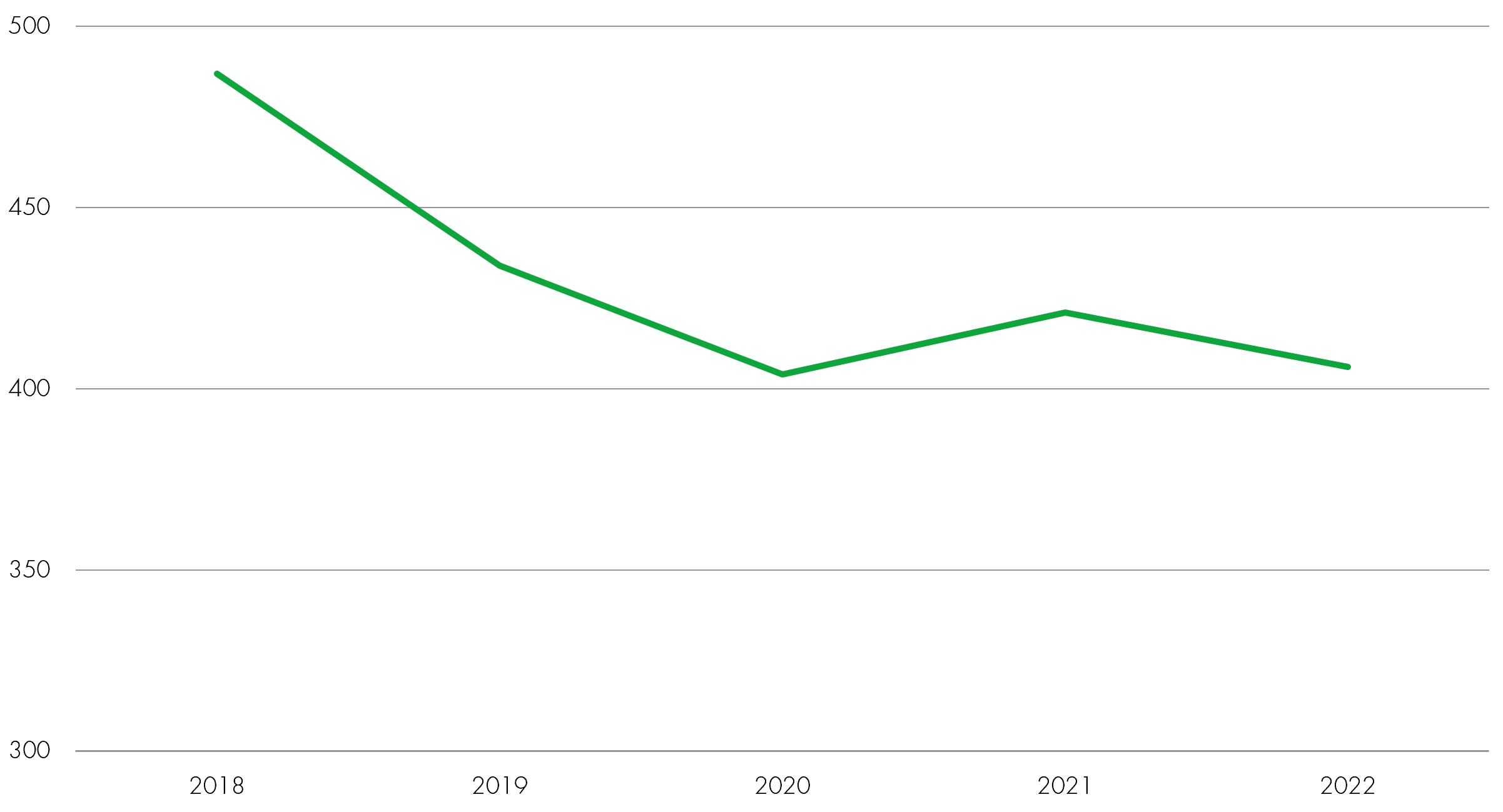

UK net carbon emissions (MtCO2e):

Source: Department for Energy Security and Net Zero (DESNZ) (2024) Final UK greenhouse gas emissions national statistics: 1990 to 2022

Emissions from electricity supply fell by more than expected

First, the good news: the Third Carbon Budget (2018 to 2022) was delivered with room to spare, with an emissions surplus of 391million tonnes of carbon dioxide equivalent (mtCO2e), or 15 per cent, between the 2153 mtCO2e emitted over the five-year period and the 2,544 mtCO2e budget.

Partly this was due to the economic slowdown caused by Covid, but also as emissions from electricity supply fell faster than projected. Coal was phased out more rapidly than expected. This is a big win and it is now clear that renewables (photovoltaic solar and wind) have become competitive and continue to get cheaper as global capacity grows.

Our sustainable infrastructure holdings which are helping drive this by owning and operating renewable electricity generating assets include Greencoat UK Wind, The Renewable Infrastructure Group and Atrato Energy. The trend also bodes well for Danish wind turbine manufacturer Vestas Wind Systems.

Electrification is increasing across all sectors and this also benefits electricity utility National Grid and manufacturing automation and digitisation specialist Siemens.

Energy efficiency in UK industry should improve

Industry in the UK actually saw a more rapid fall in emissions than predicted, but this was linked to a decline in steel production rather than dramatic improvements in the efficiency of industry. We believe this area is one where the commercial rationale for investment in efficiency is very strong.

For this reason we are invested in those companies enabling industrial energy efficiency – for example, industrial design technology specialist PTC; steam management and pump specialist Spirax-Sarco Engineering; simulation software provider Ansys – as well as Siemens – and also manufacturing companies investing to improve the energy efficiency of their production such as card box manufacturer Smurfit Kappa and Genuit, the producer and distributer of building products for the management of water and air.

SDCL Energy Efficiency Income Trust invests in and operates energy efficiency projects which reduce wasted energy and customers bills within industry. We are optimistic that decarbonisation can continue apace in this area.

Electric vehicle take-up has disappointed so far, but we expect it to accelerate

Domestic transport emissions fell less than projected due to slower-than-expected take up of electric cars and a trend to bigger, less efficient, vehicles. Internal combustion engine cars’ carbon emissions actually increased by 19%. However, we believe the shift to electric vehicles will accelerate.

As with renewable energy they become cheaper as their supply increases and so the economics will move more in their favour. We are unsure which manufacturer will succeed, so we look for those working in the development of lighter weight batteries – such as Oxford Instruments, which provides technology products and services to the world’s leading industrial companies and scientific research communities – or those that will provide the intelligence that will operate electric cars, such as chipmaker Infineon.

The biggest improvement comes from making mass transport convenient, cheap and rapid. For this reason, we invest in Mobico, which runs buses, coaches and trains in UK, US, Spain, Germany and Morocco.

Existing buildings require insulation retrofitting and conversion to electric heating

Buildings have seen much slower progress to improved energy efficiency through insulation or non-gas heating. Although new buildings, both residential and commercial, are well insulated, the difficulty is with the existing stock. The houses we will occupy in 2050 are for the most part those we see around us today.

Therefore there is no other route than retrofitting insulation and heating with electricity (with heat pumps or direct). Part of the problem is that even if it makes medium-term economic sense to upgrade insulation, it tends to be a small enough issue for property owners that there is no urgency to carry it out. We can only see this accelerating with clear, well-signposted regulation and incentives. Our exposure is mostly in the new build sector with Genuit and Kingspan. Autodesk allows the design of energy efficient buildings with its software for construction, manufacturing and entertainment industries, while PRS REIT owns a portfolio of A&B rated houses.

Waste recycling needs to increase; A/C units need regulation and substitution of refrigerants

Waste emissions came down due to lower methane emissions from landfill (a consequence of the landfill tax imposed in 1996). The problem has been that too much waste ends up in energy production versus being recycled or composted. We back companies that look at these waste streams as sources of valuable materials. Both Smurfit Kappa and Genuit take waste paper and plastic respectively and turn them into value-added product.

Fluorinated gases from air conditioner units have a disproportionate effect on global warming when they leak into the atmosphere in small amounts. It appears that regulation and substitution of refrigerants is beginning to bring this down. We invest in Trane which provides refrigeration and air conditioning that is adapted to work with these lower GWP (global warming potential) refrigerants.

We are invested in companies that will help the UK stay on track for the Fourth Carbon Budget

Overall the business case is strong for decarbonising most of the sectors covered in the Carbon Budgets (international aviation and shipping are excluded). The one area where government intervention is essential (but also has to be carried out with care) is in retro-fitting of buildings. We are positioned in companies that will help the UK to stay on track to meet the Fourth Carbon Budget and subsequent budgets; in doing so we believe they will see strong growth in their own profits which they can reinvest in further innovation.

|

Company Name |

Matrix Rating |

Primary Theme |

What this company does & how it contributes to a more sustainable economy? |

|

ANSYS |

B2 |

Improving the resource efficiency of industrial and agricultural processes |

Simulation software is the process of modelling a real-world phenomenon with a set of mathematical formulae. Essentially, it is a computer programme that allows the user to observe an operation through simulation without physically performing that operation. The virtual testing and monitoring enables higher safety and quality standards in the design, development and maintenance of our products and Ansys is the global leader in complex multi-physics real-world simulations. |

|

Atrato Onsite Energy |

A2 |

Increasing electricity from renewable sources |

Atrato Onsite Energy is a renewable energy infrastructure fund that installs solar modules principally on industrial use roofs in the UK. They contract the sale of electricity from this to the willing occupier. The result is more lower carbon electricity generated and lower power price costs for their customers and dividend payments for investors. |

|

Autodesk |

B1 |

Improving the resource efficiency of industrial and agricultural processes |

Autodesk provides software for construction, manufacturing and entertainment industries. Its products effectively lead the digitisation of these industries, which in turn directly reduces resource wastage, wasted time and watered costs. The Building Information Management (BIM) secular trend in construction is being driven by Autodesk’s market-leading products. |

|

Genuit Group |

B2 |

Building better cities |

Genuit, formerly Polypipe, produces and distributes building products for the management of water and air. As weather events become more extreme, and urbanisation increases, surface water management becomes more important. In addition, cleaner indoor air promotes better health. |

|

Greencoat UK Wind |

A2 |

Increasing electricity from renewable sources |

Greencoat UK Wind PLC is a sustainable infrastructure fund that owns and operates renewable energy electricity generation assets. These assets are split across 49 different projects, all of which are wind generation assets (56% onshore and 44% offshore) in UK. This fund plays a crucial role in owning renewable assets which are displacing higher carbon alternatives off the electricity grid helping us move towards an ultra-low carbon economy. |

|

Infineon Technologies |

B1 |

Improving the efficiency of energy use |

Infineon is a German company that produces efficient power management chips, which are used across the economy in electronics, particularly in computing and mobiles as well as autos and industrial automation. It is the largest player in power semi-conductors, which are key for electrification, so they are well positioned here. |

|

Kingspan Group |

A3 |

Improving the efficiency of energy use |

Kingspan products will help to decarbonise our economies by reducing the energy required to keep our buildings at the correct temperatures. 85% of their products provide superior insulation, up to twice as effective as mineral fibre. Green new deals will drive growth in demand for insulation in new build and refurbishment. In its operations the company is exceptional having reduced its carbon intensity by 54% since 2012. |

|

Mobico Group |

A2 |

Making transportation more efficient or safer |

The company operates bus, coach and rail services, with an exceptional record on safety and progressive on environmental improvements. It helps to make cities less congested and air cleaner. |

|

National Grid |

B2 |

Improving the efficiency of energy use |

National Grid engages in the transmission and distribution of electricity and gas to millions of customers and communities. As operator of the UK electricity grid, it plays an important role in investing to upgrade the grid to be fit for the energy transition towards an ultra-low carbon economy by enabling more renewables as well as upgrading infrastructure for electric vehicle charging points and heat pumps. |

|

Oxford Instruments |

A2 |

Better monitoring of supply chains and quality control |

It provides high technology products and services to the world’s leading industrial companies and scientific research communities, with world-class ability to image, analyse and manipulate materials down to the atomic and molecular level. |

|

PRS REIT |

B2 |

Building better cities |

PRS REIT has developed and now rents 5264 family homes for private rental in major UK towns and cities. They offer quality accommodation to people that cannot afford, or do not want to own, property directly. The emphasis is on developing communities sitting within other types of tenure (owner occupier and affordable) and to regenerate and invest in under-served urban areas. |

|

PTC Inc |

B3 |

Improving the resource efficiency of industrial and agricultural processes |

PTC is an Industrial Design technology business for niche industrial end markets. It effectively supports the digitalisation of the manufacturing industry. This in turn helps reduce production errors and the associated materials waste and emissions. |

|

SDCL Energy Efficiency Income Trust |

A2 |

Improving the efficiency of energy use |

SDCL Energy Efficiency Income Trust invests in and operates energy efficiency projects in different technologies that deliver significant energy savings globally. The energy these projects save results in lower bills for the customers. These savings are shared between the customer and the fund which pays out c. 5% dividend to investors. |

|

Siemens Aktiengesellschaft |

A3 |

Improving the resource efficiency of industrial and agricultural processes |

Siemens has restructured itself into just four main divisions: Digital Industries; Smart Infrastructure; Healthineers and Mobility. These help to drive improvements in resource efficiency; electricity use; diagnostics and health; and mass transport (trains). Each of these divisions will grow as our economies become more sustainable. |

|

Smurfit Kappa Group |

B1 |

Delivering a circular materials economy |

Smurfit Kappa is the #1 card box manufacturer in Europe. It benefits from the move away from plastic to recyclable and biodegradable cardboard packaging. As a leader in recycling, forest sustainability and efficiency in operations, we forecast the company will deliver strong returns through the cycle. |

|

Spirax-Sarco Engineering |

A2 |

Improving the resource efficiency of industrial and agricultural processes |

Spirax’s steam systems dramatically improve the resource efficiency of chemical and industrial plants. They estimate that they save their customers 17.7mt CO2e pa, and 88.4m m3 of water. |