Conducting stewardship activities within investment portfolios is one of the most direct levers that investors can use to achieve real-world change.

Having equity in a company means that you have part ownership of that company, which comes with certain shareholder rights. One of these is that you get to share in the company’s financial success, but another is that you get to influence change through various mechanisms such as voting, engaging, and shareholder activism (collectively known as stewardship).

Stewardship goes beyond merely investing money and aims to ensure that assets are being managed appropriately and in the best interests of those who ultimately benefit from them.

Why using your voting rights matter

At EQ Investors (EQ) we believe supporting a fairer and more sustainable world is aligned with our long-term fiduciary duty to clients, which is reflected in our stewardship activity. Voting on resolutions at invested company’s annual general meetings (AGMs) is one way in which investors can have an impact on a business. Every year, asset managers around the world use voting rights on behalf of their clients to influence the trajectories of the companies they invest in.

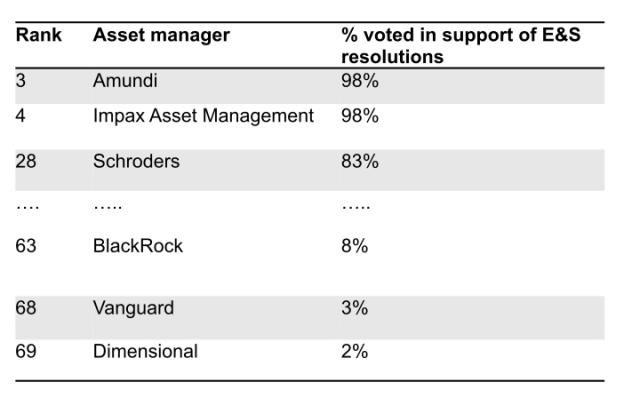

However, the reality is that not all asset managers take this responsibility seriously, in fact it’s a minority. The table below is an extract from ShareAction’s Voting Matters 2023 Report. It ranks some of the largest asset managers based on whether they supported shareholder resolutions that would have asked for greater social and environmental disclosure and performance from companies.

EQ uses this information, among other stewardship assessments, to select ambitious partners, and to engage with those that can still improve. Many people don’t know that some of the largest managers, Vanguard, and BlackRock, are routinely preventing positive changes in the real world.

Another stewardship method is to engage with management on relevant sustainability weaknesses, and to personally attend AGMs to interact directly with the board of directors. These are opportunities to alert companies to evolving best practices and the risks of negatively affecting any of their stakeholders.

To act as responsible stewards of our clients’ capital, we are pleased to share EQ’s 2024 Stewardship plan with you. It details our five-levers to stewardship, as well as our strategic engagement themes. Given that the next AGM season is starting soon, EQ is once again working closely with

ShareAction to help engage with company boards. We look forward to keeping you updated with our activities, and their outcomes.