In an ever-evolving world, it’s important for sustainable investors’ priorities to evolve alongside it. Here, Mike Appleby of Liontrust Asset Management looks at important new investment themes – and those that have run their course.

The world is changing and evolving and, as investment specialists, we look to make sure that we evolve alongside, in order to ensure the best outcomes for investors and from the themes we focus on.

As a result, we regularly review our sustainable investment themes; typically every two years. We use input from experts at Cambridge Institute for Sustainable Leadership, which the investment team attended in September 2022 as well as input from our Advisory Committee. This is to ensure we are not missing any new investment themes as well as retiring any investment themes that have run their course. The following changes take effect from April 2024.

Financial resilience

Financial resilience is retired – this theme recognised the importance of a well-capitalised and well-governed financial system in developing a sustainable economy. It was born in the aftermath of the global financial crisis, where the severe negative social impacts of weak governance in financial institutions were laid bare. It is pleasing to see that many financial institutions now meet the criteria for financial resilience. Without neglecting the dimension of financial resilience, we want to extend this to also incorporate the nature of the business these companies carry out and to focus on those with the largest positive sustainability impact.

Enabling SMEs

This theme seeks to find companies enabling the foundation, scaling, and improved efficiency of innovative new businesses. Small to medium sized enterprises (SMEs) are the anchor of a resilient and sustainable economy, accounting for 44 per cent of US GDP and creating two thirds of jobs in the US. According to the Organisation for Economic Co-operation and Development (OECD), SMEs facilitate innovation, reduce inequality in society, and increase economic resilience within society. Yet there are key barriers to SMEs achieving success as they struggle to overcome complexity and reach scale. Within this theme, we look for companies enabling this journey from idea formation to value creation, helping increase SME productivity and efficiency, and ideally growing with the SMEs they support.

Financing housing

Housing is a basic human requirement that is central to human wellbeing. A lack of housing also has detrimental effects on the wider economy; for instance, rental and mortgage costs in many developed countries have outpaced wage growth, leading to declining disposable income for households and increasing inequality.

In this theme we are looking to find companies that are allocating capital towards residential housing or making the market more efficient.

Transparency in financial markets

We believe that companies working to improve the transparency of financial markets are set to benefit from increasing regulatory compliance measures and the growing availability of data that can provide valuable insights for financial market participants to manage risk. In effect, if there is equal information on both sides of a market then markets are likely to function better, risk is likely to be more accurately assessed, and the financial system will be more resilient.

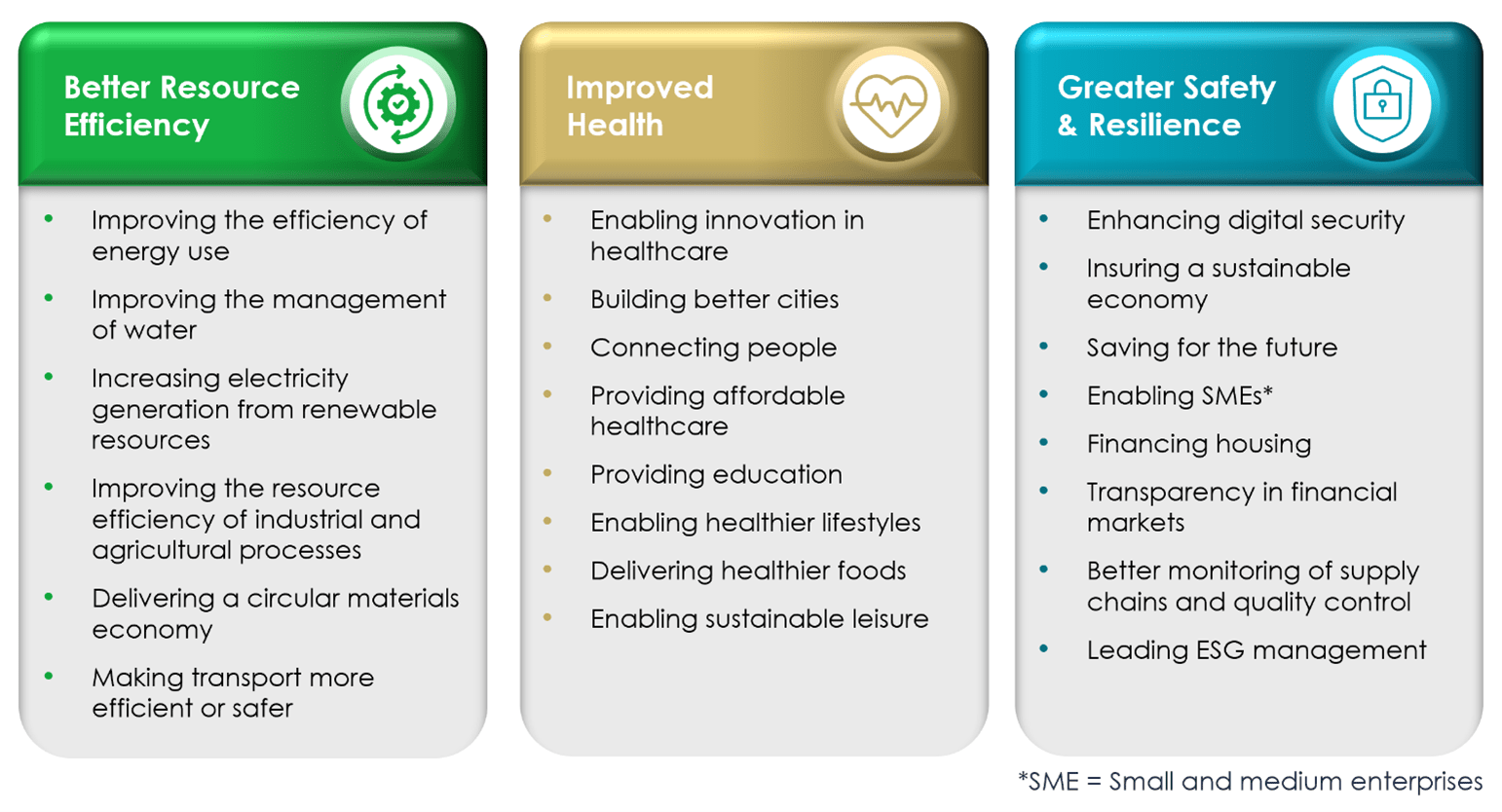

We have identified 22 sustainable investment themes which make our economy cleaner, healthier or safer. Understanding these sustainable investment themes helps us find structural long-term growth trends which we believe will be a key driver of investment returns over the medium term.