JPMorgan Chase, Barclays and HSBC are named in a damning new report exposing the banks pumping the most money into fossil fuels.

The annual Banking on Climate Chaos report offers a detailed picture of global financing of fossil fuels such as oil, gas and coal (the biggest drivers of climate change) – and it’s not a pleasant one.

The analysis, produced by a network of environmental organisations including Rainforest Action Network, Banktrack and Reclaim Finance, reveals that the global banking industry continues to fund the climate crisis at dangerous levels.

It shows that lending and underwriting to over 4,200 fossil fuel companies by the world’s 60 biggest banks reached $705 billion (£560 billion) in 2023, up from $669 billion (£532 billion) in 2022.

In 2016, 196 countries signed the legally-binding Paris Agreement to limit global heating to at most 2C above preindustrial levels, and ideally 1.5C, to prevent the most drastic impacts of climate change.

Ranked: the UK’s DIRTIEST banks – and the greenest

The worst climate offenders

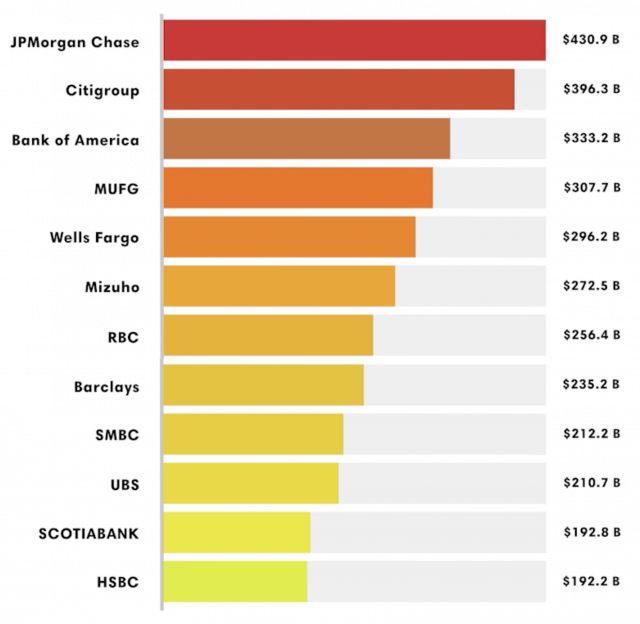

JPMorgan Chase – parent company of digital bank Chase, which operates in the UK – takes the top spot as the biggest fossil fuel financier in the world, having increased its financing from $38.9 billion (£30.94 billion) in 2022 to $40.8 billion (£32.45 billion) in 2023. The US heavyweight also ranked among the worst banks for financing companies involved in fossil fuel expansion.

It comes as Chase was last week crowned ‘Best British Bank’ at the British Bank Awards 2024, which were set up by hosts Smart Money People to celebrate “excellence in the banking sector.”

Meanwhile, the new report labels the UK’s biggest bank, Barclays, as the number one fossil fuel funder in Europe after its fossil fuel lending rose to $24.5 billion (£19.5 billion) in 2023 from $16.58 billion (£13.2 billion) in 2022.

It was singled out for financing what the report describes as ‘deadly’ coal power plants in the United States, despite high profile climate commitments. HSBC came 12th in the world for its financing of fossil fuels since 2016 at £153 billion.

Top 12 banks financing fossil fuels globally, 2016–2023

Lifting the lid on greenwashing

April Merleaux, report co-author and research manager at Rainforest Action Network, said the report lifts the lid on the banks’ greenwashing. “In a year with record climate impacts, I am shocked to see financing for any category of fossil fuels increase,” she said.

The report found that £277 billion, more than half of the biggest banks’ financing for fossil fuels for 2023, went to expansion alone. Meanwhile, a total of £2.6 trillion was found to have gone towards fossil fuel expansion since 2016.

This is despite the latest Intergovernmental Panel on Climate Change (IPCC) report making it clear that “no more fossil fuel sources can be opened if the world is serious about living up to its commitments and avoiding a significantly worsening climate crisis”.

Top 7 ethical current accounts in 2024

How to find a greener bank

The gold standard for ethical banking in the UK is Triodos Bank – a Good With Money ‘Good Egg’ firm and B Corp company. Triodos only lends its customers’ money to projects and organisations that make a positive impact on the environment and society. We also like Nationwide and the Cooperative Bank as well as digital bank Starling. See our full list of ethical current accounts here.

Last month, environmental organisation Bank.Green published the first climate performance analysis of 101 UK banks and building societies.

It ranked the 103 financial institutions on a scale from “Great” to “Worst” – and found that some of those marketing their climate concerns the loudest are the worst offenders. As well as Barclays and Chase, banks to avoid include Santander, Tesco, HSBC, First Direct, Standard Chartered and M&S Bank.

Bank.Green said not enough banks are ramping up renewable energy lending to meet the urgency of the climate crisis. It also wants to see banks provide favourable terms for green loans, such as those for electric cars, heat pumps or other fossil fuel reducing opportunities.

Top 9 ethical savings accounts in 2024