The majority of Brits have financial regrets, according to a revealing new study – but one looms larger than others.

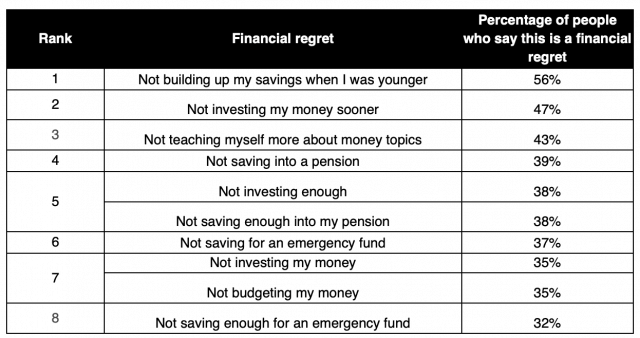

The most common regret, cited by 56 per cent of those surveyed by Shepherd’s Friendly, is not saving more money when they were younger.

Not investing sooner came in second, with 47 per cent saying it was their biggest regret, followed by not teaching themselves about money sooner, given by 43 per cent.

The survey also highlights big differences in financial regrets between Gen Z (aged 18 to 24) compared to their parents in Gen X (aged 55 to 64).

More than two thirds (67 per cent) of Gen Z have significantly more regret about not building up savings when they were younger compared to Gen X (52 per cent), showing a stronger concern among young people about their financial stability.

Almost half (46 per cent) of Gen Z were much more likely to regret comparing their financial situation to others, whereas only 15 per cent of respondents in Gen X expressed this regret. This suggests that younger generations are more influenced by social comparison, possibly driven by social media.

The majority (58 per cent) of Gen Z felt more regret about not investing sooner compared to 46 per cent of Gen X. It appears that younger generations are more aware of the benefits of early investing due to greater access to financial information now, while older generations, with longer investment histories, experience less regret.

Top-paying ethical savings accounts

Gaps in financial knowledge

The findings also make the link between financial and emotional wellbeing, with more than one in six of those polled reporting that financial worries negatively impact their mental health. This emphasises the importance of financial education, with 60 per cent of respondents advocating for its inclusion in school curriculums. A notable 45 per cent also believe young people lack adequate opportunities to learn about personal finance.

The survey revealed that while 87 per cent of Brits said they are confident in their financial knowledge, just 49 per cent passed the financial literacy test.

Age played a crucial role in financial understanding, with only 14 per cent of 18-24 year olds passing the test, compared to 67 per cent of those aged 65 and over. Additionally, gender differences were observed, with 54 per cent of men passing the test versus 46 per cent of women.

Graham Drummond, Head of Communications at Shepherds Friendly, said: “Our survey showed that many people are unsure about things like budgeting, investing, and understanding financial products that can help them prepare for the future, such as ISAs and investing. It’s not just about knowing the terms, but really feeling confident in making decisions that affect our financial well-being. To close these knowledge gaps, we believe it’s crucial to start teaching financial literacy in schools and continue promoting it throughout our lives.

“Whether you’re looking to improve your money skills or just starting out with building up your savings, there are plenty of ways to learn. You can explore online resources, join a workshop, or chat with a financial advisor. By boosting our financial knowledge, we can all make smarter choices, feel more secure, and build a better future for ourselves and our families.”