A new report from Make My Money Matter reveals the extent to which our pensions are fuelling climate change.

According to the report, £88 billion of UK pension savers’ money is invested in fossil fuels – that’s around £3,000 per individual penision saver. Additionally, £300 billion of UK pension savers’ money is invested in companies with a high risk of driving desforestation.

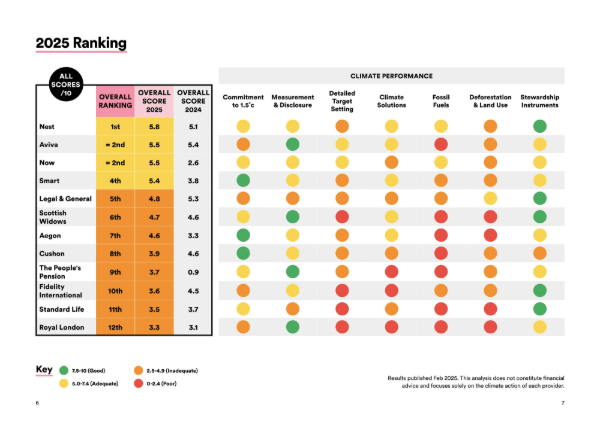

The 2025 Climate Action report looks at publicly available documentation on the UK’s 12 largest (Defined Contribution – DC) workplace pension providers.

DC pensions are typically workplace stakeholder pensions or personal pensions – whereby money paid in by the pension holder or their employer is invested by the pension provider, and the ultimate value of the pension pot is determined by how much has been paid in over time, as well as how successfully the investment has performed during that time.

While this year’s report shows signs of progress in the sector, Make My Money Matter say. ‘the pace and scale of progress falls short of what is needed given the severity of the climate and nature emergency.’

Which providers are improving?

Pensions giant Aviva has this year slipped down to second place, losing out to the government-backed scheme Nest. Newer providers like Smart Pension and Now Pension move into the top five alongside another large, more traditional provider, Legal & General.

Average scores have risen across almost all environmental themes – for example, fossil fuel phase-out or deforestation and land use – compared to last year, and 4 of 12 providers now score 5 or above (‘adequate’) compared to only 3 providers last year. Aegon has made improvements, and progress by The Peoples’ Pension means no providers are scored overall red (‘poor’) this year.

Which providers remain climate laggards?

Royal London holds the bottom spot of the 12 providers analysed, with Standard Life, Fidelity, The People’s Pension and Cushon (owned by Natwest) forming the rest of the bottom five providers.

British savers want sustainable pensions

Make My Money Matter surveys show that 2/3 of British savers want a sustainable pension, one that doesn’t drive the climate and nature emergency, but instead helps to tackle it.

Luckily, later this year Make My Money Matter will join a coalition of organisations coordinated by the Finance Innovation Lab to run a campaign on pensions calling for planned government pensions reforms to:

1 Deliver decent pensions for all, through boosting savings in a way that reduces inequality in the system.

2 Fuel long-term sustainable growth through green investment.

3 Phase out destructive investment in fossil fuel expansion and deforestation.

Here at Good With Money we are delighted to support Make My Money Matter and the Finance Innovation Lab and urge our readers, savers and employers to engage with this campaign and demand better from your money.

To read the Climate Action pensions report in full, click here.

If you want more detailed ideas on how to make your pension GOOD, then download our FREE Good Guide to Pensions.