| Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you are unlikely to be protected if something goes wrong. Take 2 mins to learn more. |

Thrive Renewables has launched a £5 million share offer to enable people to invest in new clean energy projects that tackle the climate crisis.

The offer, available through Triodos Bank’s crowdfunding platform, aims to bring thousands of individuals together with impact-driven corporate investors to help create a fairer, brighter future where everyone benefits from cheaper electricity.

In 2023, Thrive – a B Corp and Good With Money ‘Good Egg’ company – announced its ambition to double generation capacity within five years.

Money raised from its latest share offer will be used to build two onshore wind farms, including Thrive’s biggest project ever – a 57MW, 14-turbine site in Scotland. Community-owned wind and solar farms will also be provided with the flexible funding they need to get local projects built and operational.

‘Help us switch from dirty fossil fuels to clean energy’

Jo Butlin, Chair of Thrive Renewables, said: “With the climate crisis more urgent than ever, now is not the time to be slowing down. That’s why we’re giving you an opportunity to join us on our exciting journey, investing directly in new renewable energy projects that not only tackle the climate emergency and benefit local people but deliver a fair return too.”

She added: “From funding community wind and solar, where revenues are fed back into local causes, to innovative projects like the UK’s first deep geothermal power station, together we can bring about tangible change.

“Our eyes are fixed on a better future. Help us make the switch from dirty fossil fuels to sustainable, clean energy today.”

Why invest in renewable energy?

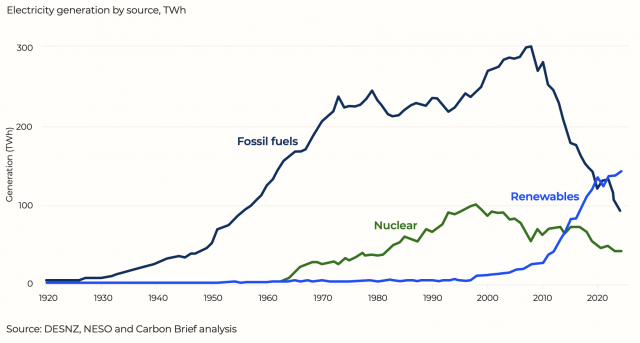

Last year was the cleanest ever year for UK electricity, with renewables generating more than half of all electricity for the first time.

However, there is a huge amount still to be done, as electrification of heat and transport ramps up and technological advances such as AI (which uses a lot of electricity) move forward at pace. A massive 130 per cent increase in production is needed by 2030.

Whitni Thomas, head of corporate finance at Triodos Bank UK, said: “The UK electricity market has transformed in the last 20 years and 2024 was a record year for renewables. Thrive allows everyday investors to play a part in that systemic shift and deliver positive climate solutions.”

The UK’s energy generation:

The last two years have been the most profitable years ever for Thrive, due to consistent generation, high wholesale energy prices and growing interest income from its lending investments. The company’s turnover increased from £11 million in 2021 to 25.9 million in 2024, with a large portion of its profits being reinvested in new projects.

Thrive’s growth comes at a key time for the renewables sector in the UK. The Labour government has set ambitious targets to double onshore wind, triple solar power, and quadruple offshore wind by 2030, as part of its “Clean Power 2030” plan.

At the heart of this is the creation of a new publicly-owned company, Great British (GB) Energy. Headquartered in Scotland, it will work with the private sector to invest in emerging energy technologies such as floating offshore wind, carbon capture and storage, and hydrogen. It will also help to advance more mature technologies such as wind, hydro and solar.

A ‘Local Power Plan’ will support the roll out of small and medium-scale renewable energy projects and help communities to own and benefit from the transition.

“We need to move fast and build things to deliver the once-in-a-generation upgrade of our energy infrastructure” Ed Milliband, Secretary of State for Energy Security and Net Zero, said in a recent government report.

How to invest

The minimum investment in the crowdfunding offer is £247 (100 shares) and shares can be held in a self-invested personal pension (SIPP). Thrive is targeting five to eight per cent return per year through a combination of dividends and increasing share value. Thrive shares can qualify for inheritance tax relief.

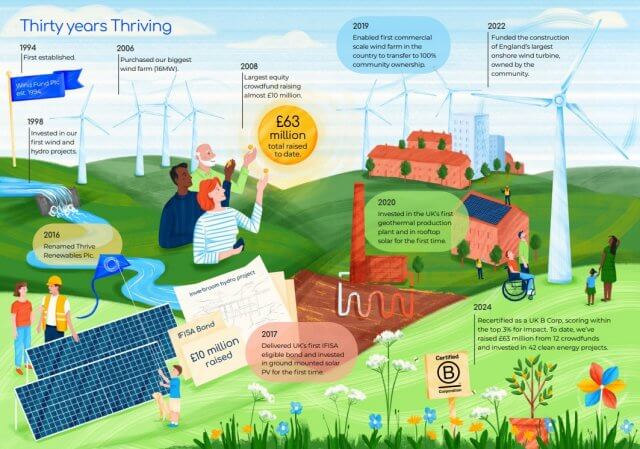

A certified B Corporation, Thrive aims to power the transition to a sustainable energy future by helping people connect with clean energy projects. Over the last three decades, it has raised £63 million from its community of over 6,000 shareholders to fund 44 wind, solar, hydro, battery, tidal and geothermal projects.

Investing in shares involves risk – including potential for loss of capital – as the value of shares may go down as well as up. The payment of dividends and the target return on equity are not guaranteed. Shares can be sold through a monthly share auction should there be buyers but may take time to sell. Tax eligibility and savings depend on individual circumstances and are subject to change.

This financial promotion was approved on 14 May 2025 by Triodos Bank UK Limited, registered in England and Wales with number 11379025. Registered Office: Deanery Road, Bristol, BS1 5AS. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 817008.