Shoal is a new savings app that lets you put money aside with confidence, earn a competitive return, and help to support positive change in the world.

Your savings are FSCS-protected and held with established British banks ClearBank and Standard Chartered. Behind the scenes, your deposits are linked to projects such as renewable energy, clean water, healthcare, and green transport.

Created by Algbra, a certified B Corp, Shoal helps you grow your savings securely while giving you clear insights into the positive outcomes your deposits help support.

The deal

Shoal is on a mission to make sustainable finance accessible to everyone, not just those with specialist knowledge or large sums to invest.

- Open a Savings Pot with as little as £1.

- Terms are fixed (three, six, or 12 months) with competitive, guaranteed rates of return.

- Every pound saved supports Standard Chartered’s sustainable finance portfolio, with 78 per cent directed to developing economies where the need for capital – and potential for impact – is often greatest.

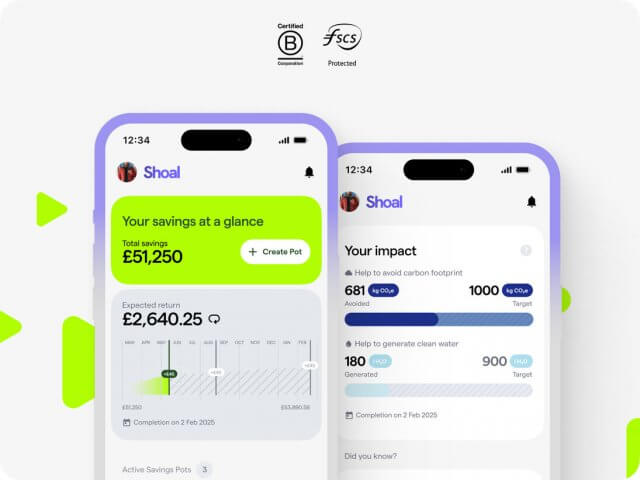

- Impact is tracked and audited. Savers can see the CO₂ avoided and clean water generated via the projects referenced against their deposits. Since its launch last year Shoal’s savers have already helped these projects generate more than one million litres of clean water and avoided over 300,000kg of CO₂.

- Shoal offers the same competitive rates not just to individuals but also to charities and businesses, giving organisations a practical way to align their reserves with their values.

Shoal also offers a practical solution for businesses and charities working towards ambitious net zero targets. Instead of relying solely on carbon credits or costly consultancy, organisations can put their cash reserves into Shoal savings pots. This way, they not only earn a return but also receive clear, audited data on the positive impact their money is having, such as CO2 avoided.

User-friendliness

Shoal has been built with simplicity in mind. The app is attractive, intuitive, and easy to use.

- Signing up is quick, and it’s free.

- Creating and managing Savings Pots is straightforward, with clear projections of your returns and sustainability impact.

- Rates are locked in when you open a Pot, so there are no surprises.

- Savings are FSCS-protected and capital is not at risk

- A dedicated “impact space” shows the types of projects your savings are helping to support.

Sustainability credentials

For every pound you deposit, Standard Chartered commits an equivalent amount from its balance sheet to its sustainable finance portfolio – funding projects like renewable energy, clean water, healthcare and green transport. This means your savings stay safe and are FSCS-protected while also being linked to real, sustainable impact.

That portfolio includes loans and projects supporting:

- Renewable energy such as solar and offshore wind

- Electrified transport networks

- Energy-efficient buildings

- Access to clean water

- Healthcare infrastructure

- Microloans for entrepreneurs in low-income communities

Unlike some impact platforms, you cannot choose specific projects to fund. Instead, your money helps support a broad portfolio.

Unique selling points

- Competitive returns with FSCS protection

- Simple, low-minimum access (save from £1)

- Measurable and audited sustainability impact

- Free to use

- Available to charities and businesses as well as individuals

The plus points

- Simple user experience and site design

- Clear, guaranteed rates

- No minimum deposit beyond £1

- Impact calculator shows your personal contribution

- Funds held with trusted institutions (ClearBank and Standard Chartered)

- Organisations can also benefit, aligning reserves with sustainability goals

Any drawbacks?

- Savings Pots are fixed term, so you’ll need to be comfortable locking money away until maturity.

- Funds help to support the entirety of Standard Chartered’s sustainable portfolio, so you can’t pick and choose individual projects.

- While Standard Chartered has a strong sustainable finance framework and net zero targets, it does still provide services to some carbon-intensive sectors.

- Shoal currently offers only fixed-term savings products, though it has plans to broaden its range over time.

Cost of use

Shoal is free to use. Its interest rates are very competitive with mainstream savings accounts, with the added benefit of a measurable sustainability impact.

How this compares

Shoal is one of very few FSCS-protected savings options with a clear ethical angle. It’s different from platforms like Ethex, Energise Africa or Abundance, which offer higher-risk investments in specific projects, often over longer terms. Shoal is simpler to use with guaranteed returns, but with less choice and less direct involvement in individual initiatives.

It’s a strong option if you want a safe, simple place for your cash savings that also contributes to positive global impact.

Other options to consider

This article is in partnership with Shoal.