Putting your savings to good use doesn’t have to mean earning less.

For many people, there has been an assumption that sustainable finance means settling for less – that if you want your money to do good, you’ll need to accept a smaller return.

But that idea is increasingly being challenged. A new wave of savings providers is showing that purpose and profit can go hand in hand. One of these is Shoal, a UK-based savings app that lets you earn a competitive return while helping support projects with measurable environmental and social impact.

Where your money goes

When you put your money into a high street savings account, it doesn’t simply sit there. Banks use customer deposits to fund their own lending and investments, but they rarely discuss what your money is helping to finance. This could include being invested in sectors such as fossil fuel extraction, mining or other carbon-intensive industries.

Shoal takes a more transparent approach. Funds saved through Shoal are held safely with ClearBank and Standard Chartered, both covered by the Financial Services Compensation Scheme (FSCS). Behind the scenes, Standard Chartered commits an equivalent amount from its balance sheet to its Sustainable Finance Portfolio, supporting projects such as renewable energy, clean transport, affordable housing and access to clean water.

This means your savings remain protected while the capital they represent helps to finance a more sustainable global economy, and the funds saved through Shoal will only ever be referenced against sustainable projects.

Purpose without the pay cut

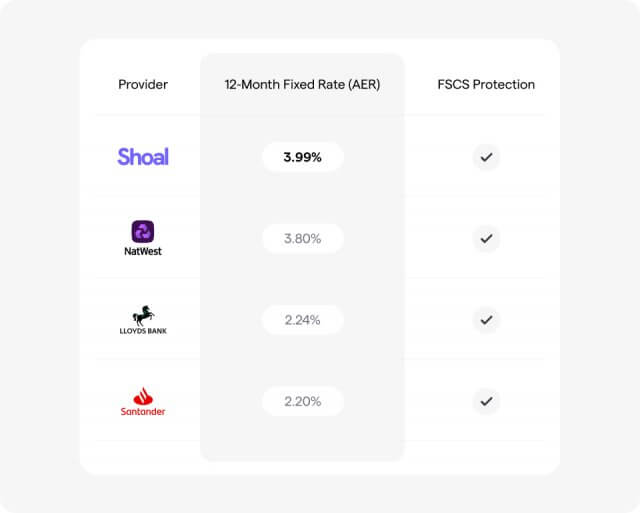

Shoal’s rates are among the most competitive in the UK – 3.99 per cent AER for a 12-month fixed-term business or personal account. That’s as good or better than many of the biggest high street names:

Source: Shoal, October 2025

In other words, you don’t have to choose between doing good and getting a good deal. Shoal’s model shows that savers can earn strong returns while helping support sustainable development. It’s a combination that’s still rare in mainstream banking.

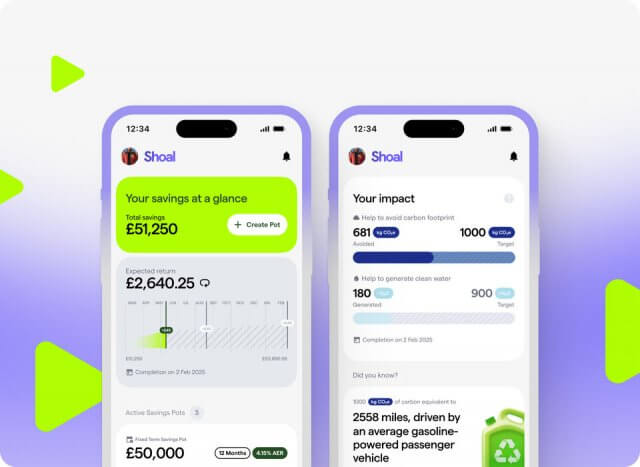

Measuring the impact

Shoal provides clear data on the projects its savers help to support and the impact achieved. To date, funds linked to Shoal customers have contributed to projects that have generated more than one and a half million litres of clean water and avoided over 350,000kg of CO₂ emissions.

Initiatives financed through Standard Chartered’s Sustainable Finance Portfolio include:

- Egypt’s first high-speed rail network, cutting transport emissions.

- A 1,000 MW battery storage project in the Philippines, improving renewable grid efficiency.

- Healthcare infrastructure in Angola, expanding access to essential services.

- Education programmes for marginalised students in India.

Each project supports progress towards the UN Sustainable Development Goals (SDGs), including clean energy, good health, quality education and climate action.

A shift in finance

Shoal reflects a growing shift in finance, from opacity to transparency. Most savers still have little idea where their money is put to work. Shoal turns that around, giving people the opportunity to align their savings with their values without compromising on security or return.

Every pound saved has the potential to have an impact in shaping the world. Shoal offers a way to know you are making a positive difference with your money, while your savings grow at a competitive rate.

This article is in partnership with Shoal.