The impact of Brexit has begun: inflation rose to its highest level for two years in September, according to figures published today, as the weaker pound begins to feed in to higher prices on consumer goods.

The Office for National Statistics (ONS) said that consumer prices were rising at a rate of 1 per cent in September – a jump from 0.6 per cent the previous month.

A rise in the cost of clothes and fuel was to blame, the ONS said, without expressly attributing the rise to higher import costs as a result of currency movements.

The Retail Price Index, which includes housing costs as well and is therefore considered a more accurate reflection of the cost of living, rose from 1.8 per cent to 2 per cent in September.

If you are under 30, it’s even worse. According to Aviva’s Age Inflation index, inflation in the year to September 2016 was 1.36 per cent for the under 30s, falling to 0.68% for the over-75s – another reason for Gen Y to feel glum. It varies because different age groups buy different things in different proportions.

Economists predicted further rises to come.

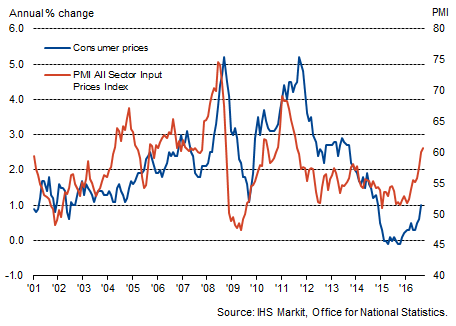

Chris Williamson, chief economist at IHS Markit, said: “While the ONS found no direct evidence that the pound’s fall has fed through to higher inflation, the link is clear from business surveys. The IHS Markit PMI surveys found companies’ costs have risen at the fastest rate for just over five years in September, with many firms blaming higher import costs resulting from the steep drop in the value of the pound, especially against the US dollar and euro. Higher fuel costs, linked to the firming of global oil prices, was also widely reported. The September surveys also found average prices charged for goods and services to have risen at the steepest rate since January 2014.”

“The historical relationship between the PMI survey data on companies costs and consumer price inflation indicates that consumer prices have further to rise as firms seek to pass higher costs on to customers in coming months. The Bank of England’s 2% target could therefore be breached within months, though much depends on the exchange rate and the extent to which costs continue to rise, as well as the degree to which firms may choose to soak up higher costs via lower profit margins.

“The rise in inflation has been anticipated by the Bank of England, who have also stated that they will ‘look through’ any short-term rise due to the pound’s weakness. However, the build-up of inflationary pressures suggests that policymakers may be less willing to loosen policy further in coming months, choosing instead to wait until the inflation outlook becomes more certain.”

How to beat inflation: 4 top tips

“Alternatives to cash savings”

Richard Theo, CEO at Wealthify, an online wealth manager, said: “Today’s surprise inflation announcement comes at possibly the worst time for long-suffering savers who are already earning next to no interest on their cash with typical easy access savings rates offering 0.01%. Combined with inflation at 1%, people are now seeing an almost 1p drop in value for every £1 they have saved.

More than ever, people must now take a hard look at how they are managing their money and explore alternatives to cash savings that can help them beat low interest rates, beat inflation and make their money work for them.”

Such alternatives might include:

-

Peer to peer lending

Where you lend money to individuals or businesses via a platform such as Zopa, Ratesetter or Funding Circle, earns higher interest than savings accounts, but carries more risk. The Innovative Finance ISA, due to launch in November, should make this form of earning money even more attractive as it will be tax-free. But not all of the big platforms will have these ISAs ready to launch in November.

-

Investing

Where you buy shares in companies either directly or in funds via platforms (such as Hargreaves Lansdown or Moneyfarm), investing also comes with typically higher rates of return than cash savings, but also more risk.

Basically, if you want to beat inflation in this low interest environment, it is very hard to avoid taking on more risk.

If you haven’t used up your stocks and shares ISA allowances (both partners if you are in a couple and junior ISAs too if you have children) then use this up first. It’s £15,240 a year, tax-free.

-

There’s always property….

Well, yes, property is certainly Britain’s default “alternative” thing to do with your cash for those who prefer the tangibility of bricks and mortar to the invisibility of funds in ISAs. But capital growth in housing is by no means guaranteed. Big changes to tax relief for landlords mean that some are now choosing to reduce their portfolios, meaning there may be rental properties for sale with room to negotiate – but you would then have to face the new tax barriers, such as the removal of mortgage interest tax relief, yourself.

Given the low supply of housing and difficulty getting onto the ladder for many aspiring homeowners, buy to let has begun to feel a bit exploitative of late (read our blog on the ethics of buy to let here). It’s up to you, of course. And there are certainly some moral arguments in favour of increasing the supply of affordable rental stock. But personally, we prefer the stock market.

Cut your cloth

-

Impossible to argue with this one and it’s totally obvious, but if you can reduce your unnecessary outgoings, now’s the time. Subscriptions, posh booze, the gym… whatever your spending achilles’ heel, you’ll ride the inflation wave much more successfully if you offload the unnecessary baggage.

Sell some things on eBay, Shpock, Gumtree, wherever

- If prices are rising, that’s your cue to switch into “sell” rather than “buy” mode. If you have anything to sell, that is. Selling things online is now incredibly easy and with inflation rising, there’ll be more bargain hunters about looking for second hand items, too. Turn that chore of getting rid of things into a money spinner by writing nice descriptions and taking good photos before you sell. If you don’t, this tip is just annoying. But the run up to Christmas is a great time to do it – you clear a space for new stuff and earn some much-needed readies.

Switch to a cheaper (preferably renewable) energy supplier

If energy prices are rising, this will push up the price of all tariffs, regardless of whether the supply is renewable or fossil fuel. However, renewable energy tariffs are less susceptible to big price changes because they are not as directly affected by things like the changing oil price. 100% renewable energy suppliers such as Good Energy and Ecotricity tend to demonstrate more price stability. Bulb is a new supplier on the block that is powered by three hydro stations in Wales and is at the cheaper end of the tariff spectrum. You can get £50 credit if you use this special link when switching to them (full disclaimer, we do too. But we’re happy to earn money from Bulb as they are a fully fledged value with values supplier).