Treat managing your money like skiing. Don’t be afraid to face downhill and execute that flawless turn = don’t be afraid to own up to your deepest financial fears and resistances to develop a smoother, more satisfying relationship with money.

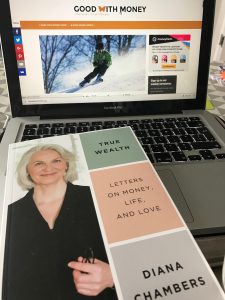

That’s the advice of Diana Chambers, a family wealth mentor and philanthropic adviser. Her new book, True Wealth: Letters on Money, Life, and Love, aims to get to the heart of how we feel about money and show us how to be truly wealthy.

We asked Diana to pen some words on our relationship with money for our MIND AND MONEY series.

“For many years, I lived and worked in the United States and didn’t like to return to the United Kingdom to visit my family. Every time I came home, I was expected to visit my sisters’ houses and be happy for them, admiring all the new and beautiful items they’d purchased since my last visit. Meanwhile, I was working in the inner city for a charity on a subsistence salary. I had to remind myself time and again that I was rich in things that were a priority for me: community, meaningful work, purpose, and passion.

“Envy is a powerful, toxic emotion. It skews your vision. The antidote is to recognise what you have in abundance, not what you lack.

“The ability to reframe a challenging situation is a valuable skill; whether you’re feeling comfortable about living within your budget or struggling to manage your finances it can help if you re-frame the way you think about money. Write down all the things in which you are rich, whether it’s the love of your family, good health, independence or the freedom to travel. Ask yourself what gives you most satisfaction, including activities which cost little or nothing, whether it’s a walk in the country or a night catching up with an old friend on the phone.

“Another question to ask yourself is, ‘How much is enough?’ Explore the level of expenditure that’s right for you. Once you’ve done that, you can put limits on your choices that don’t leave you feeling deprived. But it’s only achievable if you stop comparing your circumstances to those of your friends; by staying focused on your own reality, you can find the level that’s right for you, even if it means choosing not to go out for a meal with friends you know will insist on buying the most expensive Chateauneuf-du-Pape on the wine list.

“Many of us make the mistake of thinking that to manage our finances effectively we simply need good financial IQ: tracking spending against income, saving, understanding how to invest, and doing effective tax planning. In reality, our financial emotional intelligence (EQ) is equally, if not more, important. Financial EQ is understanding our relationship to money and being able to talk about it honestly and openly with others who may have a very different perspective on money. It’s an invaluable skill, whatever our level of income.

“Most of us don’t find such conversations easy, but rather than inventing an excuse to avoid an expensive night out with friends it’s better to explain why you’re not joining them on this occasion. While those conversations might cause some awkwardness there’s also the possibility that your willingness to be honest and vulnerable will deepen your friendships.

“Money and material possessions may be inhibiting rather than facilitating your relationships. Once you’re clear about your relationship with wealth, you are no longer a pawn to your financial desires. A useful experiment is to try going a whole day without spending a single penny. It’s hard, but highlighting what you find difficult to stop doing is a good way to confirm where you’re most hooked and would benefit from setting effective limits.

“One of the pitfalls for today’s twenty and thirty somethings is an addiction to technology, which may result in a compulsive need to buy all the latest gadgets. In my new book, True Wealth: Letters on Money, Life, and Love, I describe a self-confessed tech addict who always visits the Consumer Electronics Show in Las Vegas and buys himself the latest ‘boys’ toys’. But when his son admitted that he played with very few of the toys his parents had bought him, it made the father realise that only a couple of the hundreds of gadgets he’d bought himself over the years held his attention at any one time. He realised it was time to declutter – they were no longer a treat and were providing little material pleasure.

“A good way to deepen your money awareness is to write your money autobiography. Ask yourself a number of questions to better understand better your relationship with money – questions that will get to the core of what shapes your relationship with money so you can decide whether you want to continue in your current path – maybe you’re primarily motivated by the fear of losing money – or whether you want to choose another perspective.

“When you’re skiing and trying to turn on a steep slope you need to face downhill in the middle of the turn. This can be frightening, especially for a beginner, until you internalise the move and realise it’s the only way to execute a flawless turn. Owning up to your deepest financial fears and resistances might feel the same at first, but it will eventually lead to a smoother, more satisfying relationship with wealth.”