If the nation isn’t saving enough, which it isn’t, the Government’s latest favoured response is to throw another ISA at the problem.

Nevermind trying to tackle rising living costs, reduce taxes or promote wage growth, what people really need is another type of tax-free savings vehicle. What’s that you say? Interest rates are too low? Well, let’s chuck in a government top-up, too, then.

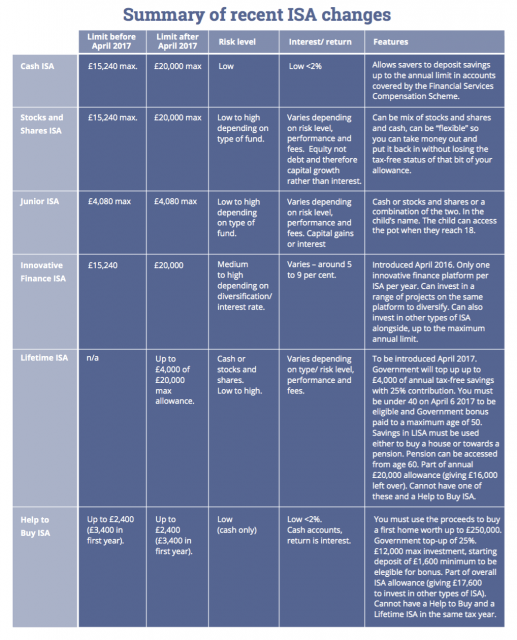

It’s easy to be cynical about the launch of the Lifetime ISA, which enables savers over 18 and currently under 40 to save up to £4,000 a year tax-free in either cash or stocks and shares and to get a 25% bonus from the Government too, but only if they use the cash for a first home or retirement. The bonus is paid up to age 50, so an 18 year-old saving the full amount for the full term could get £32,000 for free. If you are saving for retirement, though, you can’t actually access that money until age 60 and if you try, there are steep penalties.

In particular, it’s easy to be cynical because it looks uncannily like a back-door way to try to patch up the gaping hole in pensions by giving people free money on savings, in a more understandable way than the tax relief on pensions. Possibly even, ahem, replacing costly and burdensome pensions altogether at some point in the future, should we find, as is likely, that people STILL don’t have enough to live on in old age, even after measures such as auto-enrolment.

The best things in life aren’t free, and this “free” Government money comes at one price: discipline.

Also, the restrictive terms have attracted criticism because they could catch people out. For instance, if you access the money before you are 60 for any purpose other than buying your first home, you lose 25% of whatever you have saved up to that point. Pretty harsh. But what’s wrong with a bit of harsh?

The idea is to provide both a stick and a carrot to get people to look after themselves when they retire – the loss of the bonus being a pretty hard stick for those who experience some misfortune and find they have no choice but to tap into the savings they’ve been making. It’s not so harsh, however, that it won’t allow you to take out funds if you have a terminal illness.

The scheme has been criticised because there are no cash options currently available. However in many ways, it is less suitable for cash accounts, because over the long term, with interest rates as they are, inflation is likely to erode the value of deposits, so that the ONLY gain to cash LISA savers would be the government bonus. Imagine if they broke the conditions and lost that too? Yes, mis-selling scandal – because you could have millions of savers in negative real returns territory.

The deepest cynics will note that the LISA is yet another way to enable people to afford housing that is fundamentally too expensive by giving them “free” taxpayers’ money (theirs anyway, ultimately) with which to do so. Not to mention encouraging people to treat property as a pension by viewing the two aims as on a par. The limit on the home value is £450,000, which goes to show the Government’s expectations of first-time buyer house prices.

Oh, and, if you give people all these options and they STILL don’t save, it’s their fault, right? Not the fault of an economy in piles of debt, using the shaky foundation of consumer spending to prop it up.

Providers seem to be cynical too, as so far only four have signed up to offer it and all of these are offering the stocks and shares option – sensible for long-term saving but out of the comfort zone of many savers who prefer the normality of cash to stock markets: Hargreaves Lansdown, Nutmeg, Scottish Friendly and the Share Centre, are those willing to embrace the new ISA so far.

Yet, despite these multiple, totally valid criticisms of the scheme and despite the shyness of providers in coming to the market with an offer, I will personally be investing in a Lifetime ISA right away.

Why? Because I invest in a stocks and shares ISA anyway for the long term, so why not boost my returns with a further 25%? Total no-brainer. Indeed, for anyone hoping to start investing or to invest more for “the long-term” be that supplementing pension savings (note, not replacing them – not a great idea), or having a pot of extra cash for whatever purpose after the age of 60 – perhaps as a safety net so you aren’t tempted to draw down your pension in one go, it makes total sense. Yes, there are restrictions, but so what? The best things in life aren’t free, and this “free” Government money comes at one price: discipline.

Neil Lovatt, commercial director at Scottish Friendly, says: “It’s such a shame that the most of the industry is neglecting what could be the answer to the fatally damaged brand of pensions in the eyes of those under 40. However given the speed of the rest of the industry to adapt to change, I suspect much of the criticism is a cover for lethargy in product development rather than genuine opposition.”

Why I’ll be all over the Lifetime ISA

I will start saving into a Lifetime ISA from this week, as Hargreaves Lansdown*, the platform I currently use to invest my Stocks and Shares ISA, has started to offer it.

I will start saving into a Lifetime ISA from this week, as Hargreaves Lansdown*, the platform I currently use to invest my Stocks and Shares ISA, has started to offer it.

Fundamentally, it serves my savings needs and the bonus is, to be frank, whopping. It won’t replace my pension savings – they are separate, but it will certainly come in handy.

My plan is to put £200 a month into this Lifetime ISA every month until I am 50. I can simply adjust my existing direct debit. I can still choose funds I like for the Lifetime ISA and I’ll be sticking with WHEB Sustainability.

If I stick to this plan, I will contribute £36,000 by the time I am 50, earning £9,000 from the Government, plus if I am lucky, 5 per cent-ish a year on returns. Using the Nutmeg calculator suggests a total pot worth £93,250 at age 60, or £56,838 adjusted for inflation.

How to get a Lifetime ISA

Is a Lifetime ISA for you? If you have enough to put aside every month, say £100 or £200 maybe (or the maximum would be £333 a month) and you a) want to get on the housing ladder or b) want to take control over your retirement income once and for all, then it is worth considering.

You also have to be comfortable with stocks and shares (you can check out our stocks and shares ISA guide, sponsored by EQ Selftrade, for the basics), because it looks like this will be the only option for the foreseeable future.

Stocks and shares aren’t as scary as they sound and if you are young, ironically, that’s the best time to put your money somewhere a little more risky, as there are more years ahead of you for years of good performance to outweigh the bad. And stocks and shares have outperformed cash over most five-year periods.

It’s worth noting that Hargreaves Lansdown is the only platform so far to allow LISA investors a choice of funds – the others offer portfolios that they have put together, based on your risk profile.

Want to use it for a first home?

The property you want to buy must cost less than £450,000. You can save into both a Help-to-buy ISA and a LISA but you can only use the government bonus for one of them.

Considering it as a retirement pot?

Great news, good for you. You have to be clear, though, that you are definitely only putting aside cash that you will not need for any other purpose. This IS NOT a rainy day savings cash ISA. You do not want to even think about this money in the event of an emergency until you hit 60. It would be a good idea to continue to pay into a rainy day instant access fund as well, so that if something does happen, you are not tempted to go near your LISA.

A bit on the platforms….

Nutmeg*

Nutmeg is one of the biggest robo-advice platforms and offers different portfolio strategies depending on things like your age and risk appetite. It then uses a bunch of clever algorithms to do the legwork for you and select appropriate funds. Nutmeg has reduced its minimum investment to £100 for LISA investors, to encourage regular, monthly long-term saving.

Hargreaves Lansdown*

The Grandaddy of investment platforms, Hargreaves Lansdown is the only platform that offers you the option to select the funds you want to invest your LISA money into – we like this because it means we can choose funds with environmental and social goals as well as profit goals, such as those from WHEB, Impax and Alliance Trust Investments. There’s a £50 a month minimum, but investment fees are higher than with Nutmeg, which can eat into returns.

Want to do some sums? Try this ISA tax benefits calculator (does not include government top-up).

Scottish Friendly

Scottish Friendly, which allows deposits of just £10 a month, has come up with a clever way to overcome the problem of people not understanding the restrictions at first. By using its existing “My Choice” Stocks and Shares ISA option when a new investor opens an account, people can save as normal before moving this money into a Lifetime ISA when they feel ready. Scottish Friendly says they won’t miss out on the top-up this way, as they will still get the government bonus when they move their savings across to the Lifetime ISA wrapper.

It’s a mutual organisation, which means it is owned by customers and not shareholders and therefore operates fully in the interests of customers.

Share Centre

The Share Centre is an investment platform that focuses on customer service. It will offer “ready-made” Lifetime ISAs, so you won’t be able to pick your own funds. A bit like Nutmeg, these choices will be cautious, positive or adventurous, based on your risk appetite.

What about other ISA options?

If you fancy an Innovative Finance ISA investing in peer-to-peer lending to businesses, then great -the returns are usually higher than cash and the risks usually lower than stocks and shares. Unfortunately, the IFISA platforms are not offering a Lifetime ISA option, yet. Read our IFISA guide.

This post contains “affiliate” links to Hargreaves Lansdown and Nutmeg, which means Good With Money is paid for new customer referrals by Hargreaves Lansdown and Nutmeg.