Everybody’s talking about green bonds. From a piddly market of just $5 billion (£3.85 billion) in 2012, the value of new launches into global markets topped $247 billion last year according to Bloomberg – a rise of more than 4,000 per cent in six years. That’s right: 4,000 per cent. Phew.

But what are green bonds? Well, like a regular bond, a green bond is debt: it’s a loan that a company or government has taken out to finance a project, promising to pay lenders a fixed interest rate in return. For example, 5 per cent a year (if you’re lucky).

With green bonds, though, the money will be exclusively used to make the borrowers more environmentally friendly. Whether that be improving energy efficiency, installing renewable capacity or reforesting: to be green the bond needs to be saving the planet.

To be green, the bond needs to be saving the planet

It is little surprise, then, that this market is exploding. With climate warnings coming thick and fast since the historic UN Climate Deal in Paris in late 2015, governments and corporates alike are waking up to the urgent need to decarbonise and transition to a clean, green and safe global economy.

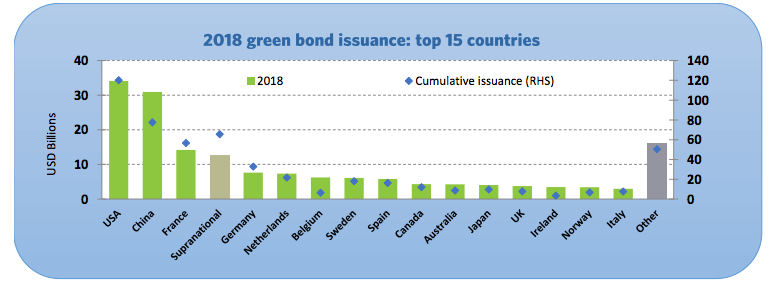

Europe is leading the clean debt charge, with close to 60 per cent of all green bonds issued last year coming from the continent, according to data from the Climate Bonds Initiative (CBI). Asia is fast catching up, though with China issuing raising more than $31 billion for green projects in 2018 – making it the third largest issuer.

Unfortunately, the UK is one of the world’s laggards, with us Brits issuing less than $10 billion of green bonds last year. This is despite a lot of talk at the Bank of England, with Governor Mark Carney laying out ambitions for London to become a leading light in the sector back in 2015. To be fair, though, he’s had a bit on his plate since then…

Shades of green

While this is unquestionably great news for the planet, the growth of green bonds is also pretty awesome news for everyday investors, too, with a raft of new investment funds launching over the past few years that allow you and me to tap into this burgeoning mega-market.

These include the Mirova Euro Green & Sustainable Bond and Allianz Green Bond, launched in 2013 and 2017 respectively and which are rated 3 stars for sustainability by 3d Investing. (For the full list of 3d rated funds see the Good With Money Good Investment Review).

The concept of investing in Good debt is not new, though: indeed a number of highly rated and long standing funds have been doing it for a while. These include the Liontrust Sustainable Bond fund, which was launched way back in 2001 and Rathbone Ethical Bond – a fellow stalwart of the sector since 2002.

All green bonds will help the environment, but they might not all be ethical

The difference with these funds, though, is that they don’t invest in just green, or environmental, bonds. Rather, they buy up the debt of companies that are doing a number of Good things based on different investment criteria.

Manager of the Rathbone fund, Brynn Jones, explains why this is an important distinction and one which investors should consider before plumping for the first green bond fund they see:

“All green bonds are going to be aimed at helping the environment, but they might not all be ethical. For example, a company that tests on animals might issue a green bond. That might be great for reducing its carbon footprint, but it still wouldn’t make it into our fund. The same for tobacco companies.”

Jones’ fund is a good option for those looking for a more rounded ethical approach to bonds. It is also a strong long term performer, returning nearly 30 per cent (excluding fees and charges) over five years to 18 February, making it the 18th best fund in a mainstream sector of more than 80.

Peer-to-peer green bonds

If you want only green AND only Good, luckily the peer-to-peer bond space is here to help. Led by trailblazers Abundance Investment, Ethex, Downing Crowd and Triodos Crowdfunding, this space has grown from £1m in 2012 to over £150 million today, according to Cambridge Centre for Alternative Finance.

Listed green bonds lack the tangibility and direct impact of investing in a specific project

Peer-to-peer issuers like those mentioned above give investors access to small scale, community renewable energy projects. With investments as low as £5, these are eligible for inclusion inside the Innovative Finance ISA and can be a good diversifier for any portfolio. They are high risk, though, and so investors shouldn’t throw everything in.

Bruce Davis, founder of Abundance Investment, says: “Listed green bonds are backed by either financial assets (loans which lend to certified green projects) or corporate programmes of investment and so lack the tangibility and direct impact of investing in a specific project or business via crowdfunding.

“Investors need to balance the need to diversify their risk versus the desire to see their money do some real good in the world, which they can measure for themselves.”

For more on investing in peer-to-peer green bonds, see: ‘How to Invest in Renewable Energy Bonds’

Sustainable and SDG bonds

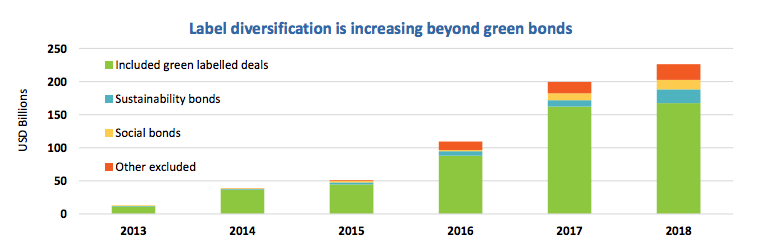

A new area to watch includes bonds linked specifically to the attainment of one or more of the UN’s 17 Sustainable Development Goals (SDGs). According to the CBI, this segment of the market grew an astonishing 114 per cent between 2017 and 2018, with $21 billion worth of new launches last year alone.

“The labelled bond market has expanded beyond green bonds. Sustainability and social bonds have been around for a few years now, but they really came into their own in 2018, with SDG bonds also emerging,” says the CBI.

However, the body warns that this is a complex area. While CBI reports very clearly on green bonds, which are easier to define, this segment of the market is a little murky, with little definition around what makes a sustainable or social bond.

Jones concurs, adding that as the green bond sector expands at such a rapid rate, it is potentially at risk of ‘greenwashing.’

Nonetheless, it is an exciting time for green bonds. As in the wider sustainable money market at large, the rapid and large scale adoption of climate finance is a decided reason to be cheerful: both for the planet, and our wallets.