The Individual Savings Account, or ISA, is a tax free savings account introduced by the UK government in 1999 to encourage more Britons to start stashing their cash for the future. It’s tax free status makes the ISA far and away the best way to save here in the UK, while the many additions to the ISA stable over the years has made it one of the most diverse savings products available to everyday savers and investors.

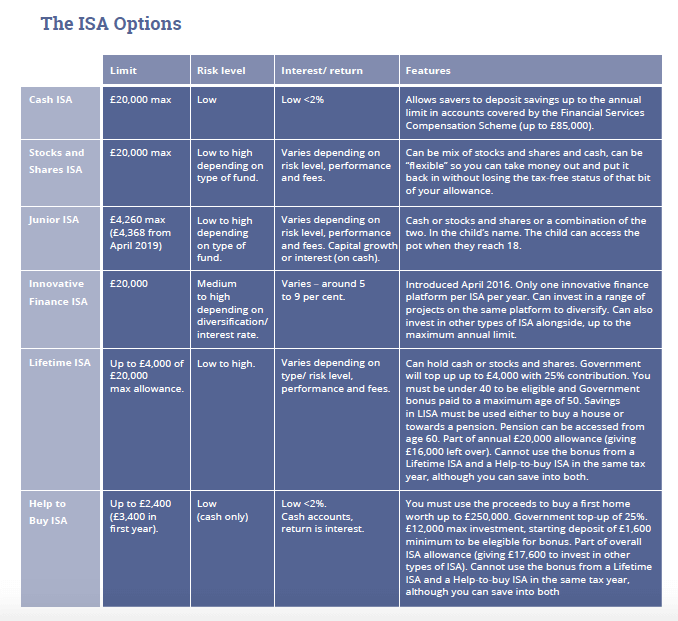

The total amount that you are allowed to save into an ISA every year – otherwise known as the annual allowance – is currently £20,000 and can be split in any-way across all of the different ISA products. The tax free status applies to the interest, or growth, on your savings, which stay free from tax as long as the money stays in the account – whether that be months or years.

For example, if you deposited £20,000 into a cash ISA paying 1.5 per cent interest at the beginning of one tax year, the following year you would be paid around £300 in interest (the interest will be lower if you saved the £20,000 slowly, month by month) and this will be tax free.

The tax free savings allowance

There is an important point to note when talking about ISA’s and tax, however. In the UK, basic rate income tax payers (those that earn up to £50,000 per year) get a £1,500 tax free savings allowance, no matter what savings account they are using. For cash savers in our current low-rate world, this means you need quite a big savings pot for the ISA’s tax free status to be beneficial.

For example, to earn £1,500 in interest over one year in a cash account paying 1.5 per cent, you would need a total savings pot of at least £100,000.

Why ISA’s matter

This is not the same for everyone, though. Higher rate tax payers (those earning more than £50,000) have a lower savings allowance that shrinks the more they earn, while higher rate tax payers (those that earn more than £150,000 per year) have no tax free savings allowance at all.

Moreover, if you happen to be earning a higher rate of interest – perhaps on a peer-to-peer bond in an Innovative Finance ISA (more on that later) – you won’t need so much in your pot to hit that £1,500 threshold. Indeed, if your investment pays 6 per cent a year, you’ll be earning £1,500 on just £25,000 of savings.

Even for cash savers, though, eventually you will have a fairly big pot (while interest rates migh, MAYBE also go up one day) – and so unless you want to start paying your personal rate of income tax on everything you make above £1,500, then you’re going to want to stash that cash in an ISA.

No mater how you save, though, saving as much as you can as early as you can in the tax year is powerful tool, with online investment platform Interactive Investor recently revealing that those that invest the maximum ISA allowance at the start of the tax year rather than the end could earn £33,000 more over 20 years.

Cash ISA

Despite record low interest rates, by far and away the most popular form of ISA in the UK is the Cash ISA, with HMRC reporting that more than 8 million Brits had an active cash ISA in 2017. Cash ISAs are everywhere – you can open one with pretty much any bank or building society in the UK, as well as through online investment platforms and more.

Rates vary depending on how long you are willing to keep your money locked up, with rates on easy access accounts varying between 0.5 per cent and 1.5 per cent a year, while more than 2.5 per cent is available if you are willing to deposit a lump sum and not make any withdrawals for two or three years.

Stocks and Shares ISA

Introduced around the same time as the cash ISA, the stocks and shares ISA allows savers to invest their hard earned cash into companies and investment funds. As these are investment products, there are no set rates of interest – instead gains are referred to as capital growth, or dividends if you get a regular payment from a share or fund.

As growth rates vary enormously depending on what kind of year stock markets are having, keeping your investments tax free inside an ISA is extra important. If, for example, markets have a storming year and your shares in Marks and Spencer grow by 60 per cent (as they did in 2009), you will smash through that savings allowance pretty quickly.

You can open a stocks and shares ISA with some banks, though the best option is usually to go through and online investment platform. You can check out our guide to platforms here, but a good rule of thumb is to always pick the cheapest for you pot size and needs as over the long term, fees and charges have the biggest negative impact on returns. Check out the Good Guide to the Stocks and Shares ISA for more.

Junior ISA

Introduced in 2011, the Junior ISA – or JISA – was the first addition to the now bulging ISA product line and allows parents to save up to £4,368 per year for their children, tax-free in cash or investments split anyway they like. As the money is for your child, and not you, it is not included within your annual savings allowance, making this a great tax efficient savings tool for parents.

Your child is, however, legally entitled to everything in the account once they turn 18 and so you instill some financial sense into her before she comes of age. As fun savings kicker, from the age of 16 to 18, your child is allowed both the annual JISA allowance PLUS the adult £20,000 allowance – making for two years of bumper tax-free savings.

Help to Buy ISA

In 2015 the UK government introduced the Help to Buy ISA (cash only) to help young people get into an increasingly steep housing ladder. Savers are allowed to deposit up to £12,000 total and the government will top this up with by 25 per cent (so £3,000 if you save £12,000) as long as the funds are used only to purchase a new home.

This, along with the government’s accompanying Help to Buy Scheme has in reality simply inflated the price of first-time homes, with participating house-builders charging around 15 per cent more. You also don’t get the bonus until after you have purchased the home, meaning the money in the ISA can’t be used for a deposit – which was kind of the idea.

Lifetime ISA

The Lifetime ISA, launched in 2016, is a dual function product. Savers can use it to fund the purchase of a first home (it will replace Help to Buy from 2019), or they can use it to fund their retirement. You can save up to £4,000 into a Lifetime ISA and again, the government will top this up with a 25 per cent annual bonus – again provided the money is used for one of the two life events. You can hold cash or investments.

If you are using it to fund your retirement, you need to be less than 40 in the tax year that you open it, and the government will pay the bonus up to the age of 50 (so for ten years maximum). You can access the funds from the age of 60 – which is currently five years above the age you can access other private or workplace pension pots.

The big bonus is – again – the tax free status, with LISA withdrawals free from income tax, unlike pensions. For more on Pension vs. LISA, click here. Savers cannot use the bonus from a Lifetime ISA and a Help-to-Buy ISA in the same tax year, although you can save into both.

Innovative Finance ISA

The latest addition to the ISA family, the Innovative Finance ISA, or IFISA, allows savers to invest in peer-to-peer bonds through crowd funding platforms for typically quite high rates of interest – around 6 to 10 per cent. They are particularly interesting to Good investors, as many community and larger scale renewable energy projects can be invested in through an IFISA, as well as social impact projects (check out Ethex for examples).

Bonds held in an IFISA are, however, very high risk – about as highest risk as you can get. This was underlined by the recent collapse of London Capital & Finance. So don’t be duped into thinking you can compare it with cash – you can’t. Having said that, this is a great way for every day saves to support truly innovative, game changing projects and UK small businesses. To find out more, check out the Good Guide to the IFISA.