Often, when we talk about being Good With our Money, the first question people ask is about their bank: specifically, whether or not their bank is evil and if it is, who should they switch to. The answer to both questions is pretty straightforward, while also being a little grey and hazy around the edges.

This week labour pressure group Momentum and People and Planet have made headlines with their campaign against Barclays Bank, the UK money house throwing more at the fossil fuel industry than any of it’s British peers.

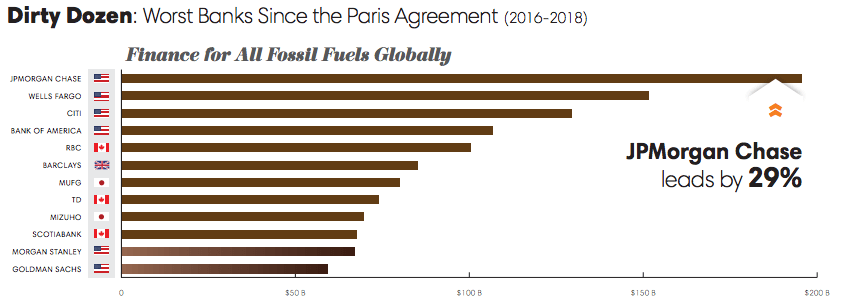

According the the latest report from Banktrack.org, the UK bank has poured more than £65.6 billion into the fossil fuel industry since the Paris climate agreement in 2015 – placing it sixth IN THE WORLD for investment in carbon energy. As such, if you care about climate change then Barclays is absolutely not your huckleberry.

Similarly, HSBC likes to sign on the dotted line for fossil fuel investment – particularly for coal expansion in developing Asia where tens of thousands of people die every year from nothing short of catastrophic air pollution. It ranks number 13 in the Banktrack report thanks to investment of nearly £45 billion in fossil fuels over the last three years.

The other UK banks in the top 33 are Santander (£11.6 billion) and RBS (£3.2 billion) however; both of these are doing good work on scaling back and implementing policies to stop investment in carbon energy, especially RBS.

(As a side note, UK banks are small fry compared to their American cousins with JP Morgan Chase ranking as the world’s biggest investor in fossil fuels by a country marathon: £151.4 billion since 2015. Wells Fargo, Citi and Bank of America closely follow.)

Source: www.banktrack.org

Consistent corruption

Literally none of the UK banks mentioned above, however, fair well in the corruption department. In 2012 Barclays, for example, was forced to cough up £60 million in the LIBOR rigging scandal and then £72 million in 2015 for some seriously shady transactions involving unnamed ‘politically exposed persons’.

More recently former chief executive James Staley took a £650,000 hit for trying to expose a whistleblower. And then there’s the gold price fixing scandal of 2014 and too much stuff to list during the financial crisis. Just Google ‘FCA fines Barclays’, and you’ll see what we mean.

HSBC, though, arguably knocks Barclays out of the park in this department, with the bank forced to hand over an eye watering £1.4 billion to the US Department of Justice in 2012 for allowing Mexican and Columbian drug cartels to wash nearly £695 million of drug money through its accounts.

Then of course there is the tax evasion case at the Swiss branch that seems to get passed around regulators and governments like a hot potato. While taking down Mexican drug lords is fair game, exposing who hasn’t being paying their taxes in Switzerland seems less appetising to world leaders. Funny that….

Then there’s RBS. Oh, RBS: the UK’s main batter during the global financial crisis. After being bailed out by the UK government to the tune of £45.5 billion for some of the dodgiest lending this side of Belmarsh (the UK tax payer isn’t getting that back, by the way), the bank was still caught red handed giving questionable mortgage in 2014 (for which is received a £14.5 million fine).

Last year an ex RBS trader was also slapped with a £250,000 fine for his involvement in the LIBOR rigging scandal (scapegoat, anyone?).

And Santander? Well, in one of the bank’s more bizarre recent fines, it was slapped with the largest FCA penalty of 2018 – £33 million – for failing to pass on the money of its dead customers to their beneficiaries.

Switch your bank, feel better

So in short, the answer to the question ‘is my bank evil?’ is usually – if you are with a big bank – yes. Yes it is probably evil. As was demonstrated in 2008, these global megaliths of money have become too big, too powerful and too inscrutable. A knotted mess of vast ambition, mis-management and just too many people to keep an eye on means not even Jesus could fix them – probably.

Luckily, you have options. On the high street both the Co-Operative Bank and Nationwide are pretty clean (as it goes). They consistently make our top five for current accounts, as well as those of Ethical Consumer and the Good Shopping Guide. As well as not being (at least) overtly evil, both have strong ethical and social policies in place about where they invest their money.

The Co-Operative is, it’s true, still struggling under the weight of the 2013 scandal that saw ex-chairman and vicar Paul Flowers sacked for his penchant for horse tranquilliser and hookers (earning him the moniker ‘the crystal methodist’) while it is also now owned by a US hedge fund. However it remains better than the big five.

The greenest of them all, though, is Triodos. This social enterprise bank started out with savings products, however it launched its current account in 2017 and is going from strength to strength and now also boasts investment funds as well as a crowd-funding platform.

By virtue of being too small to be too evil, the digital challenger banks are also a good choice for those looking to switch. The undisputed leader in the space is Monzo, however coming up the rear is Starling Bank – which is rated highly for its interest bearing current account – as well as Revolut.

These challengers have nifty little features too, including in-app budgeting tools that help you to see exactly what you are spending your money on and where you can afford to save a little, with some automatically syphoning that off into a savings account should you so wish. It is also very easy to open an account with them – you can do it from the sofa.

And so, the Good news is: if you want to stop funding fossil fuel expansion and rampant corruption, you absolutely can. Thanks to the move your money campaign, it’s also not that hard. Like all admin it’s not fun, but it’s not hard.

It’s also well worth it because, while coal fired power stations in China and international exchange rate-rigging bankers may feel very far removed from our day-to-day lives: they’re doing it – and paying for the hefty fines – on our pound.