It can be easy to forget that where we keep our money has consequences far beyond our own saving and spending potential.

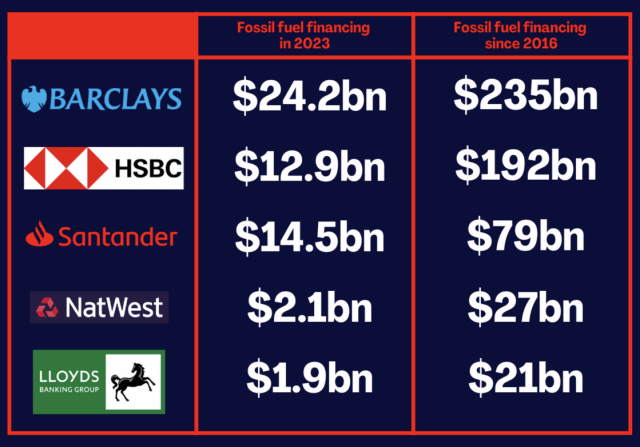

Research shows that the UK’s ‘Big Five’ banks – HSBC, Barclays, Santander, NatWest and Lloyds – are still pumping BILLIONS into fossil fuel projects. This is despite them having made net zero pledges.

A campaign from Make My Money Matter reveals that in 2023 alone, these banks provided more than $55 billion (£41 billion) in finance to oil and gas companies to help them expand. If you are a customer of these banks, you have the power to create meaningful change.

One of the most significant things you can do as an individual to fight climate change and help create a better, safer, more sustainable world is to move your money to a provider that shares your ethical values.

Ethical banks and building societies avoid investing in environmentally harmful or otherwise unethical industries. A minority – such as Triodos Bank – go much further by proactively investing your money to make a positive impact on the planet and society.

The Current Account Switching Service takes care of transferring all your direct debits to your new account and closing your old one, so it’s easier than ever to move your money for Good.

These seven providers rank highly on the ethical stakes.

1. Triodos Bank

Triodos Bank, a B-Corp company, sits firmly at the top of our list of ethical current accounts. Founded in 1980, Triodos champions a new way to do finance that’s good for people and planet. It believes that banks should be an active source for good and will only lend your money to organisations that are committed to making a positive social, environmental or cultural impact.

Sectors Triodos invests in include renewable energy, sustainable farming, education, charities and social housing. You won’t find it investing in fossil fuels or other destructive industries such as fast fashion, weapons, tobacco or deforestation.

The bank publishes a map with details of each investment it makes on its website in the name of total transparency.

Find out why Triodos is a Good With Money ‘Good Egg’ company

The Triodos mobile banking app allows you to monitor your balance and spending, including alerting you when you’re down to your last £100; when you have insufficient funds to make a payment and can help keep track of your daily card use at home and abroad.

Its contactless debit card is made from a recycled plastic that has the lowest possible carbon footprint and environmental impact.

Triodos was granted a UK banking license in 2019, so current account holders’ assets are protected under Financial Services Compensation Scheme (FSCS), which covers up to £85,000 per person.

Triodos has achieved ‘Best Buy’ status for its personal current accounts from Ethical Consumer magazine – the only bank to do so – alongside joint Best Buy status for its savings accounts. It is also a Which? ‘Eco provider’.

In first earning its Good Egg mark in 2018, Triodos was rated as making a ‘high impact’ in all areas, a high bar it has maintained every year since.

There is a £3 monthly for its current account, which Triodos says is “the cost of a fair trade coffee”. It says: “Most banks fund free accounts with hidden costs and high overdraft charges – often with financially vulnerable customers footing the bill. We don’t think that’s right or fair.”

However, Triodos does not offer an arranged overdraft.

2. Nationwide

As Britain’s biggest mutual, Nationwide says “the fact that we are owned by our members and run for their benefit, makes us fundamentally different from our big competitors.”

The building society – another Which? ‘Eco Provider’ – continues to offer a competitive package for those looking to switch their current account. Its FlexPlus current account comes with an £18 fee. If you make use of the free insurance that comes with it (the travel, mobile and Europe-wide breakdown insurance could be worth more than £500 a year in total), it’s still an attractive option. Having a FlexPlus current account also gives you access to exclusive savings rates for Nationwide members.

Nationwide also offers a FlexDirect current account, which has no monthly fee and comes with an attractive five per cent (AER) interest on balances for the first 12 months on balances up to £1,500 before reducing to 0.25 per cent (AER). There is also one per cent cash back on debit card spend and a £50 interest-free overdraft buffer.

To qualify for this account, you must pay in at least £1,000 per month. You’ll pay no overdraft interest for the first 12 months, followed by a steep 39.9 per cent (as with all its current accounts) so it pays to stay in credit.

The society discloses the carbon emissions associated with its mortgage, commercial real estate and registered social landlord lending, and has set science-based targets to reduce all three. It says: ‘We have committed to playing our part in the transition to a net-zero future. This is just one of the ways we demonstrate our mutual difference.’

In June 2024, Nationwide gave millions of its members £100 each for the second time as part of its unique reward scheme. And in April 2025, it gave an additional £50 each as a ‘thank you’ after it bought Virgin Money.

However, the building society has been criticised by Ethical Consumer magazine for excessive remuneration of its top staff. In 2024, its highest paid director was paid over £2.4 million. It also has a low customer service score of 1.9 on Trustpilot, with customers citing long waiting times and unhelpful staff.

The UK’s most ethical banks and building societies

3. The Co-operative Bank

The Co-operative Bank was bought by Coventry Building Society for £780 million in May 2024.

Both organisations will continue to operate under their current names and branding while they are integrated, which is expected to take several years. Eventually, Co-operative Bank customers will be migrated to become Coventry society members. Coventry – the first B Corp building society – does not offer its own current accounts.

The deal means Co-operative Bank will return to a mutual structure, where it is owned by individual members rather than shareholders and investors like most UK banks.

This is positive news following years of uncertainty over the bank’s ethics. In the 2010s, the Co-operative Bank got itself into deep financial trouble which led to it becoming fully owned by private equity, including hedge funds. Hedge funds often use tax havens and are lightly regulated with limited transparency.

Despite ownership obstacles, the Co-operative Bank has stood by its ethical policy since 1992. This means it doesn’t lend to companies that don’t fit with its values, so it doesn’t do business with the oil, coal or gas industries.

The bank’s standard current account is free and you can earn up to £2.20 a month in rewards. If you are looking for extras alongside your current account then its Everyday Extra account is a good choice. In return for £15 a month you’ll get mobile phone insurance, worldwide travel insurance and UK & European breakdown cover. Just make sure you aren’t doubling up on insurance you already have elsewhere.

The Co-operative is another ‘Eco-provider’ with Which? – it was applauded for its “high ethical standards for the businesses it offers services and finance to, most of which are small and medium-sized”.

It sets high ethical standards for the businesses it offers services and finance to, most of which are small and medium-sized. It excludes firms involved in the exploration, extraction or production of fossil fuels, and the unsustainable harvest of natural resources. Its ethical review process includes parent companies both in and outside of the UK.

4. Cumberland Building Society

The Cumberland is a building society based in Cumbria. It offers current accounts, as well as mortgages and savings accounts, to customers living in Cumbria, South West Scotland, West Northumberland and North Lancashire.

It does not invest its members’ money in stocks and shares, so many of the issues normally associated with ethical investment do not apply to it. It says on its website: “We don’t make direct investments in stocks and shares and we do not provide funding for fossil fuel projects or companies. Furthermore, we don’t invest your money outside the UK.”

The Cumberland’s Kinder Kind of Kitchens initiative, in partnership with Fareshare Lancashire and Cumbria, supports people across Cumbria and Lancashire to overcome food poverty.

The Cumberland Plus Current Account has no monthly fee and the interest on an arranged overdraft is 14.99 per cent (EAR variable), which is low compared to its competitors. To be eligible, you must pay at least £750 per month into your account (you will be charged £2 per month if you don’t meet this). Note that you will only be considered for an arranged overdraft once your account has been active for at least six months.

Cumberland also offers a Freedom Apprentice Current Account, designed for young people on apprentice schemes, and a Day2Day Account, which has no overdraft facility and no amount of funding required for younger people.

The Good Guide to Financial Planning 2025

5. Starling Bank

Starling – voted ‘Best Banking App’ at the British Bank Awards 2024 – offers 3.25 per cent variable interest on its personal and joint current accounts. (up to balances of £5,000).

Its multitude of app features make banking and managing your money easy, as well as more environmentally friendly.

Starling says it expressly avoids “directly” funding fossil fuels, mining, arms and military, and instead invests in “government securities and other high quality liquid assets”. It adds: “We invest your money on supranational bonds and securities backed by UK residential mortgages. These investments are to support the Bank’s liquidity. We carefully consider who we invest in, taking into account a number of factors. We do not invest directly in fossil fuels.”

Starling also says: “We will not do anything in our tax affairs that runs contrary to either the letter or spirit of tax legislation in the UK and any other country in which we are liable for tax.”

However, Ethical Consumer magazine has criticised Starling for not having an adequate policy excluding loans to companies linked to significant workers’ rights abuses, oppressive regimes or factory farming. It also has no lending policy in place that favours organisations and projects making a positive impact on the environment and society.

Also, it is worth noting that despite its longstanding opposition to fossil fuels, in March 2021 Starling accepted funding from Qatar’s sovereign wealth fund. The fund was set up in 2005 to invest Qatar’s substantial oil and natural gas revenues around the world.

A spokesman for Starling Bank said that “one of the key roles of QIA is to reduce Qatar’s dependence on revenues derived from oil and gas and to expand investment into non-hydrocarbon sectors. That’s one reason why it has been investing in a range of well-known British brands in addition to Starling.”

In April 2022, Starling raised £130.5 million from previous backers, including Goldman Sachs Growth Equity and the Qatar Investment Authority to build an “acquisitions war chest.”

Since Starling is a paperless, branchless bank, its carbon footprint is significantly lower than some of its competitors. It uses renewable energy to power its four offices and its debit card is made from recycled PVC plastic. Starling will plant a tree for every friend you refer – so far it says it’s planted 60,000 trees.

There are no monthly fees and arranged overdraft interest is charged at 15 per cent, 25 per cent and 35 per cent EAR (variable) based on factors such as your credit rating.

Read our full review of Starling Bank

If you want to have a savings account, insurance policy, investment fund or mortgage from companies that do the right thing, check out our Good Eggs.

These are companies that have passed strict (independent) criteria to prove they make a positive impact – to the planet, society, and you.

If you’d like to find out more about the above providers, a Which? membership gives you access to in-depth, expert reviews, ‘Best Buys’ and ‘Don’t Buys.’

Good With Money occasionally uses affiliate links to providers or offers, where relevant. This means that if you open an account or buy a service after following the link, Good With Money is paid a small referral fee. We choose our affiliates carefully and in line with the overall mission of the site.