This article is from the Good Guide to First-Time Investing, which you can download for free here.

You may feel confused by the world of sustainable investing because, well, it IS confusing. There are lots of different styles of investing that all broadly live under the umbrella of ‘sustainable’.

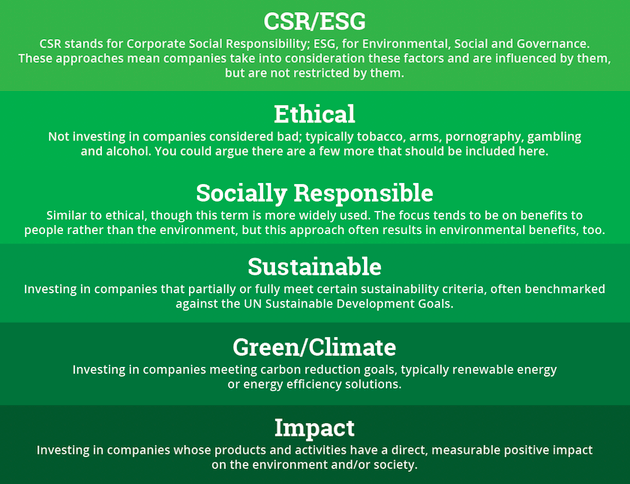

Environmental, Social, and Governance (ESG), Socially Responsible Investing (SRI), Impact Investing and other labels. But despite the similar labels, they have material differences that make some more worthy of the term than others.

There is a way to make it easier for you – a way to sift out the the spinners and the greenwashers: the gold standard for investing in planetary betterment is increasingly considered to be the positive ‘impact’ approach, rather than just ‘negative screening’ (where destructive industries are avoided).

If you look for the term positive impact when you invest, you have a better chance that your money will ONLY be invested in companies that are working to improve life in some way.

Bear in mind though, that investing for good means something different to everyone. For example, while some people will want to avoid negatively impactful companies such as oil and gas firms altogether, others might want to keep investing in them so they have a voice in how they are run.

Known as ‘stakeholder engagement,’ this means that your asset manager or pension provider will actively push them to become more ethical or sustainable over time. The threat of divestment (no longer investing) can be a powerful thing.

Whatever your preferred approach, just make sure your chosen fund and fund manager share your values.

To help you sift the greenest from the green, here’s a broad guide to what the different ‘sustainable investing’ terms mean: