The majority of top UK pension providers have “inadequate” or “poor” plans in place to tackle climate change, new data reveals.

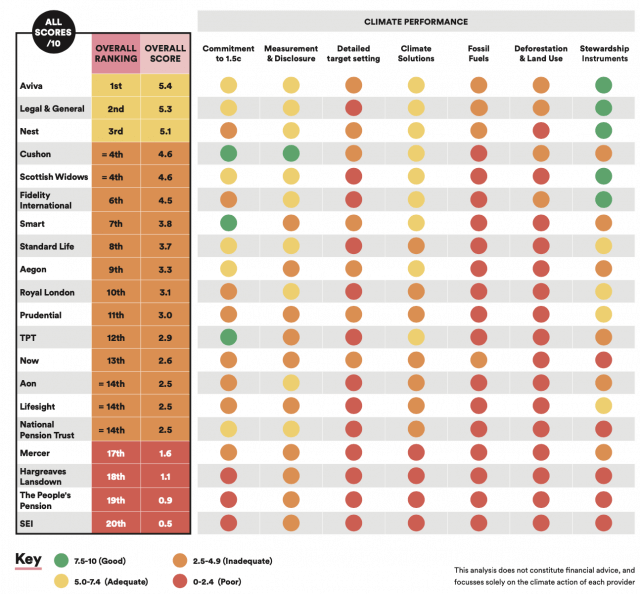

The UK’s top 20 Defined Contribution workplace pension providers are ranked on their climate action plans for the first time in a Climate Action Report from green pensions campaign Make My Money Matter. Together, these firms manage more than £500 billion on behalf of around 15 million active members.

The analysis, compiled by sustainability research firm Profundo, reveals that 85 per cent of pension firms are failing on climate action despite most having set public net zero targets.

‘An urgent wake-up call’

Richard Curtis, director of Love Actually and co-founder of Make My Money Matter, said: “Climate leadership is not just important for the planet – it’s popular too. But the fact that 17 of the UK’s top 20 providers have inadequate or poor climate plans tells you all you need to know about how seriously the industry is taking this issue.

“The public will rightly be worried about these results, and we hope this ranking acts as an urgent wake up call for the pensions industry to up its game on climate change. In doing so they can help protect the planet and provide savers with pensions they can be proud of.”

Where does your pension provider rank?

4 ways to make your pension ethical

Household names Royal London, Prudential and Standard Life are among 13 firms deemed to have “inadequate” climate plans.

The worst performing providers are Hargreaves Lansdown, SEI, The People’s Pension and Mercer, who collectively manage the pensions of over two millions UK savers. They received the lowest possible ranking of “poor”, scoring just one out of 10 for climate action.

Only three providers – Aviva, Legal & General and Nest – are deemed to have set “adequate” plans.

Industry-wide failings

On average, providers scored just 3.2 out of 10 overall. The report concludes that industry-wide failings on climate present risks to the UK economy, pension holders’ savings, and global efforts to combat climate change.

Ranked on commitments to 1.5C pathways, disclosure of carbon emissions, target-setting investment plans, nature and fossil fuel phase-outs, not one provider was deemed to be taking a leadership role in climate action. Progress was found to be particularly poor in policies around fossil fuels (eight providers scored zero out of 10) and deforestation (all 2o were found to have “poor” or “inadequate” plans).

Make My Money Matter says it hopes the rankings will help savers and employers to make more informed and environmentally conscious decisions on their pensions and encourage the UK’s largest providers to ramp up climate action in 2024.

A call to action

It is calling on all providers to end finance for fossil fuel expansion, tackle deforestation in their portfolios, and urgently scale up investments in climate solutions.

Tony Burdon, CEO of Make My Money Matter said: “In a year where an average temperature rise of 1.5 c was exceeded for the first time, this report should concern everyone who cares about their pensions, or the planet.

“While there are pockets of progress which indicate what funds could achieve if they showed energy and ambition, overall leadership is scarce and progress slow. That’s why we now need all pension providers to recognise the findings of this report and invest in the skills and capacity needed to meet the climate crisis.”

Read the full report here.