If, despite loathing the British obsession with property, thinking buy to let is really unfair and generally not wanting to fuel an economy entirely dependent on debt, you’d STILL like to own your own home, chances are you’re feeling:

- Impatient to buy

- Frustrated at how much money you need to do so

Could this year be the year? Well, there are some “headwinds”, or as we like to call them, giant breeze blocks, in your way. But you can do it. To paraphrase Obama (adieu, Obama), YES YOU CAN.

NB. Is the grass really greener?

Before you embark on home ownership, do decide whether it is the commitment you want to make. Once you have a mortgage, you have a whole new set of responsibilities, and while a home of your own is a good feeling, there is something to be said for renting (decent accommodation, at reasonable rental levels). There’s the flexibility, no responsibility for maintenance and no requirement to spend a lot of money on furniture, for example.

If you do decide that now is the time for home ownership, here’s a little timeline, with some deadlines for you:

NOW UNTIL FOREVER:

- Start putting aside as much as you can

But let’s say, £300 a month, into a Help to Buy ISA. It will receive a 25% top up from the Government, up to a maximum of £3,000 a year, and if you don’t take the money out for other purposes. Even if you don’t end up needing to save in a Help to Buy ISA for a deposit (ie. if your parents give you that), any money saved will come in very handy once you move in. So look at other ISAs, such as the Innovative Finance ISA or Stocks and Shares ISAs. Read our how to save this year post for more ideas.

- Cut back on spending

So, you might not see your friends for a couple of months if you don’t go out to restaurants or the pub. If they are not still your friends, they weren’t anyway. Invite them round to yours for lentil bake and ask them to bring a pudding.

BEFORE END OF JANUARY:

- Work out what you can afford

You might need to establish the size of the deposit you can expect first, which would mean working out how much you can save + how much relatives might be able to stump up. But you can certainly work out based on your income the maximum loan size that lenders would be prepared to offer. It varies according to lender but is somewhere around 3.5 times income in most cases. Sometimes it is 3.5x the first income and 2x the second, if buying with a partner. But for guidance, stick with 3.5 times. This means if you earn £35,000, a lender would offer you £122,500. If you had a 5% deposit, you’d be looking at a property worth around £135,000.

- Work out how long it will take you to save up that 5% deposit

Using your own savings and whatever you think you might be able to get from parents. Remember the more you save, the lower your repayments, so if you can aim for a deposit bigger than 5%, do.

- Have a little search around on Rightmove

To see what type of properties you can get for this money near you, or in an area to which you would consider moving. NB. A little realism check: Do remember that this is your first home, compromise is therefore usually a necessity and you won’t be there forever. So don’t worry too much about imperfections, as long as they are not structural or beyond your powers to fix/ live with.

BEFORE END OF FEBRUARY:

- Hit up parents and relatives

On the understanding that they are totally entitled to say no and that you do it in the gentlest, most respectful way possible. You might feel it is your right to get on the housing ladder, but it is their money. Pitch it right (try asking for the money as an interest-free loan instead), and you might win.

Of course, if your parents do not have any money to give you, then the question could seem insensitive and you’d be wise to pursue other options rather than upset them with a request they cannot meet.

There are some lenders who will offer you a better rate on a mortgage linked to a savings account that your parents can put money into (see the Family Building Society, below). Their savings are effectively the deposit that a lender can draw upon should you fail to meet repayments. If all goes well, your parents get their money back. The only catch is their savings will not be earning much interest in the meantime.

- Check your credit score

For several months, you will need to have kept up repayments on every form of borrowing, which includes mobile phone contracts, credit cards and personal loans. If your credit score is anything less than good, lenders will turn the other cheek.

- Speak to a mortgage broker

Once you have your deposit agreed. London & Country is fee-free for borrowers because lenders pay them for your business, but don’t dismiss paying a small fee to get the best possible deal on the market. Trinity Financial is offering Good With Money readers 50% off their usual £499 fee (just email goodwithmoney@trinityfinancialgroup.co.uk). Others to try: Anderson Harris, Coreco, or John Charcol. Spare the time to go through all of your finances with them. You might end up pleasantly surprised by what you can afford.

- GO HOUSE-HUNTING!

The fun bit. Again, it can be helpful to take parents who have done this sort of thing before along, so they can spot things that you, with your first-time buyer eyes, might miss, like wall thickness, damp, mould, poorly installed cabinetry, etc. Set their pedantry free.

CLEVER NEW THINGS TO TRY:

The mortgage market is still quite creaky and traditional, meaning it is primed for disruption, which will hopefully reduce broker, estate agency and conveyancing fees, just in time for you. Here are some new providers we like the look of:

Unmortgage is the missing step between renting and a mortgage. It claims it is restoring the homeowning democracy by enabling people to buy and sell a fraction of their home. It helps people struggling to raise an almost impossible to reach deposit by investing alongside them in their chosen property. In this way it gives people the freedom to own their home without any interference from landlords, and no traditional mortgages either.

Traditionally, many feel caught in a bit of a rent trap, paying increasing rent bills while property prices increase faster than anyone – especially with such low interest rates at the moment – can manage to save. Once people finally manage to scrape together a deposit, they might end up having to settle for something much different to their dream home, sacrificing location, size, or both.

Unmortgage works by funding 95 per cent of the value of the property you are buying, and the home-buyer needs to contribute 5 per cent. You then pay ‘rent’ on the remaining 95 per cent, which decreases over time, as your contribution to the overall pot grows.

The Family Building Society, the organisations behind the Family Mortgage, says it understands how many millions of young people still live at home or are struggling paying expensive rent.

Most of these such potential borrowers will only have a small deposit to put down on a property and as such are likely to miss out on most of the better mortgage rates. At the same time, their families may have savings and property that could be used as security for a buyer. The Family Mortgage brings these wider family assets into the mortgage calculation, helping to reduce the cost for the buyer but not asking family members to hand it over as a gift.

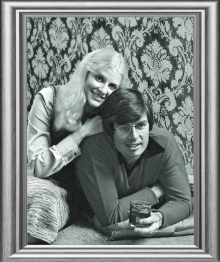

There’s a handy video on their website which explains more about how the Family Mortgage works, complete with some pretty ‘cool’ stills like the one on the left.

Meet Mortgy is new online mortgage platform aiming to save UK mortgage holders as much as £30 billion.

According to the site’s founder, Danny Matthews, a third of borrowers have no idea what interest rate they are paying on their mortgage, meaning as much as £57 million could be lost every day as a result of borrowers sitting on lenders’ Standard Variable Rates.

Mortgy plans to offer thousands of mortgage products from almost 100 lenders and claims it will reduce mortgage review times from weeks (as currently, with a typical bank mortgage) to around 30 minutes for a full application on via the platform.

Mortgy will be free to use. Matthews wants to help educate borrowers by communicating with them on YouTube, Facebook, Twitter, promoting transparency and connecting with people in a more personal way than is currently on offer at mainstream lenders.

WANT TO BE EXTRA GOOD ABOUT IT?

If you have the luxury of choosing your lender and there is not much to choose between the deals on offer, we’d like to make the case for choosing a building society rather than a bank. Building societies are mutually-owned, which means owned by their customer-members, and therefore function in the best interests of their customers – and often of their local areas too. They are therefore altogether just that bit nicer than their shareholder-owned counterparts in the banking industry.

While we’re at it, when choosing your new home, be mindful of how energy efficient it is – this is in your best interests too as homes that leak energy (often gorgeous “character” period properties) will cost you in the long run.

Check the energy performance certificate and think carefully about anything that is rated D or below. If you are ultra energy conscious, then new builds or new-ish builds are probably your best bet. “Eco” homes are clearly the piece de resistance, but few of these are in first-time buyer price brackets, unfortunately.