This article is an excerpt from the Good Guide to First Time Investing, sponsored by impact investing specialist Triodos Bank. Download your free copy to find out how to get started with investing for good.

So, now that you’ve decided that you’re not about to follow your mate’s hot bitcoin tip and would prefer to take a more considered approach to investing for the first time, where do you start?

First things first, work out what you can afford to put away each month, and stick to it. You could then of course save it all in cash with your bank – but with interest rates stuck on a low, it’s unlikely that saving in cash will meet your longer- term money-making goals. And while a small ‘rainy day’ fund would be useful for emergencies, why not make the most of youth being on your side, and dip your toe into stock market investing?

Starting early also means you get to make the most of compound interest – a wonderful effect where the interest you earn then earns interest on itself.

Now you’ve decided the stock market is for you…where do you go then? The options – and jargon – are seemingly endless but it’s easy enough to get started.

While many TikTok’ers would have you believe picking stocks to invest in is as easy as spinning a bottle, that approach may well bring a whole load of downs along with any ups.

You can invest directly into shares, of course – but it would make sense to leave that to the pros.

That means investing directly into funds – where a professional stock-picker chooses a selection of companies to invest in, pulling in new ones and chucking out poor performers as they see fit. This is called an ‘actively managed’ fund and the approach means you have to pay a fee to the pro who’s managing your money, as well as potentially another fee to the platform you use to access your chosen fund.

You could also invest in the stock market via an Exchange Traded Fund (ETF) where the fund not only invests in a selection of companies, but also tracks a particular stock market index, for example, the FTSE100. These ‘passively’ managed funds tend to have lower fees and charges than actively managed funds, but also come with potentially lower returns.

Types of savings or investment accounts:

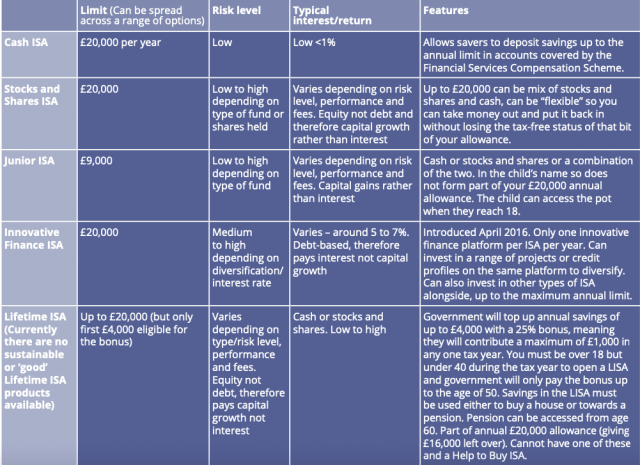

Once you’ve chosen your fund, or been recommended a fund by an adviser which suits your appetite for risk – how much money you might make or lose – then you will want to make the most of any tax reliefs available. Tax reliefs can vary according to personal cirtumstances so make sure you read the small print. Our table below explains the different types of tax-relief vehicles available – such as ISAs, LISAs and IFISAs – and how they all differ, so you can decide which might suit you best. Or ask an adviser.

If you’re not using a financial adviser to make fund recommendations for you, you can access ISA and LISA funds yourself on a range of platforms. This can be directly with the fund manager or provider themselves – including impact investment specialists such as Triodos Bank and WHEB, via investment platforms such as Interactive Investor, or you can opt for a ready-made portfolio of select funds offered by advisers such as EQ Investors, Bluesphere or Clim8, or a ‘robo- adviser’ such as Wealthify or Nutmeg.

If you prefer to invest directly in companies yourself, rather than funds, it could be worth considering an IFISA offered via platforms such as Triodos Crowdfunding, Ethex and Abundance. Find out more about IFISAs in our Good Guide to IFISAs.

You also need to consider what your chosen fund invests in, and whether those companies and sectors align with your own personal values. Funds such as the Triodos Impact Investment Funds invest only in those stock market listed companies and bonds that have a positive impact on society and the environment.

If this is something you care about, read our Good Guide to First Time Investing to find out how to avoid ‘greenwash’.