In most areas of finance we generally believe that choice and diversity are good things. Whether it be easy access, limited withdrawal, one, two or five year fixed-term accounts for cash savings; or bonds, equities, multi asset, infrastructure, gold and much, much more in the investment space – range and differing levels of complexity are usually seen as desirable, and healthy.

In the Good Money space, however, ambiguity and complexity is often leveled as a charge against it. Rather than celebrated, these attributes are thrown up as evidence of a failing that means money will never be able to be used to benefit people and the planet, no matter how hard we try.

Financial advisers are some of the worst culprits here. Raised on a diet heavy with unyielding rules and regulations, advisers have little idea how to make this kind of money management fit their tick boxes and so, many will simply steer clients away from it.

The usual refrain goes something like this: “Well your ethical means something completely different to my ethical. So let’s just call the whole thing off and go back to safe old tobacco and arms, shall we?” Thanks, Mr. Smith.

More choice for Good

The range of Good money products has exploded in recent years – from ethical and impact current and savings accounts, to green mortgages and insurance products to a now booming array of investment options all aimed at helping people to do Good With their Money.

This – few would disagree – is a Good thing. After decades of shoving its fingers in its ears the finance industry is finally waking up to our collective desire to halt the worst practices of capitalism, and instead channel our capital into making things better. It is something to be roundly and widely celebrated.

This does not mean, though, that education is not desperately needed. It is, after all, absolutely true that one man’s ethical is another man’s skeptical. A traditional ethical fund that excludes only tobacco, arms and alcohol, but invests in fossil fuels, for example, will not meet the demands of an investor looking for a zero carbon portfolio.

Similarly, a single sector impact fund – perhaps in solar energy or social housing – is not going to meet anyone’s diversification needs. Putting all of your eggs in one basket is never advisable, no matter how Good those eggs may be.

Embracing diversity

As a staring point, though, we must accept – like in most areas of life – that the Good money world is vast, and diverse. That this means not all products will be for everyone, but that it does mean that one can be found to meet most investor’s needs, desires and expectations.

This is important as, just like Mr. Smith, often investors will see the label ethical and assume a number of things about the holdings – similarly for sustainable or impact. These terms are used so interchangeably in so many areas of life now that, truly, we all do have different ideas.

Sadly, this often leads to disappointment when, shown a fund factsheet, an investor might spot a company she thoroughly disagrees with and so throw the whole thing off as a scam invented by the evil finance industry.

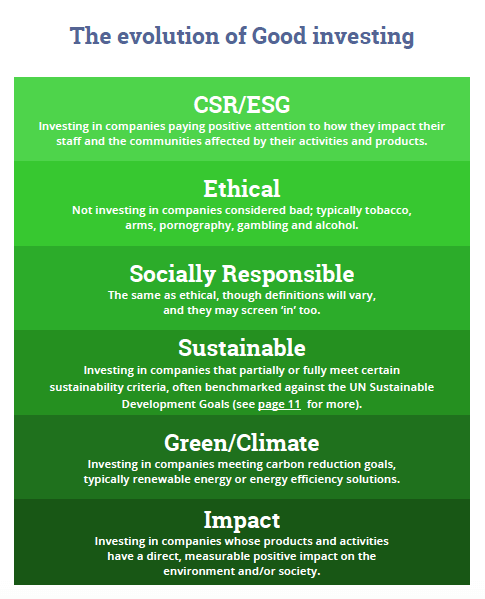

In our latest Good Guide to Impact Investment, we came up with a ‘Six Shades of Green’ Good investment grid that we think is a pretty nifty guide, which you can see below:

‘Six shades of green’: the range of Good investment approaches

As our grid suggests, there is now a broad and growing array of Good investment approaches employed by investors everywhere.

In our regular Good Investment Review, produced in collaboration with 3d Investing, we narrow this down to around 300 of those available to UK investors that we consider to be some of the best in terms of policy, practice and performance. Check it our latest review here.

Greenwashing risk

All of this wonderful diversity does not mean, though, that there are not problems in the Good money world. Indeed, in some ways Mr. Smith is right to be skeptical, and perhaps now more than ever.

As we frequently cover on Good With Money, ‘greenwashing’ is a major threat to this industry. This is especially the case at the highest levels where behemoths like BlackRock (the world’s biggest investor in fossil fuels) are launching ‘environmental, social and governance’ (ESG) funds like candy that claim to be changing the world, but in truth do nothing more than invest in BP over Shell (for example) based on a ‘least worst’ metric.

Firms like these have huge marketing budgets and so have the capacity to sew mistrust among investors and derail the Good money train significantly.

As such, regulators are now starting to do more to bring in some set definitions around Good money. Leading the charge is the EU Commission, which is currently consulting on how to implement definitions of sustainable investment to ensure that European banks and insurers are doing what they need to do to help countries meet climate and sustainable development goals.

Defining questions

In the UK, the Investment Association (IA) is also currently undertaking a long overdue review of the sector, proposing to set out three key definitions for funds (negative ethical, sustainable and impact) that could lead to a clearer labelling system, while also tightening up rules around how firms implement broader ESG targets in house.

There is no mention as yet of creating sectors for these funds – as we have for every other type of investment area, and which would help investors find and compare Good funds – but we live in hope.

In the impact space, The Global Impact Investor Network (GIIN) has just published a paper detailing its extensive work on defining impact. This has led to the creation of IRIS – a system of classification based on a number of globally recognised benchmarks like the UN Sustainable Development Goals and Principles for Responsible Investment that could become the new benchmark for impact.

As demand for ethical, sustainable and impact investment continues to explode (investment in ‘ethical’ funds as defined by the IA grew 250 per cent in the three years to 2018 while investment in all funds fell 124 per cent) the Good money world is coming of age.

Regulators are, admittedly, struggling to keep up with product providers, however they’re coming along. In the meantime, Good investors have an ever expanding universe to choose from. It just requires a little work: like choosing your next laptop, for example. Only the former might pay for your retirement, while the latter will clap-out in ten years – if you’re lucky.